You Get To Decide This…

A friend said yesterday, “This looks like the start of World War 3. How bad do you think it will get?” This reminded me of the “Be the Calm in the Market Storm” post by Jason Zweig in the Wall Street Journal in January 2022. He wrote, “For more than a year it seemed like the stock market could only go up, buoyed by a river of money that gushed from the government. In the past week that illusion has been shattered.”

When he wrote this post, the Beijing Winter Olympics had started, and Putin was in China yawning (during the Olympics opening ceremony). The biggest certainty at that point of time was about the Federal Reserve raising interest rates as early as March and this was making the market nervous. Add to this now – the War, Oil Price shocks, the impact of cutting Russia off from the global financial system and supply shocks. Given the inflationary spiral and continued supply chain disruptions, the last thing we needed was a disruption in the supply of commodities. This is what we are seeing in most commodities as continued trade with Russia becomes even more uncertain.

So how much worse can this get?

Jason Zweig writes, “But what happens next isn’t the right question to ask.”

He adds further, “In a speech in 1963, the great investment analyst Benjamin Graham said: In my nearly 50 years of experience in Wall Street I have found that I know less and less about what the stock market is going to do, but I know more and more about what investors ought to do.”

“You ought to do two things. First put the market’s recent fluctuations in a long-term perspective. Then recognize that what kind of an investor you are matters more than which investments you own.

There is nothing abnormal about the way stocks have been heaving up and down the past few weeks. It’s the calm of last year, when stocks rose almost 28% but fluctuated with about half their usual intensity, that was abnormal.”

A sharp decline in the stock market is not a new discovery. I have written extensively about declines and volatility in the stock market. By now you know, the higher return from a diversified portfolio of stocks comes thanks to volatility. It is a compensation paid to sit calmly (easier said than done) and patiently during a rollercoaster ride. It is a compensation paid to ignore the noise (including the financial porn networks) and stay invested. You also know by now that stock markets on average correct 15% in a typical year, 30% in about 3-5 years and 50% + several times in your life as an investor. Understanding and accepting this reality are prerequisites for becoming a stock market investor.

Jason adds, “Chances are, you barely remember those declines.” Investors are exceptionally adept at retroactively revising their memories. No one likes to admit fear or to feel foolish or incompetent, so we polish our own pasts; what was terrifying then becomes not so bad now.

That’s why it’s so important to understand who you are as an investor. Falling markets set up a battle between your present self and your future self.

Our future selves are like strangers to us. This is precisely why at the age of 21-35, it is difficult for most people to connect with their retirement goals. Similarly, when you are going through a downturn, it is difficult to think about your future self when there are so many emotions going on in the present moment; the chief among them – fear.

Jason writes, “Now imagine your future self is looking back at you from 2032 or 2042 or 2052. Would you remember the fear you felt in January 2022 (I would add March-May 2022)? If you don’t believe me, see if you can describe or even recall a single investment decision you made in 2012. I will wait.

When you buy or sell stocks based on short term market turmoil, the person you are trading with is your future self. In every trade, there has to be a winner and a loser. Who are you going to be?”

Taking care of your future self means embracing uncertainty and volatility in the short term.

Real Financial Planning is not about being right today, it’s about being less wrong tomorrow. The basic facts of investing have remained the same. Over time (think 10,15 or 20 years), stocks typically do significantly better than bonds and bonds do better than cash.

Finally, what I am about to tell you might sound crazy but, let me say it anyway.

We get to decide what we focus on.

Yes, that’s right.

We Get To Decide What We Focus On.

This means you have a choice.

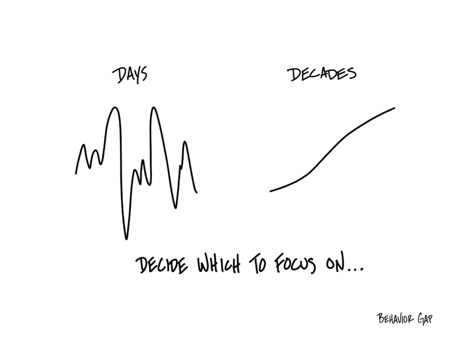

Focus on Days or Decades. Focus on Goals and Planning or Markets and Events.

When you focus on days, markets and events, you are signing up to make yourself miserable. And for no good reason.

History, on the other hand, has shown that when it comes to investing, we actually get rewarded for ignoring the noise.

But then, you already know this.

and then tap on

and then tap on

0 Comments