What Really Counts: Key Principles for Successful Investing

Try to remember a time when you read or heard something about money in the news, you acted on it, and then, with the benefit of hindsight, you were glad you did.

This could include any number of things: the latest IPO, bear markets, bull markets, mergers, market collapses.

Go ahead, I’ll wait. Close your eyes and think about it.

I’ve done this experiment hundreds of times around the world, and I’ve only had one person come up with a valid example. It was news about a change in the tax law.

That’s it.

Isn’t that interesting?

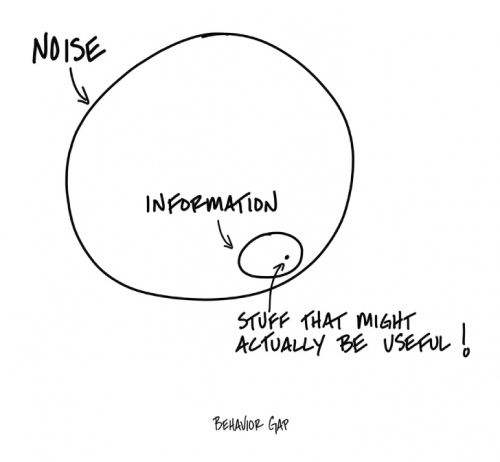

Think of all the financial pornography out there, think of all the places that have CNBC playing in the background, think of the investing news on social media and traditional media. Almost all of it is noise. Almost none of it is actionable.

Sure, occasionally, there is this little, teeny tiny speck of information that might be useful. But you sure must wade through a lot of garbage to get to it.

This leads to one obvious question:

Why are we paying attention to the noise in the first place?

It might be fun, if you’re into that kind of thing. You know, like going to the circus. But most likely, it’s just a waste of time.

What if, instead of obsessing over the financial pornography network, you used that time to focus on the things that count.

We all know how to count, but do we truly understand what counts when it comes to money and investing? While numbers are integral to financial success, the deeper principles that guide successful investing are often overlooked. It’s not just about accumulating wealth; it’s about making informed decisions that align with your long-term goals and values. This post is then about the essential factors that truly count in investing and how focusing on these can lead to sustained financial success. Many of these might seem obvious. A lot has been written over the last several decades about these factors. Yet, it’s worth reiterating and internalizing these fundamental truths because they are often overshadowed by the noise.

1. Time in the Market, Not Timing the Market

One of the most critical aspects of investing is understanding the power of time. The concept of “time in the market” refers to the importance of staying invested over the long term rather than trying to time the market to buy low and sell high. Obviously, you know this. Market timing is notoriously difficult, even for seasoned investors, and can lead to missed opportunities and losses.

What Counts: Consistency and patience. Staying invested allows you to benefit from compounding returns, where the returns on your investments generate their own returns. Over time, this compounding effect can significantly increase your wealth.

2. Diversification: Don’t Put All Your Eggs in One Basket

Diversification involves spreading your investments across various asset classes, sectors, and geographical regions to reduce risk. By not putting all your money into a single investment, you can mitigate the impact of poor performance in any one area.

What Counts: Risk management and stability. Diversification helps protect your portfolio from significant losses and provides more stable returns over time. A well-diversified portfolio is less vulnerable to market volatility and specific economic events.

3. Understanding Risk Tolerance

Every investor has a different risk tolerance, which is influenced by factors such as age, financial goals, income, and personality. Understanding your risk tolerance is crucial for creating an investment strategy that you can stick with during market fluctuations.

What Counts: Personalization and comfort. Aligning your investments with your risk tolerance ensures that you are comfortable with your investment choices, reducing the likelihood of panic selling during market downturns.

4. Financial Goals and Planning

Investing without clear goals is like setting sail without a destination. Identifying your financial goals, whether they are short-term (buying a car), medium-term (saving for a down payment on a house), or long-term (retirement), is essential for crafting a successful investment strategy.

What Counts: Purpose and direction. Clear financial goals help you choose the right investment vehicles and strategies, ensuring that your money is working towards achieving your specific objectives.

5. The Power of Compound Interest

Albert Einstein famously referred to compound interest as the “eighth wonder of the world.” Compounding involves earning returns on both your initial investment and the accumulated returns from previous periods. The earlier you start investing, the more time your money has to grow exponentially. Compounding seems notoriously slow over the first 15-20 years but then it shoots like a rocket.

What Counts: Early and consistent investing. Starting early and contributing regularly to your investments allows compound interest to work its magic, significantly growing your wealth over time.

6. Keeping Emotions in Check

Emotional decision-making is one of the biggest pitfalls in investing. Fear and greed can drive irrational decisions, such as panic selling during a market downturn or chasing high returns during a bull market. Successful investors maintain discipline and stick to their long-term strategies.

What Counts: Emotional discipline and rationality. Keeping emotions in check and making decisions based on logic and research rather than impulses helps avoid costly mistakes and keeps your investment plan on track.

7. Continuous Learning and Adaptation

The financial markets are dynamic, and staying informed about economic trends, new investment products, and changes in your personal circumstances is crucial. Continuous learning and adaptation ensure that your investment strategy remains relevant and effective.

What Counts: Education and flexibility. Investing time in learning about finance and being willing to adjust your strategy as needed helps you stay ahead of the curve and make informed decisions.

8. Rebalancing Your Portfolio

Over time, the performance of different investments can cause your portfolio to drift away from its original allocation. Regularly rebalancing your portfolio ensures that it stays aligned with your risk tolerance and financial goals.

What Counts: Consistency and alignment. Rebalancing helps maintain the desired level of risk in your portfolio and ensures that your investment strategy remains on track to meet your goals.

9. The Role of Professional Guidance

While some investors prefer to manage their investments independently, seeking the care and counsel of world class financial professionals can provide invaluable insights and expertise. Real financial professionals can help align your use of capital with what’s truly important to you and tailor investment strategies to your specific needs.

What Counts: Expertise and support. Leveraging professional guidance can enhance your investment strategy and provide peace of mind, knowing that your financial plan is built on sound principles and expertise.

Investing successfully is not just about knowing the numbers; it’s about understanding the principles that drive long-term growth and stability. By focusing on time in the market, diversification, understanding risk, setting clear goals, harnessing the power of compound interest, keeping emotions in check, continuous learning, rebalancing, and seeking professional guidance, you can build a robust investment strategy that aligns with your life goals.

Ultimately, what really counts in investing is a disciplined, informed, and strategic approach that considers both the financial and personal aspects of your life. By understanding and practicing these principles, you can master the complexities of the financial markets with confidence and achieve sustainable financial success.

and then tap on

and then tap on

0 Comments