Be Less Wrong

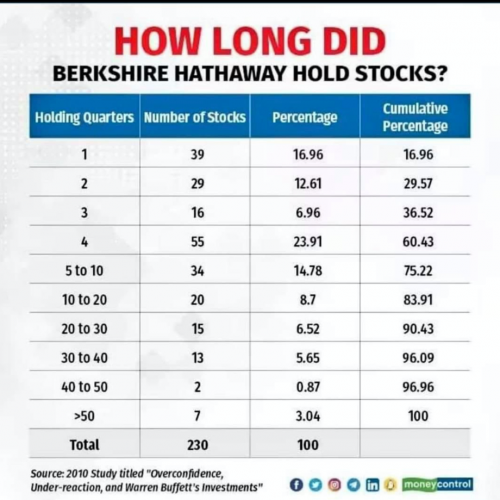

An executive (Vishal – name changed) of a portfolio manager recently sent me the following WhatsApp message.

Additionally, he made a remark that I reproduce here – “This is the holding period of the man who talks of holding forever. 60% of the stocks are held for less than a year.”

While I am not about to defend Warren Buffett here (he does not need one), Vishal certainly missed some nuances and important points. The objective of this post then is to highlight these key insights.

If the above data is true (which it is even though it is outdated), then the most important thing to understand is that very few stocks are actually responsible for Warren Buffett’s investment outcomes. In my previous post “Not So Obvious”, I had written about the source of his magic though (hint: compounding), so I am not about to harp on it again. In fact, I am going to stick to the topic for a change 😊

Let’s now unpack the words that very few stocks are responsible for his investment outcomes.

There is no real debate about the fact that Warren Buffett wears the crown of being the best investor in the world. Even if you wish to argue this (with other names you prefer), let’s just pretend for a few minutes that he indeed is.

In that case why would someone like him have so many stocks in his holding company’s portfolio?

Because even he and his partner Charlie Munger know that despite their skill, intelligence, wisdom and all the due diligence that they do, they can go wrong. Even the best (investors) make mistakes.There is nothing wrong with this.

Investopedia wrote, “Buying at the wrong price, confusing revenue growth with a successful business, and investing in a company without a sustainable advantage are all mistakes Buffett has shared with his shareholders in his legendary annual letters to them.” Not just these, he has also lost money in a Ponzi scheme (hint: DC Solar).

Additionally, he has had years (even more than a decade in the recent past) of solid underperformance and many bad stock picks. These stock picks have erased billions of dollars from the Berkshire (his holding company) portfolio. Despite this, he has had solid market beating performance. But that is not the point I wish to make.

The point is they know they are going to be wrong. And not just with one or two calls. But hundreds of calls. Sometimes even behaviorally and in a damaging way. During COVID-19, right before the airline stocks shot up, Buffett dumped all his airline holdings near their lows.

And when they are wrong, they admit it and learn from it (which is a life-long process in itself).

Another important point to be noted here is that a stock portfolio needs more stocks in it than less stocks for it (the portfolio) to do well. I am not getting into a technical debate on diversification or the right number of stocks in any portfolio. The point I wish to make is that one certainly needs a lot more than 15-18 stocks to make a portfolio deliver goods with consistency. However, many portfolio managers (including Vishal’s company) use the trick of concentration to generate high returns or demonstrate their value. While everyone gloats about their alpha (in the context of a benchmark), no one talks about the Beta (the second letter of the Greek alphabet) of their portfolio. Beta is a measure of volatility of a portfolio (or a security) compared to the benchmark or market as a whole. If a portfolio’s beta is higher than 1.0, this means that the portfolio is more volatile than the benchmark. While I promised to stick to the point, I think I digressed a bit.

The point is that you need a well-diversified portfolio (and thus many stocks in the portfolio)…because you too are likely to be wrong. Every portfolio manager is likely to be wrong. No matter who the portfolio manager is, they are likely to be wrong.

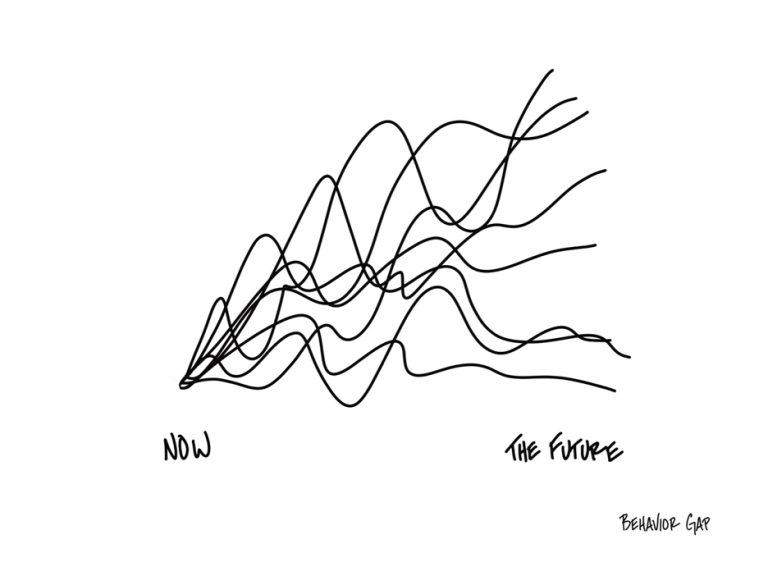

Even though we know this in our heart, we seem to look for the one who is always (or most of the times) right. It’s human nature to desire something that seems impossible. We then believe the lies we are told. We believe the bullshit we are told. We believe the bullshitters. Because most times bullshit is delivered with far better confidence than real good counsel is. We start believing that our portfolios will keep going up in a straight line and so will our life. But the reality of life is best visualized by this sketch.

The ultimate reality of investing is that no matter who the portfolio manager is, he or she will go wrong. And if a portfolio manager bets on 15-20 stocks like most do, what do you think happens when 5-7 stocks in his/her portfolio goes down. There is no place to hide. You can then see the “on steroids portfolio” showing its true colors and you can also smell the real stink of the portfolio. Are we not witnessing this today? Why do you think that is?

It is because many portfolio managers bullshit about their ability to pick out (only) winners. They create the illusion of certainty in an uncertain world. They aim for being exactly right when all along they should have focused on this one thing. Be Less Wrong.

and then tap on

and then tap on

0 Comments