The YES Mandate

Before your mind starts running, let me tell you this – the headline has nothing to do with YES Bank. But it has everything to do with another bank with 3 letters in its name. This time it’s a Swiss (Global) Giant – UBS. The firm writes these gems on their landing page – “Thinking and acting with the long term in mind”. I wish these statements even had an iota of truth. But let’s dive straight into the post instead of wishful thinking.

Eric Rasmussen recently wrote the following in FA Magazine – A Financial Industry Regulatory Authority (FINRA) arbitration panel has ordered UBS Financial Services to pay more than $5 million to a couple who lost money in a controversial options product that the plaintiff’s attorneys say has lost almost $ 1 billion for wealthy clients since 2018.

FINRA awarded $5,028,412 in compensatory damages to George and Sandra Schussel, as well as $94,679 in prejudgment interest (under Florida rates) and $91,939 in costs. The Schussels had originally sought $6.5 million. Still the award was one of the largest to claim.

What has this got to do with YES and UBS?

YES, stands for Yield Enhancement Strategy and is UBS’s options product sold to investors with the promise that they would be protected from downside risk.

Can you believe this?

Wealthy and sophisticated clients are still made to believe this downside protection bullshit. If you look for certainty in a world where none exists, we are likely to meet such people and welcome them in our lives.

I like to explain two terms before moving on to the next paragraph.

The words “discretionary accounts” mean that buy and sell decisions are taken directly by the portfolio manager or investment counsellors for the client’s accounts. The Fiduciary means someone who will act in your best interests even at the cost of his/hers.

Eric adds further – “Ross Intelisano, the attorney for the Schussels, a retired couple living in Florida said – The biggest thing we focused on was breach of fiduciary duty. These are all discretionary accounts, so the firm and the advisors have fiduciary responsibilities, and from our perspective, that means doing what’s best for the client even if that’s not good for you. The firm was making so much money on the YES strategy and it was so complex that even advisors recommending it didn’t understand it fully.”

In its cease-and-desist order, the SEC (Securities and Exchange Commission) said UBS provided inadequate training to its financial advisors recommending the YES Strategy, and they weren’t aware of its potential for downside risk. UBS Investor documents show that the product lost 18.44% in 2018 and lost another 11.34% in 2020.

Closer home in India, a similar case had happened in 2011-2013. A wealth management firm was selling similar shit to its high net worth clients. Their relationship managers didn’t understand head and tail about the options product either. They only spoke the following words – “1.5% per month risk free with our proprietary options product” and people bought in. Over time, this strategy lost significant money for investors.

There is still a lot of bullshit sold these days (in the name of innovation) using the following words – yield enhancement, downside protection, uniquely structured products etc. Bullshit comes in different flavours and varieties.

One of the pitches made to high net-worth investors (so their bullshit looks attractive) is as follows – our size and scale ensures that we gain preferential access for sourcing and customizing products. Essentially, you get a first mover advantage to unique, value-added investment products ahead of the market.

A colleague of mine who has now joined a newly minted asset manager says – “We don’t focus on mutual funds. We focus on PMS and AIFs. They sell fast.”

Why does it sell so fast? Because it’s packaged well and sold even better. We are told people like us are buying them. This is like saying we have to take XYZ prescription because others are taking it.

Truth be told, most people who buy these products don’t even fully understand them. To be fair, they have been made to believe that doing this leads to diversification and higher returns. Who in the world will argue with that? After all they have been shown charts, fancy presentations and invited to expensive meetups.

The sad part is that people still continue to fall for this. A bullshit detection kit is the need of the hour. I had written about this earlier but will expand on this and come up with some meaningful content for you.

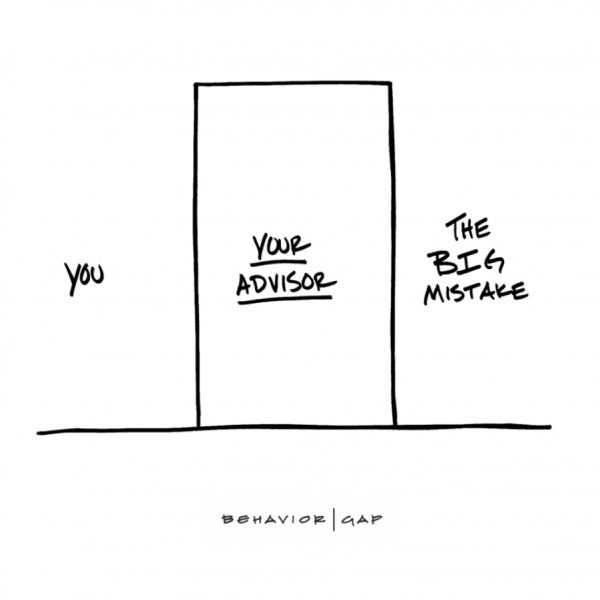

The question you might be asking – How should I protect myself and my loved ones from such practices. The answer to this can be found in my post “The Missing Diagnosis”. Commit to having no prescription without a thorough diagnosis done by a world class real financial professional. Needless to say, you need the care of one such professional in your life.

But the key question is “how do we find one?” The reality is that we don’t know or are not taught how to select the best financial caregivers.

We simply expect world class financial care from anyone and everyone.

Most of the time we look at how this person appears. If he/she wears a suit or is dressed sharply – check box ticked. This is like believing everyone who wears a white coat is a doctor.

If they take names of other billionaires and millionaires – another check box ticked. Size of the firm – another check box ticked.

While we check these basic boxes, we miss the most important thing. We fail to see that we have been handed over a prescription without even being diagnosed thoroughly.

and then tap on

and then tap on

0 Comments