All You Have To Do Is Stay

My elder daughter Reet is going to love this post (I can feel that as I am writing it). The younger one Preet did when I simply shared the headline with her. Why? You will figure that out by the end of this post, and I promise if you have teenage daughters, they are going to love it too. This might simply be the perfect investing lesson for them and for you, a lesson they will hopefully never forget (and one that will pay rich dividends), but I am willing to bet that you might enjoy this one too. Let me now go to a different world – the world of Wall Street Forecasts.

Let’s see what Wall Street’s top strategists told their clients last year (end of 2022) about their forecasts for 2023.

The S&P 500 (US Stock Market Index of 500 Companies) was at 3764.49 as on December 22nd, 2022. This is what strategists from various institutions had predicted:

Barclays: 3675

Morgan Stanley: 3900

UBS, Citi: 3900

Bank Of America: 4000

HSBC: 4000

Credit Suisse: 4050

JP Morgan: 4200

According to a Bloomberg survey of 17 strategists, the median forecast was 4009.

Where is the S&P right now?

At 4559.34 and just 259.28 (or 5.68%) points away from it’s all time high of 4818.62 (made on January 4th, 2022).

The median forecast was off by around 14% and the most bearish was off by 25%. And it’s not just about the targets. Most strategists were bearish about the economy too confidently predicting a recession. And look where we are today. Many companies had stellar results. The US GDP grew at an unbelievable 4.9% in the third quarter of 2023. Who would have thought this? NO ONE is the right answer.

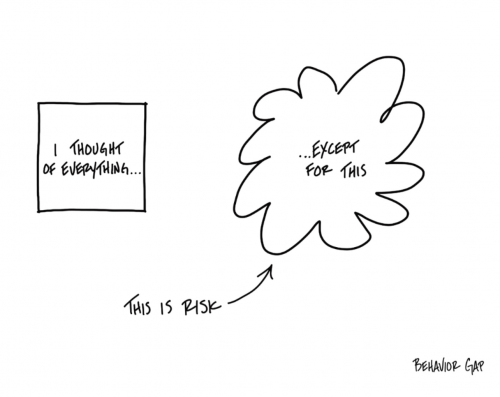

It’s incredibly difficult (if not impossible) to forecast or predict where the stock market will be in a year or in the short run…I have even dropped the word, “consistently”, as no one seems to even get lucky with it one or two times…While strategists will often revise their targets as new information comes in, there are simply too many variable and countless developments to consider…It’s simply not possible to make sense of all of this…There are millions and billions of events, and interactions that are happening daily. A small event can shake global markets in the short run.

Thus, we cannot predict what will happen in the short run.

But this hasn’t stopped Wall Street strategists from making forecasts. They are back with their 2024 forecasts (and will continue doing so every year). But more on the latest forecast in some other post, the question to focus on is why they do it even when they get it wrong all the time. It’s like banging your head against a wall and expecting a different result. And all of them are super smart …They know they don’t know what’s really going to happen over the next 12 months. This inability to forecast the past seems to have no impact on their desire to forecast the future. They continue to do this confidently.

Why?

Because their clients or investors want this. As we all know forecasting is a popular sport with investors. Certainty is so valuable that human beings will never give up their quest for it. The strategists know investors won’t come to them if they don’t predict or produce 70–100-page research reports. They know they are paid to sound certain, they are paid to demonstrate they are in control.

Will people ever choose to ignore these forecasts or these experts?

Some might but most won’t…And there is a constant flow of people into the system…who will continue their quest for certainty.

University of Pennsylvania Professor Philip E Tetlock in his study (an interesting post on this coming soon) and research had said, “We will never ignore the experts. We need to believe we live in a predictable, controllable world, so we turn to authoritative sounding people who promise to satisfy that need.”

But the reality is that we live in an unpredictable world…

And Real Investing is a very different game…

When played correctly, investing is a game where you get rewarded for being lazy, it’s a game where you are actually paid to stay (hint about Taylor Swift)

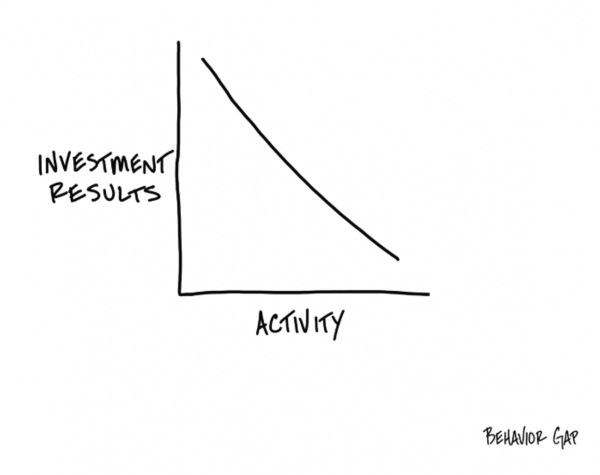

That may seem counterintuitive, because we’ve been trained to think that when we do more, we get more. That Activity = Results.

But investing is a do-less proposition because of the power of compounding.

The question to ask is not where the stock market will be next year or what the economy might be doing this time next year.

Instead, the question to ask, “what will be true of the stock markets 5 years down the line or 10 years or even 20 years…what will always remain the same?”

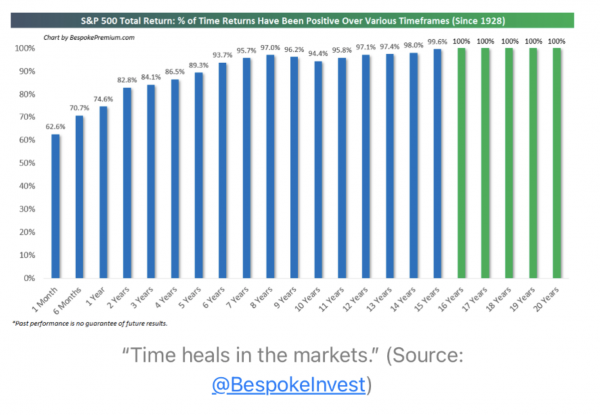

While there are many things that will remain the same, a key thing that will remain the same is: The stock market usually goes up…Understand the emphasis on the word is usually (not always). The stock market is up 62-74% of the time in a typical year.

Look at this interesting chart of the US S&P 500.

This brings me back to Taylor Swift.

She has been all over the place including the financial media and Wall Street. Financial Times had many headlines besides this one Taylor Swift may hand out bigger bonuses than many banks this year. A magazine published, “What wealth managers can learn from Taylor Swift?”

David Kostin of Goldman Sachs even wrote his 2024 US equity forecast report subtitled “All You Had To Do Was Stay.” This is the title of the song from Taylor Swift’s 1989 album…an album whose replica (this is an interesting thing in itself) has sold nearly 1.7 million copies in the first week of its release. Taylor Swift is on a project to regain ownership of her music after the catalogue was sold to a private equity group. That’s why the current one is a replica of her 1989 album. I guess I digressed a bit.

According to David, “The launch of the singer-songwriter Taylor Swift’s Eras tour represented one of the most notable cultural events. Global ticket sales are estimated to be $1 billion. The tour’s economic multiplier effect is significant. According to the Federal Reserve Bank of Philadelphia, May was the strongest month for hotel revenue in Philadelphia since the onset of the pandemic, in large part due to an influx of guests for the Taylor Swift concerts in the city.

The Eras tour will conclude in late November 2024, roughly the 12-month horizon of market forecast in this report. As homage to the global icon, our 2024 US Equity Outlook is subtitled “All You Had To Do Was Stay” – invested. The title of the song reflects our baseline forecast that despite intermittent volatility, fund managers will ultimately be rewarded for staying invested through the end of the year.”

Really…Staying invested only through the end of the year?

That is not how real investing works…

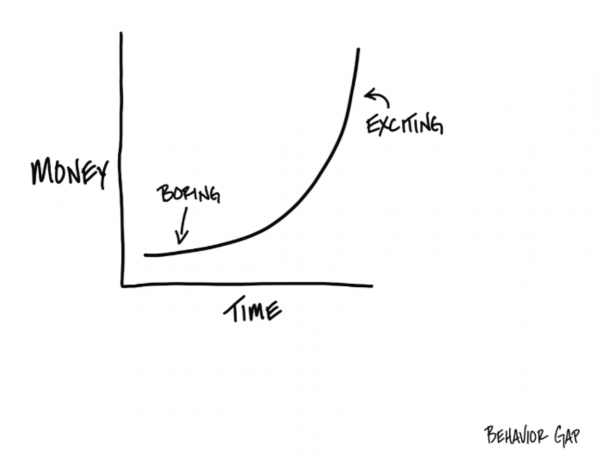

The real secret in investing is time, and the magic is in compounding (of equity returns), the longer you allow time to work on your investments, the better it is for you and your family.

Real Investing is not about your money working for you. Real Investing is about letting your time to work on that money that is supposed to be working for you (instead of being distracted by all these predictions and forecasts). And there is only one thing that you have to do now and always – Just Stay Invested (take out money when you need it for a purpose) and let compounding do its job.

and then tap on

and then tap on

0 Comments