Free yourself from …..

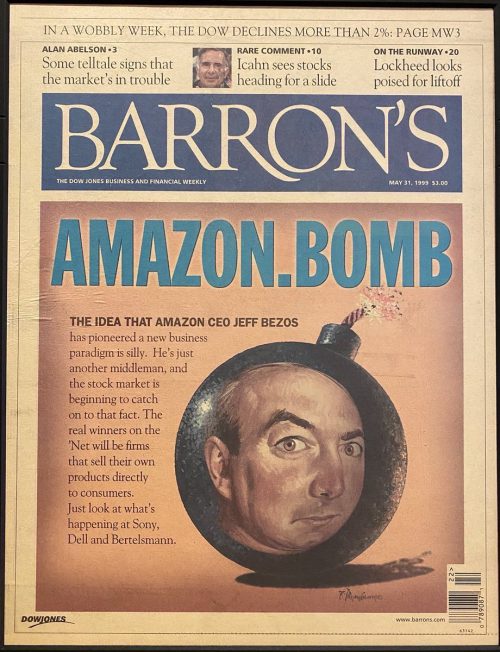

On 31st May 1999, Barron’s published a cover story titled “Amazon.bomb.” The media house published “The idea that Amazon CEO Jeff Bezos has pioneered a new business paradigm is silly. He’s just another middleman.”

The author argued that the company was overvalued, and that Amazon stock price would crash. There were many who had lapped on to this profound wisdom (in case you didn’t realize, I was being sarcastic). The stock did crash 93% by 2001 to $6, and the author looked like a genius. But we all know what happened subsequently over the last 2 decades. Jeff Bezos had the last laugh. Not only were they wrong about Jeff Bezos and Amazon, but they were also wildly wrong about the new business paradigm. Amazon’s market capitalization hit close to $2 trillion in 2021 ($1.5 trillion today) and the dot com business paradigm is the way of life today. We can’t imagine life without the internet today.

The point here is that no one can predict the future but at the same time there are people who are working on the future. Trying to make things better. The financial media on the other hand confidently predicts the future (and sometimes they get experts to do so too). And the narrative is almost always negative.

In his amazing newsletter, Author Nick Murray writes “Even the most fleeting positive trend represents a grave threat to financial media’s digital cash register. The modern financial rendering of the eternal truth “if it bleeds, it leads” is “the higher the VIX (volatility), the higher the clicks.” All the way to the bank. Thus, the mortal danger to the financial media business is that you will start to relax and feel just a little better about what seems to be going on in the markets and even the world.

Media cannot allow this, because they know if your financial blood pressure declines to normal levels, you will just naturally stop clicking on every apocalyptic headline they can hallucinate. This will, with everything else being equal, tend to make you a marginally better investor. But if this is allowed to continue, it will depress their advertising revenue.”

Thus, consumption of media is certainly injurious to an investor’s (financial and emotional) health.

Behavior Gap Author, Carl Richards writes “What if, for one whole week, you did a media fast?”

You know… like, don’t consume any media at all. No screens, no devices, don’t even pick up a newspaper.

No. Media. Period.

Is one week too long? Then scratch that… make it three days. THREE DAYS. That’s just a long weekend. You can do it, I promise.

If all screens and devices are not possible, begin this fast with the newspapers you read and the financial media channels you watch.

Give it a shot. And when you do, pay close attention to your emotional state.

How does it make you feel?

Happy? Sad? Energized? Exhausted? All of the above? None? Something else?

Carl adds, “When I’ve done media fasts, I find myself feeling calm. Really calm. And to me, that feels good. Really good.

Which makes me wonder… if taking a media fast makes me feel so good, why do I ever go back to it at all?”

Warning: You may find yourself asking that same question…

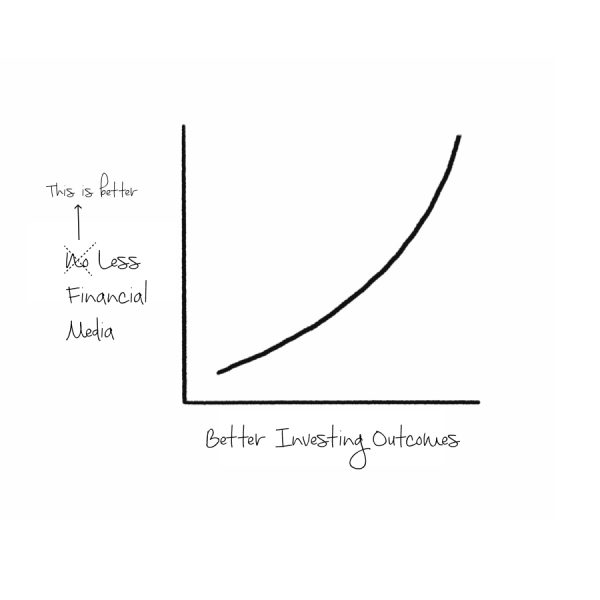

Another sketch that you might find useful.

Make a Pledge to free yourself from the noise that comes between you and better investing outcomes. Free yourself from the perennial negative narrative. There is something negative going on somewhere in the world. Even a broken clock is right two times a day. However, the world, our lives and the stock markets run on the fuel of optimism.

As Nick Murray says, “Optimism is the only realism.”

While I am writing this post, we celebrate our 75th Independence Day Anniversary. What do you think will happen by the 100th Independence Day Anniversary or for that matter the 150th Independence Day one?

All I can say is that the Best is Yet to Come. On that note, wish you and your family a Very HappyRich 75th Independence Day Anniversary.

and then tap on

and then tap on

0 Comments