The Missing Diagnosis

Let me make a bold yet true statement. The majority of investor portfolios today are a complete hodge-podge of products (as depicted in the first part of the sketch) unless they have been designed (and thoughtfully crafted as depicted in the second part) by a caring and compassionate real financial professional. The bigger the portfolio, the bigger this problem.

“Sir- you need an absolute return strategy (had done a post on this), so you must have a private equity fund, says a senior executive of a wealth management firm. You also must have a PMS in your arsenal says another fellow. People like you are lapping up these investments, we have kept some allocation specially for you- after all, you are special – this is another real pitch.” Yes, all of these are real life pitches (I chose to use a polite word here even though they are not just pitches).

Now imagine a doctor starting to prescribe you a medicine even before she/he has got a chance to diagnose you thoroughly.

What would you do?

I like to believe most of us would walk away and find another doctor.

Yet this is not what happens in our industry/profession.

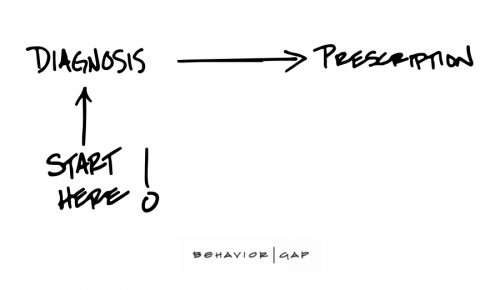

We almost always start with prescriptions. We know the treatment even before we have diagnosed someone’s situation thoroughly. We are specialists in prescriptions and treatments without a diagnosis.

The best part is investors also don’t expect to be diagnosed thoroughly. They want the prescriptions and a treatment plan now. They want the high-flying prescriptions that their friends have got. Most don’t seem to care that their situation might be different than that of their friends.

Even people with a lot of money think like this. Other people like me have invested in this product – I am sure they are not stupid- I think I should too.

Maybe I am ranting, and I should stop it now and start making a point. Let me justify my ranting though – this is as frustrating to me as it is to any self-respecting world class medical professional. Ok- Fine, I know you get it so let me stop.

But Investors are not to be blamed for this. Our industry has spent (and continues to spend) so much money to tell them this is how it’s done. This approach has actually become a part of most investor’s consciousness. The point is that our industry has had it backwards (always). Rather it is not even backwards completely. We simply start and end with the prescriptions and a treatment plan if there is any.

I have seen families having 6 treatment plans (from 6 different people) and 50+ prescriptions. And they believe they are getting to pick the brains of 6 people. This is nothing but insanity. Similar to 6 brain surgeons working on your brain doing 6 different things and no one coordinating with each other. By the way, there is also a fancy name given to these families having 6 treatment plans (but more on this some other day). In case, you are still wondering about the fancy name, let me give you a hint – FO (no it’s not the word that first came to your mind).

Coming back to the point, I cannot emphasize enough the importance of a thorough diagnosis. Let me share a personal experience that I am going through right now.

In early 2022, my father (all of 82 years and super fit), suddenly started losing weight. He lost 16 kilos in 3 weeks. We couldn’t believe the speed at which he lost this weight. We immediately met up with his doctor to figure out what was really happening. 100+ tests and diagnostics led us to the correct diagnosis after 4-5 months. Till that point of time, we were just treating the symptoms.

I have spent the most of my last 2 months in a hospital to take care of dad and his situation. There are so many learnings that I would love to share with you (including some of the mistakes that I have done) but more on this some other day.

The common thread across so many patients was just this – the diagnosis is not yet clear – we don’t know what has happened. While the doctors were doing their best, there are times when the diagnosis is just not clear, and I can’t emphasize enough the importance of getting this step right.

If you don’t get this step right, 4 things can happen –

- No Treatment

- Under Treatment

- Over Treatment

- Wrong Treatment

Thus, getting the diagnosis right is a matter of life and death.

Let me repeat it again by changing a few words here and there – Getting the right/wrong diagnosis can be difference between life and death.

While you are not a patient when it comes to money (or maybe you are) and while the diagnosis might not be so fatal initially (in many cases it absolutely is) when it comes to your money, getting your diagnosis is the first and most important step. It’s absolutely critical for your wealth and health.

Thus, always and always, start here at Diagnosis.

And don’t expect this just from anyone. Care, compassion, and trust are not cheap. They are invaluable and can only be expected from a world class real financial professional. Finally, it’s your luck whether you meet this professional and more importantly whether you let this professional help you (complete the missing diagnosis).

and then tap on

and then tap on

0 Comments