The Stock Market is not a High Return FD…

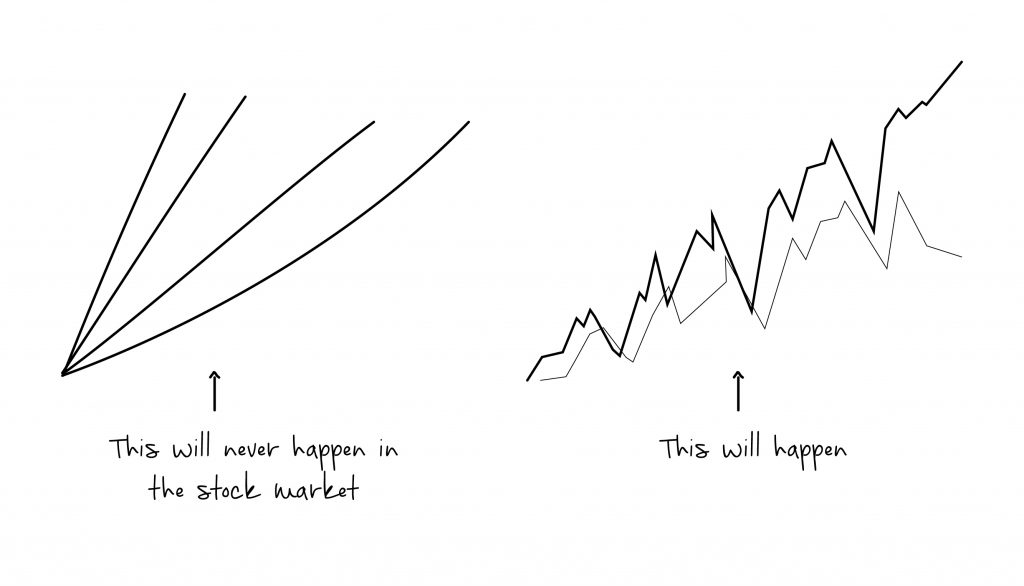

Unlike a FD, the investment value will go up and down.

Some people bullshit about removing volatility and stuff. It is because you like hearing this. The reality is if you lower volatility, you lower return (to be taken conceptually).

Lower Volatility means Lower Return. Period.

If you are not comfortable with the market going up and down, you should not invest in equity ownership…Please be happy with Debt Loanership and UnReal Estate (where you cannot see the daily fluctuations and thus feel happy).

By the way, you don’t have to watch the stock market movements daily, weekly, monthly or quarterly. A semi-annual or annual discussion with your financial professional is enough.

No one can ever remove volatility without lowering returns. Do not believe bullshitters who do.

It’s Stupidity to compare FD (Loanership) and Equity (Ownership). There is a tendency however to do this (compare) when stock markets are flat for a few years, or they give low or negative returns in a year or two. Truth be Told – There is No comparison and there will never be One.

The High Return of a portfolio of Equities is thanks to Volatility. Remove Volatility and you Remove these Returns.

and then tap on

and then tap on

0 Comments