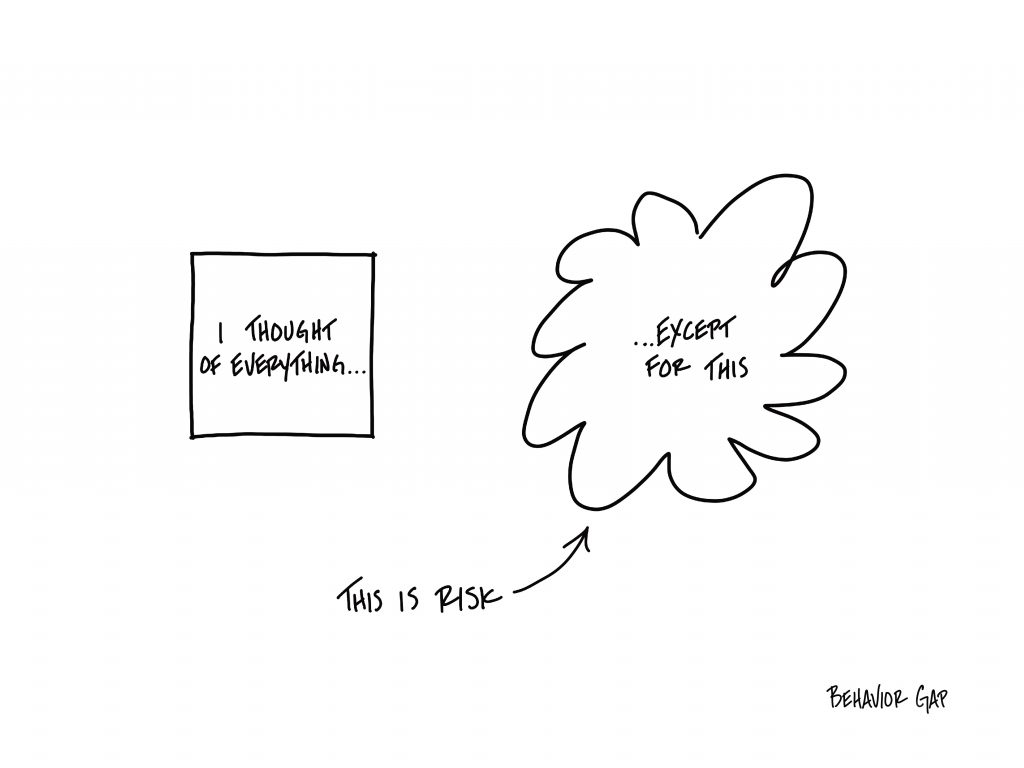

This is Risk

We are good at managing risk by preparing ourselves to handle an event or situation we have already seen or experienced. For example, we are now prepared for the next set of pandemics that are likely to occur in our lifetime. But we are not very good at managing risk by looking forward and preparing ourselves for something we can’t even imagine.

The problem is, “something we can’t even imagine” is precisely what we need to be prepared for. Because risk is what’s left over after you think you have thought of everything.

It’s not the car you see coming that will kill you…it’s the one you don’t.

This is exactly the car Reema Bijlani (a corporate executive in her mid-thirties) couldn’t see. There was a liquidity event in her family and her father Balkrishna wanted to invest the corpus he had received, for Reema. Balkrishna is 70+ years old but was extremely comfortable investing in equity. He told Reema to follow her financial professional’s guidance and invest all the funds they had received in equity. He said, “We have a decent exposure to tax free bonds and thus this money should be invested from a long-term perspective in equity mutual funds. This is for Reema’s retirement that might happen in the next 25 years or so. Since this is long term money, I don’t want any debt exposure in this.”

While Reema was broadly comfortable as there was a lot of detailed work done by her financial professional, there was something going on in her mind. I was an observer in the meeting and was listening to the conversation intently.

Reema said “My biggest thing is safety of capital. I don’t mind investing in safe investments.”

I asked her, “Can you kindly explain what you mean by safe?”

She seemed a little irked by this and told me, “While I understand risk, I want protection of my capital and don’t want my portfolio to go in the negative. Thus, I am even considering investing a sizable portion in investments that are safe.”

To Reema, Risk was all about the stock prices going up and down (volatility/market risk) . She could see this risk clearly because this is what she read in newspapers. Even her quarterly portfolio reports showed the changes in prices. However, she was missing the biggest risk. The Risk of Losing her Purchasing Power. There was no report showing her this. She was simply unable to visualize this monster.

And it’s not just Reema. There are many who get blindsided with this. They don’t see inflation and more importantly lifestyle inflation as a risk. While some do understand inflation conceptually, they are unable to make the link between safety of capital and inflation. They don’t see protection (or preservation) of purchasing power as safety of capital. They simply look at the return of capital as safety of capital. This is one of the reasons there is a ton of long -term money (the official figure is simply mind boggling) lying in extremely low post tax return fixed deposits and savings accounts.

Inflation by definition is a decline of your purchasing power. On the other hand, lifestyle inflation is way higher than the inflation we read in the newspapers. In fact, lifestyle inflation is a killer of purchasing power.

This leads me to this equation:

Preservation (or Safety) of Capital = Preservation of Purchasing Power

Thus, the ultimate objective of any rational long-term investment plan is the preservation of your purchasing power until you live (followed by your spouse’s/family’s). And this is a risk you can’t afford to miss.

P.S. A few more statements about Risk – Risk is measured as the probability that you will outlive your money. Risk is also measured as the probability that you won’t achieve your financial goals. Thus, the objective of a sound long-term investment plan is to minimize (or eliminate) these risks.

and then tap on

and then tap on

0 Comments