Speculation Series – Part II

In the first post of the Speculation Series, I focused on defining speculation (as well as speculator), investing (investor) and the difference between the two. I did that because this subject of speculation is as misunderstood as the subject of risk is.

In this post, I attempt to highlight Austrian economist J A Schumpeter’s observation that speculative manias typically occur at the inception of a new industry or technology when people overestimate the potential gains and a lot of capital gets allocated to new ventures. Whether it was the novelty of tulips in the 1600s or the novelty of NFTs in the last 18 months, people still continue to overestimate potential gains.

On February 16th, 2022, news broke out that American Rapper, Songwriter and Actor Snoop Dog had sold $45 million worth of NFTs. In simple terms, Non-Fungible Tokens (NFTs) digitally represent ownership of any asset (whether digital or real-world assets). The ownership is encoded on a blockchain (a distributed digital ledger technology but more on this and NFTs in a future post).

Though I understand the use cases of NFTs (and believe in its core proposition), the $45 million sale to me was a clear example of irrational exuberance on the price.

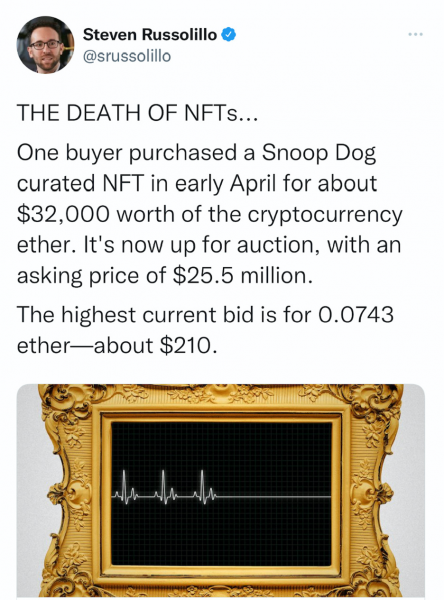

Then on May 3rd, 2022, I came across this interesting tweet:

The buyer was hoping to turn $32,000 into millions in just 2+ months. Sadly, the highest bid was around $210.

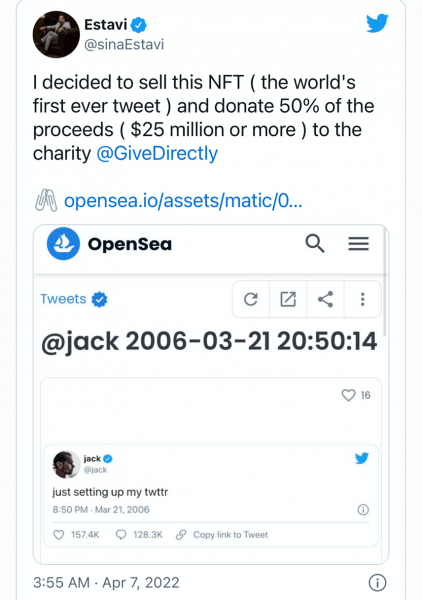

This didn’t come as a surprise as just a month earlier, I had read about the speculative auction of an NFT of Jack Dorsey’s first tweet.

Malaysia based Mr. Sina Estavi had bought this tweet in the form of a NFT in 2021, when it was auctioned off by Jack Dorsey for charity. At that time, Mr. Estavi had paid $ 2.9 million for the tweet.

$2.9 million for a Tweet. This is like paying $2.9 million for a Tulip. Well beauty lies in the eyes of the beholder. Doesn’t it?

BBC even reported that Mr. Estavi has compared the digital asset to Leonardo Da Vinci’s Mona Lisa.

The price of $2.9 million for a tweet that read “just setting up my twttr”, was as crazy then as it is now. Never mind, the other thing that drives me crazy about this tweet is that Jack Dorsey wrote twttr instead of twitter. A remarkable thing is that all of this is done in the name of charity. Pardon my little detours, but there is some connection to the charity comment.

Fast Forward April 2022, and Mr. Estavi puts this tweet on auction and pledges to donate 50% of the proceeds to a charity. The intersection of speculation and charity is amazing here. I have shared his tweet below:

The best part is that he listed the NFT at $48 million.

What do you think was the investors’ interest in this?

Fortune Magazine’s Nicholas Gordon wrote in a post “Investor interest was tepid. When the auction closed, Coindesk reported that only 7 bids had been entered for the token, with the highest coming in at $280. More bids have come in then. Yet the highest offer of $6,200 as of the publication time is still significantly below what Estavi paid for the NFT, let alone what he hoped to earn through the auction.”

There are many such stories of speculative behaviour in the last 24 months. And yes, this behaviour is not restricted to NFTs or the Crypto markets. The Gamestop and AMC stock saga in the US stock market is yet another example of speculative behaviour. Similar examples can be found in every asset class so this time it was not really different. People will keep needing something new to speculate on. Speculation is a deep human desire or should I say a need.

99% of NFT’s are worthless today, just like 99% of dot coms were during the late 1990s. Many of them were “get rich quick or make more money quickly” schemes powered by greed and FOMO (Fear of Missing Out). This does not mean there was anything wrong with the technology. We have all witnessed the evolution of the successful 1% dot coms and the role ecommerce plays in our lives today.

NFT’s are a young asset class with extremely low levels of liquidity and daily trading volumes. The younger the asset is, the more of its value comes from speculative value. Think about common stocks in the 1600s. As the asset class matures, the speculative value goes down and the utility value goes up. We are still in the very early days of NFTs. Things are likely to change over a period of time as more use cases and more people globally participate in this space.

2 brilliant quotes that instantly come to my mind when I reflect on the above. I hope they work for you too.

Warren Buffett wrote “What we learn from history is that people don’t learn from history.”

The second one is one of my favourites from US President Truman – The only thing new in the world is the history you don’t know.

and then tap on

and then tap on

0 Comments