The Boring Part

I recently read an interesting headline “Disney Goes All in on Sports Betting”, in the Wall Street Journal. The headline piqued my curiosity as the first thing that came to my mind was “Disney and Betting…Really! Isn’t this crazy?” What about the Disney brand I wondered…Apparently after years of internal debate, the entertainment giant did a deal with a gambling company…More on this in a little while but let me clarify that this post is neither about this deal or whether Disney should have done it or not…This post addresses an important connection between their decision and money & investing in general. While the connection might not be apparent initially, it will be as you progress through the post.

According to the WSJ column, “In early 2019, an analyst asked Disney Chief Executive Bob Iger if sports betting could co-exist with the House of Mouse’s brand. He said he didn’t see the company facilitating gambling in any way.

Just four years later, the world’s most beloved name in family entertainment is going all-in on sports betting. In August, the company struck a 10-year deal with sports betting company Penn Entertainment to bring gambling to Disney’s ESPN sports network. Sports fans will be able to wager on games on their phones through a new app called ESPN Bet that accepts bets through Penn’s sportsbook.

The idea of gambling under the same roof as Disney has roiled some company executives and employees who feel it will damage the brand. In the last year, at least one large investor warned Disney that it might have to sell some of its Disney stake if the company embraced betting.”

What then made Disney do this?

Two simple words…more money…and engaging with the audience (keeping them hooked)

The money is simply too good to pass for many.

As I was writing this post, a piece of wisdom I had heard a bookie say on a Netflix show “Caught Out: Crime. Corruption. Cricket.”, came to mind… He had said, “Gambling is a part of Life…People will gamble or bet on anything if not cricket.”

The reality is people like to gamble. It comes naturally to us. If we think there is quick money to be made in something, we are likely to go for it or at least be tempted to go for it.

Earlier fans used to watch and cheer…

Now fans want to watch, cheer and bet…

Technology has removed all the friction and made it super simple to bet…You don’t even have to get up…The best thing…all of these are now legal in many states and countries.

Disney like many others wanted to capitalize on this human impulse…of gambling.

The executives might even have convinced themselves with the most logical (but stupid) explanation that we generally give ourselves.

If I don’t do it, someone else will do it…

And in the case of Disney, many someone(s) were already doing it…So why leave money on the table if people want it…Just give it to them…

In this deal, Penn will pay Disney $1.5 billion in cash while ESPN will receive warrants worth $500 million to purchase shares in the gambling company.

The reality is it’s not just Disney…Many want a piece of the “fast money pie”.

Just look at the billboards and advertisements around you…Many of them are likely about sports betting or fantasy games (a fancy phrase that sounds like sports porn) ones. This fantasy game stuff is even integrated in cricketing events including the World Cup.

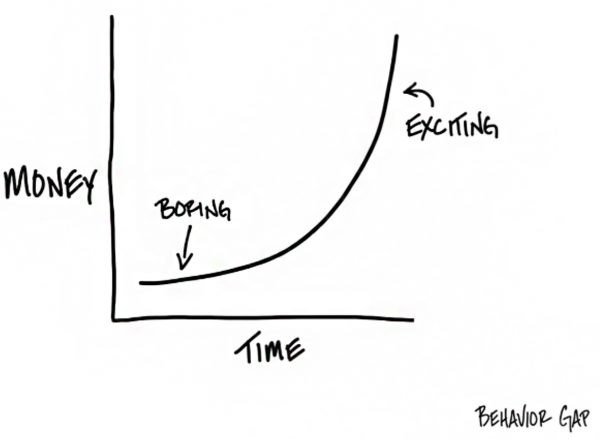

It’s time now to quietly (forget my ranting) look at a visual…

Do you recollect a similar visual I had shared some time ago?

If not, do you know what this visual is about?

It’s about the most important concept (and secret) of money and investing.

Compounding.

Fast doesn’t last when it comes to investing.

Real investing is always boring in the beginning…it’s never about speed …it’s as boring as watching grass grow…The exciting part in real investing comes over a period of decades…The exciting part only comes and more importantly stays to those who go through the boring part…

You might make money quickly once or twice but don’t mistake this luck as your skill.

Let me give you an extreme example – Sam Bankman Fried (SBF) who is in jail now and going through his trial. He quickly bypassed the boring part and went from $0 to $30 billion… As you know now, not only is he back to ZERO…but he is way below ZERO…$30 billion was wiped out faster than it took him to build.

He didn’t start off as a criminal. He was a trader obsessed with more and fast money. The kind of arbitrage trading he did in Crypto…gave him the feeling and belief that he had a golden hand. He didn’t stop. Eventually made losses like everyone. He then did a lot of criminal stuff to cover his losses while trying to make fast money (his natural impulse and habit).

Fast Money might be short term exciting…But it is detrimental to your Long-Term Wealth (that includes your health, joy, and peace of mind).

The only way to make fast money (in the long-term) is by making it boring and slow initially. It is only when you activate the sleeping giant of compounding that fast money is made.

Don’t believe this?

Do you recollect The 500 Year Plan Post? If you don’t, I strongly encourage you to read it again…

If you take ten paise and double it every day for 30 days, you end up with…

Can you guess the number?

Many guesses were below Rs.1000…Some said Rs.10000…A few adventurous ones said Rs.100,000 (when I gave them a few prompts) and by the way this also includes a fund manager.

What was your number?

Despite knowing how to calculate, the power of this sleeping giant does not come to us naturally like the instinct of making fast money.

The answer is Rs.107,374,182 (Rs.10.73 Crore).

Behold, the magic of compounding interest—something Albert Einstein is said to have called the most powerful force in the universe.

But you know what I find interesting about the doubling ten paise example? On day seven, you’re only up to Rs.12.8… In fact, after 15 days—halfway to 30—you’re still only at Rs.3,276.8 and after 20 days you are at Rs.104,857.

Don’t get me wrong – turning 10 paise into three thousand bucks is great in 15 days and then 1 odd Lakh in 20 days. But you’re still a long, long way from Rs.10 + Crore.

That’s the tricky thing about compound interest, it starts out boring.

In fact, the reason most of us don’t ever get to see this powerful force at work is because we’re not willing to go through the boring part.

Things do get exciting eventually… look at the steep end of the curve.

It just takes a while to get there.

Unfortunately, the only way to get there is to go through the boring part of the curve first.

So be patient.

Very, very patient.

and then tap on

and then tap on

0 Comments