Overcoming the Trap

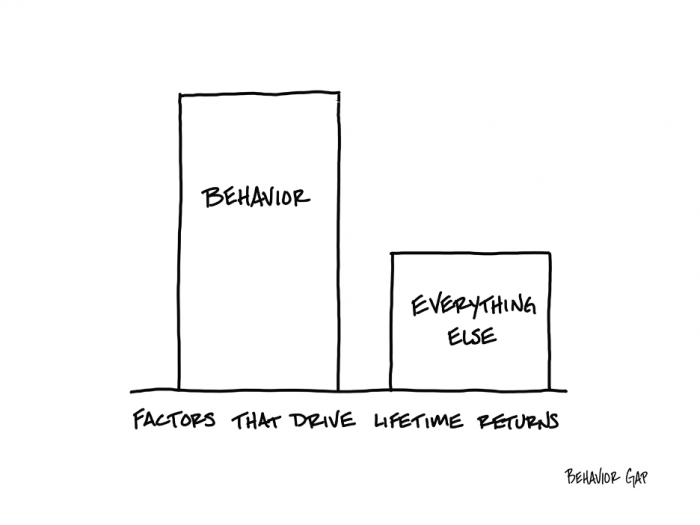

The single most important factor in a lifetime of successful investing is your own behavior.

You could have the greatest portfolio ever created. But one poor behavioral mistake a decade, and you might as well have just kept your money in the bank.

In fact, I would argue that portfolio design only matters to the degree that it influences your behavior.

So next time some hand-wavey person on the financial pornography network starts talking about how you should buy, sell, or do anything at all, just remind yourself: none of that matters if you don’t behave.

As an investor, it’s natural to compare your returns with those of peers, especially when you hear about someone else’s higher gains. This comparison, however, can lead to a cognitive trap known as the Relative Deprivation Bias. This bias doesn’t just cloud our judgment; it can actively distort our investment strategy, pushing us toward unnecessary risks or changes. Let’s take a deep dive into understanding and overcoming this potentially harmful bias.

Understanding Relative Deprivation Bias

Relative Deprivation Bias in investing manifests when you compare your financial achievements not on their own merits, but against the more favorable outcomes of others. For example, if your portfolio returns 15% in a year, you might feel successful—until you hear that your friend’s portfolio returned 24%. Suddenly, your own success feels inadequate. This isn’t just a harmless twinge of jealousy; it’s a perception that can lead you to question your strategies, potentially driving impulsive decisions to switch advisors or shift to higher-risk investments in an attempt to match or outperform others.

The Dangers of This Bias

The main danger of Relative Deprivation Bias lies in its ability to make you abandon well-thought-out investment plans for more aggressive strategies that may not align with your risk tolerance or long-term goals. This can lead to increased exposure to market volatility and potential financial loss, especially if the new strategies do not perform as expected.

How to Mitigate Relative Deprivation Bias

1. Focus on Personal Financial Goals: Keep your financial goals front and center. Investments should be tailored to personal circumstances, including risk tolerance, investment horizon, and financial needs—not someone else’s success.

2. Embrace a Long-Term Perspective: Investing is a marathon, not a sprint. Short-term fluctuations and comparisons are less relevant when you focus on long-term growth and stability.

3. Cultivate Financial Literacy: Understanding the markets and the nature of investing can fortify you against emotional responses to others’ successes. Education helps in appreciating the complexity of different investment strategies and why certain choices might be right for one investor and not another.

4. Understand Yourself: In the journey of investing, understanding yourself is far more crucial than understanding the market. It’s about comprehending not just your financial goals, but also your deeper motivations, fears, and biases that drive your decision-making.

This self-awareness is the anchor of your behavior. Self-awareness in investing means recognizing your own financial behavior patterns, emotional responses to market changes, and the psychological biases that may influence your decisions. Are you someone who feels the need to change your investment strategy just because your family member has earned higher returns? Are you someone who panics during a severe market downturn? Do you find yourself chasing performance? Being aware of these traits allows you and your real financial professional to develop strategies that accommodate or counteract them.

5. Regularly Review Your Investment Strategy: Regularly consulting with your real financial professional to review and possibly adjust your strategy based on changes in your life, not due to comparisons with others, can help maintain alignment with your goals.

6. Practice Gratitude: It’s beneficial to regularly reflect on and appreciate your own gains and successes, regardless of others’ outcomes. Gratitude can increase overall satisfaction with your financial journey.

The Takeaway

Relative Deprivation Bias can turn even a well-performing investment portfolio into a source of dissatisfaction and unnecessary risk-taking. By recognizing when your feelings are being influenced by this bias, and recentering on your personal financial goals and context, you can avoid the pitfalls of this deceptive mindset and maintain a steady course towards your financial objectives.

This approach emphasizes the importance of personal satisfaction and long-term stability in investment strategies, aiming to empower you to remain focused on your own goals and not be swayed by the success of others.

Here are some real-world examples that illustrate the Relative Deprivation Bias in various contexts, including investing:

1. Investment Club Comparisons:

Imagine an investor named Deepali who is part of an investment club. Deepali has achieved a respectable annual return of 12% on her portfolio, aligning with her risk tolerance and retirement goals. However, during a club meeting, she learns that another member, Samir, achieved a 18% return by investing in a more aggressive portfolio. Despite her own success, Deepali feels unsatisfied and considers shifting her strategy to mimic Samir’s, disregarding the greater risk involved and the fact that such investments may not suit her long-term financial needs.

2. Colleague’s Real Estate Success:

Madhu, a conservative investor, has consistently invested in mutual funds and bonds, gaining steady, and solid, returns. She overhears a colleague bragging about making a significant profit by flipping a property in the real estate market. Suddenly, Madhu feels her own investments are inadequate, even though they suit her aversion to risk and provide the income stability she desires. This feeling might pressure her to consider real estate investments without fully understanding the risks or market timing involved.

3. Social Media Influence:

Ajay, a young investor, regularly follows financial influencers on social media platforms where people often post about their investment wins, rarely mentioning losses. Seeing constant updates about lucrative stock picks and crypto fortunes, Ajay feels his own diversified portfolio is underperforming. This perception could tempt him to make hasty decisions, like reallocating his investments to high-risk options that promise high returns but come with potential for significant losses.

4. Family Financial Comparisons:

Jyoti is happy with her retirement savings progress until she attends a family reunion where her cousin boasts about doubling his investment. Despite Jyoti’s solid and suitable investment strategy, she feels a sense of loss and begins questioning her investment approach and her financial advisor. She considers investing in such investments too, overlooking the fact that her cousin’s risk profile and financial situation might be very different from her own.

These examples show how Relative Deprivation Bias can make individuals feel unsatisfied with their own achievements due to comparisons with others, often leading to inappropriate financial decisions that do not align with their personal financial goals or risk tolerance. Recognizing and addressing this bias is crucial to maintaining a sound investment strategy tailored to individual needs and circumstances.

In the quest to overcome Relative Deprivation Bias, self-awareness stands as a beacon. By knowing oneself — your triggers, tendencies, and true objectives — you set the stage for investment choices that are conscious, deliberate, and anchored in your personal reality. This is the path to fulfilling not just your financial ambitions, but a vision for your life well-lived.

To this end, it is crucial to establish a practice of introspection and honest self-evaluation. It means having the courage to face your financial fears and the discipline to adhere to your investment principles, even when the world around you seems to be chasing the wind.

In bringing this understanding into practice, remember that your investment journey is unique to you, much like your fingerprint. It’s not merely about where you stand in relation to others, but how each step you take aligns with your ultimate destination. To navigate this journey with wisdom, heed the words of Warren Buffett, “The stock market is designed to transfer money from the Active to the Patient.” Let patience and self-knowledge be your guides as you craft an investment story that is authentically yours.

and then tap on

and then tap on

0 Comments