Inactivity, Right People and Flourishing

Last weekend, the investment world was all about one of the most successful people in the world of investing. You guessed it right – Warren Buffet and his company Berkshire Hathaway’s renowned annual shareholder meeting. His annual shareholder letter in which he reflects on the past year is a gold standard in the investment industry. Everyone quotes from it on a regular basis. This year, he did something interesting. He managed to summarize his career in two numbers. While the first number focused on his overall returns over that period, the second number was super interesting. Can you guess what that is?

Now please don’t do a google search here because I am going to give you the answer shortly.

Here are some hints through the words I have written in this blog over the years.

a. Be Less Wrong

b. It’s a smaller number

c. Let Compounding Work for you.

Did you get it?

If you haven’t, here is the ultimate one.

Mr. Buffett wrote, “Our satisfactory results have been the products of about a dozen truly good decisions. That would be one every five years.”

The number is one every five years.

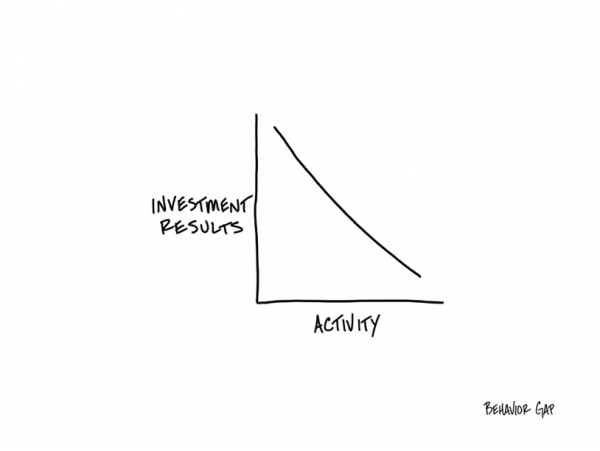

This is contrary to what we see in the IPL advertisements, or on social media where the obsession is about activity. There is so much garbage about doing things and more importantly doing things on your own. Most business models in the investing world are based on activity. We are told to make money fast. We are told to make big money. We are told to simply open an account and start making money. But then here is the richest investor in the world who talks about a tiny number of decisions and inactivity in general.

The best part is that he suggests that his success is not about getting every decision right. In fact, he admits that most of his investments have been mediocre or average. But his one truly good decision every five years was sufficient to produce his investment outcomes. And the most important thing – let compounding do its job. The message should be loud and clear to everyone, but is it?

Because we have been told to obsess about activity. We have been told that when you do more, you get more.

That activity = results.

And when we see others doing it (buying and selling), we think they are making more money than us or that it is the right thing to do. But as Warren Buffett wrote, “Success in investing can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.”

When done correctly, investing is indeed a place where you get rewarded for being lazy. Though it may seem counterintuitive, investing is a do-less proposition because of the power of compounding. But didn’t you know this already?

The next time you are tempted to do something, don’t. If it compounds, let it.

Now we come to the second and most important part of the post – his best investments. What do you think the answer is?

If your response is Coke, See’s Candies, Geico, Bank of America or even Apple, you are wrong.

Hint: He knows what he is not good at. “The Warren Buffett” knows many of his biases and blind spots.

Many of his best investments have not been in companies but people. And these people led him to many of his best investments. Warren Buffett calls Ajit Jain, Vice Chairman of Berkshire’s Insurance Operations the best investment he has ever made. It was not Warren Buffet’s idea to invest in Apple in 2016. He is famously averse to invest in technology companies. He considers technology beyond his circle of competence. But at the same time, he knew he had to expand his circle of competence.

It was one of his team members who advised him on investing in Apple. But the best part is that he listened to them, which is so important.

And today, Apple is the biggest position of Berkshire. Almost 45% of Berkshire’s portfolio.

Can you believe the world’s savviest investor telling us that his best investments have been in people?

And here we are told by stupid fellows – do it alone…You can do it, because I have done it. And we are hounded to indulge in activity, trading and what-not.

Truth be told (and as you might know by now), we cannot see our biases, blind spots, feelings and behaviour. But we are very good at self-deception. And we are really good at gathering information and opinion to support the conclusion we like to hear. We even call it research. And it’s this approach that gets in our way. We need to get out of our own way. We need to understand that activity is not equal to results. And we need that objective someone, a real financial professional to care and guide us in our journey to (financially) live a life that’s truly important to us. But the critical question is – will we invest in such a person to help us flourish.

Will you?

and then tap on

and then tap on

0 Comments