The Investor’s Creed: Loving Volatility, Cultivating Security

In the previous part (Part 1 of our story, we ventured through the forest of flashy headlines and discovered the true nature of market corrections. In this Part 2, let me share some wisdom on weathering financial storms, and on equipping ourselves with the tools needed for the journey ahead. Together, we’ll learn to embrace the ebbs and flows of investing, not with anxiety, but with the calm certainty that comes from understanding and preparedness. Join me, as we continue our quest for a HappyRich life, one thoughtful step at a time.

Before we step into the heart of our discussion, let’s pause for a moment. It’s important to approach what comes next with a mindset ready for growth and change. The points we’re about to explore are more than just markers on a chart; they are time-tested beacons, long-standing truths that you may already know but perhaps have not yet fully integrated into your financial ethos. Think of them as a series of lanterns illuminating our path—each one casting light on a principle or a strategy that can lead us toward financial serenity. Now, let’s move forward, gently but confidently, as we discover the guiding principles that will help us navigate the financial journey ahead.

1. Never ever invest money that you require in a day or a month/quarter or even a year (or two) in the stock market. This effectively means all this money is simply long-term. You are not dependent on this for day-to-day expenses or any lifestyle expense.

2. Ensure you’ve set aside what I like to call a ‘Lifestyle Reserve’—it’s your financial safety net for those times when the economy takes a dip. Think of it as your personal buffer against uncertainty, tailored to your unique financial picture: your income stream, the life you lead, the debts you carry, and your overall appetite for risk. It’s your stash of funds that could cover your needs for anywhere between 6 to 24 months, customized to support you and your loved ones when you need it most.

For your ‘Lifestyle Reserve,’ consider not just the amount but also the accessibility. This fund should be in a form that allows for immediate withdrawal without significant penalties—think savings accounts or liquid funds. It’s not just a pool of money; it’s peace of mind, ensuring that life’s unexpected turns don’t turn into financial freefalls. Regularly review and adjust this reserve in line with life changes such as a new home, a growing family, or a change in career. It’s a living part of your financial plan that should evolve as you do.

3. Additionally, I advocate for establishing what I refer to as your ‘Sleep Well At Night Reserve.’ This goes a step beyond your Lifestyle Reserve. It’s the assurance that you have enough liquid assets that stand firm even when the stock market is on shaky ground. These are funds you can count on for a prolonged period, say 3 to 5 years, if necessary. It’s about having that extra layer of financial security that lets you sleep peacefully, knowing you’re prepared for extended market lows.”

As for your ‘Sleep Well At Night Reserve,’ it’s a testament to prudent financial life planning. Beyond just liquidity, this reserve is about strategic allocation. While you can keep this in savings accounts and/or liquid funds, you can also diversify into assets such as conservative short term fixed income (debt) funds that offer stability independent of the stock market’s ups and downs.

Think of it as your financial anchor—keeping your overall portfolio steady in turbulent waters. This reserve is not about growth; it’s about preservation of capital and ease of mind. Regularly assess this reserve to ensure it aligns with the current economic climate and your long-term financial goals.

Incorporating these reserves is a proactive step towards a comprehensive, resilient financial strategy.

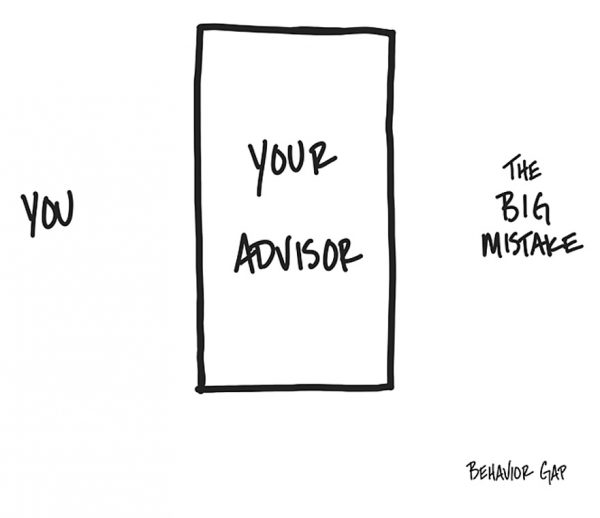

4. Get the Care of a World Class Real Financial Professional to come between you and your worst impulses or behaviour.

5. Keep Investing (every month and whenever you can).

6. Embrace Volatility… Not only embrace it but LOVE it…

Wise investors embrace volatility. They love it and they welcome it. It’s not for a reason Warren Buffett said, “Be fearful when others are greedy and be greedy when others are fearful.”

The essential point here is that wise investors know that market declines are generally temporary, but market advances are usually permanent.

Write or repeat the following statements.

a. This volatility was/is necessary for me to beat inflation. I love volatility.

b. This volatility was/is necessary for me to create/maintain real wealth. I love volatility.

Do not bear or endure volatility. Love it. Feel Gratitude for it. Enjoy it when it happens. Thank the Stars for Volatility when you go through a sharp correction. That’s a recipe for peace of mind and for avoiding doing the wrong thing.

To wish for a bear market or correction to happen is a smart way to avoid any disappointment when it actually happens.

Finally, one day drops, however severe they are, don’t matter to a long-term investor. Is there really a way to avoid these drops and yet participate in the biggest daily up moves. Absolutely not. In that case, what is the point of investing even an iota of energy on this number and such headlines?

In essence, those sensational headlines serve as a daily reminder of the media’s penchant for drama over substance. They thrive on the pulses of our innate fears and hopes, pulling us into a whirlpool of short-term reactions. But as seasoned navigators of financial waters, we must rise above. We need to recognize these headlines for what they are: mere noise against the symphony of long-term investing.

The true north for your financial compass should not be set by the clamour of daily market movements but by the cardinal points of sound financial principles. It’s about understanding the cyclical nature of the markets, acknowledging that corrections are not roadblocks but rather natural, necessary parts of the investment journey. They offer opportunities for those prepared with a plan and a perspective that sees beyond the horizon of immediate events.

So, let us not be swayed by the cacophony of dire predictions. Instead, let’s anchor ourselves in the wisdom of preparation and the power of patience. Invest not just your money, but also your confidence in a strategy that withstands the ebb and flow of market tides. Build your reserves, embrace the volatility, keep buying, stay invested, and let your financial decisions be guided by knowledge and foresight, not fear and sensationalism.

Remember, the markets will rise and fall, but your vision should remain steadfast. Equip yourself with the tools of prudence: a Lifestyle Reserve for the unforeseen, a Sleep Well At Night Reserve for peace of mind, and an unwavering belief in the philosophy of long-term investing.

Stand firm in your convictions, and you will find that the market’s most tumultuous days are no match for a well-prepared investor’s resolve.

In the end, it’s not the headlines that define your financial legacy, but the calm, considered choices you make each day. So, brace not for the next correction, but for a lifetime of informed investing. That’s how you truly brace for success.

and then tap on

and then tap on

0 Comments