Emotions and Worry

What better way to start the year than writing about Emotions and Worry? Don’t you agree? Maybe Not. I get it if you don’t. Trust me, I don’t get it too, but this is a post that builds on the “Amor Fati Volatility” Post. And as you know, Real and Wise Investors Love Volatility. We need to Master volatility. Thus, it’s important to master our Emotions and lower our Worry Quotient (WQ). Hence this post aims to seek your valuable attention in the first week of 2022 itself.

Emotions are like clouds. They change even though you might feel they won’t. They might take some time to change but they will change at some point of time. As you know, emotions play a key role in the life of a successful investor. Thus, we focus a lot on emotions, behaviour, and wise investor construction.

In 2020, was there a point in time where you felt you could take no more? That point for most people was somewhere between March and May 2020. Very Specifically March 23rd, but mostly the feeling continued in the first half of 2020.

What about 2008 -2009 and 2000-2002? When was it where you felt you couldn’t take it anymore?

It is generally at this point that you feel the worst. We feel it’s all over. Some get angry at themselves. Some get angry at their financial professionals. Some feel stupid and say, “I should have never got into this.” Some quit investing altogether. We try to fight something that has already happened.

While we don’t know what the future holds, if you are at this position after having invested wisely at any point in your investing career (following the process of planning and diversification), more than likely, the feelings you have left to experience are generally better than this one only. This means that things will get better from here. Even if things get worse from here, they will get better at some point of time. Let me add that the same can’t be said about speculation and trading. I had to add this because today there are more speculators than investors and the worst part is that they don’t know it yet.

In 2022, we will witness a few things – QE by the Fed will come to a halt. Interest rates in the US and many countries will go up. In the recent bimonthly monetary policy review (December 2021), RBI kept interest rates unchanged. At some point of time though, the interest rates will go up. Additionally, there are geopolitical risks such as Russia invading Ukraine or China’s military adventurism with Taiwan. While the stock markets are always forward looking, we never know how an event or two can cascade into something that might surprise the markets. What I wish to highlight here is the nature of stock market investing. Uncertainty is the only Certainty. There is no way to avoid these surprises and these short term declines other than being out of the markets. And as wise investors, we shouldn’t.

Even if any event were to happen that spooks markets, it should certainly not surprise or worry us. After all, we expected this to happen. Volatility is simply the tax we pay for compounding to work for us.

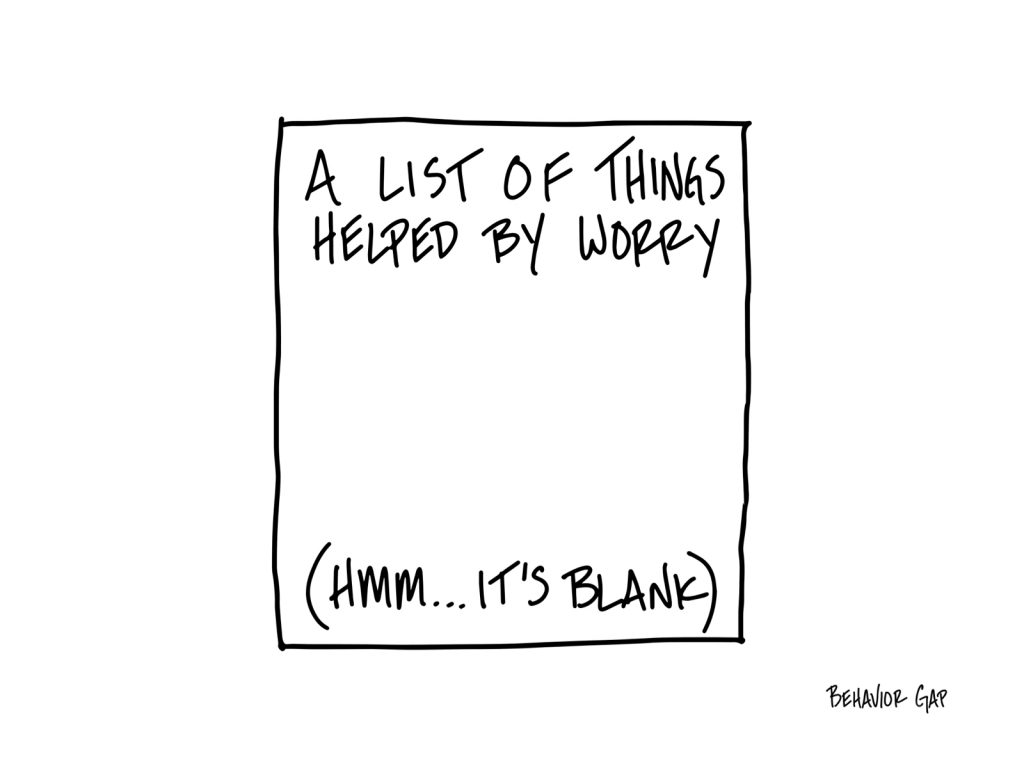

Many keep worrying about what will happen next. The 2 questions that keep people worried are – Will the market go down and when is the right time to invest?

Indian Buddhist monk and scholar at Nalanda, Shantideva had said “If the problem can be solved, why worry? And if the problem can’t be solved, then worrying will do you no good.”

Especially after what we have witnessed in the last 2 years, nothing should really surprise us or worry us. One thing for sure is that we will all be OK.

and then tap on

and then tap on

0 Comments