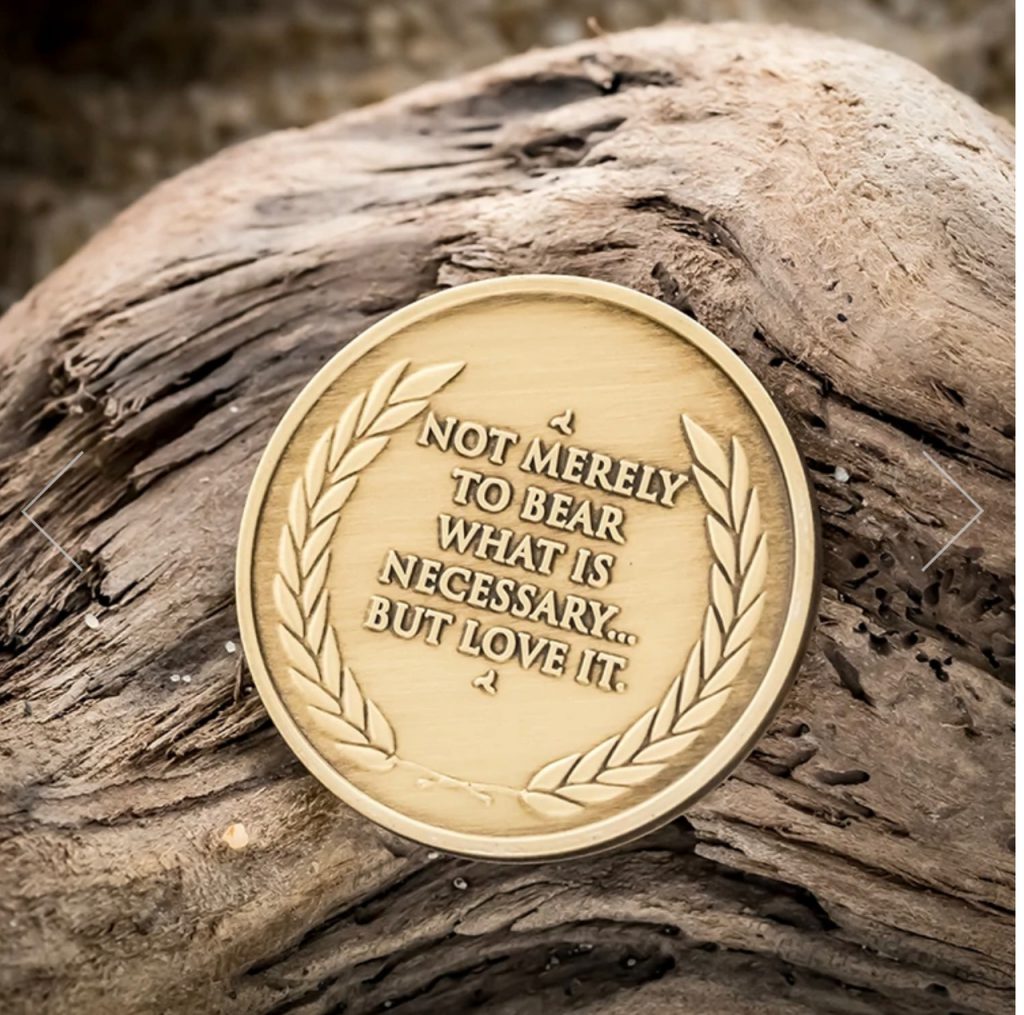

Amor Fati Volatility

I thought of intentionally keeping today’s post short and sweet but insightful. This concept is one of the most important concepts for investors and I am confident you will agree with me by the time you digest this post.

By the way, Amor Fati and volatility are two different concepts and technically are in no way related but I have attempted to marry them together in the context of investing.

Put simply, Amor Fati is a Latin phrase that means “a love of fate or a love of one’s fate.” Though Friedrich Nietzsche coined the phrase, Amor Fati as a concept was a part of Stoic philosophy many centuries before. The Great Roman Emperor Marcus Aurelius as well as philosophers such as Seneca and Epictetus practiced the concept of Amor Fati without actually calling it Amor Fati.

In short, Amor Fati is not just about accepting. It’s loving everything that happens.

In the context of investing, most investors do not like volatility. They hate volatility. Rather they hate volatility on the way downwards. Everyone loves when the asset price goes up but when it goes down, most hate it. We all love a straight line upwards.

On the other hand, financial professionals tell investors to bear volatility. To Endure it.

Look carefully at the words. Bear Or Endure. Doesn’t it sound like a punishment?

Why should we bear or endure something? We are generally not very good at bearing or enduring something for a long period of time?

What if instead we embrace volatility or love it or welcome it? Can you see where I am going with this?

The reality is that we have to thank volatility or love it.

It is thanks to volatility that we can beat inflation and create wealth.

It is thanks to volatility that we can maintain our lifestyle.

It is thanks to volatility that we will have enough.

Yes, all of it is because of volatility.

Imagine an investing world with no volatility. Will there be any wealth creation in this world?

Will an investment with no volatility be able to beat inflation and more importantly beat lifestyle inflation (which is higher than normal inflation)?

Never.

Even Gold, the biggest inflation hedge, has failed to stay true to its label.

The stock market will be volatile.

The crypto world is even more volatile. In this world, asset prices fall by 30-70% in hours and it’s far more volatile than the stock market. I am not comparing the two markets in terms of risk and return but simply highlighting the volatile nature of both.

Wise investors embrace volatility. They love it and they welcome it. It’s not for a reason Warren Buffett said, “Be fearful when others are greedy and be greedy when others are fearful.” The essential point here is that Warren Buffett embraces volatility as he knows that market declines are generally temporary.

Thus, Amor Fati Volatility (Write or repeat the following statements).

- This volatility was/is necessary for me to beat inflation. I love volatility.

- This volatility was/is necessary for me to create/maintain real wealth. I love volatility.

Do not bear or endure volatility. Love it. Feel Gratitude for it. Enjoy it when it happens. Thank the Stars for Volatility when you go through a sharp correction. That’s a recipe for peace of mind and for avoiding doing the wrong thing.

To wish for a bear market or correction to happen is a smart way to avoid any disappointment when it actually happens.

Once again, Amor Fati Volatility.

We might need this in 2022. If not 2022, we will surely need this at many points in our investing journey.

If you have loved the content or if we have made a difference, kindly share the link below to your friends, family, and people you think will appreciate this.

On that note, I wish you and your family a very HappyRich 2022. Have a wonderful and a prosperous New Year.

P.S. The two images of the medallion are from the Daily Stoic Store. FYI, I carry this medallion with me every day.

and then tap on

and then tap on

0 Comments