Beyond the Spin: The Hard Truth About Financial Outcomes

As I was writing last Tuesday’s post (The Boring Part), Satish was writing his (this one) …Later when I read his post, I realized we had written about similar ideas…and that this could pass off as Part II of The Boring Part (with a different headline).

If you want to win at the roulette wheel in a casino, you must find a foolproof method of predicting the outcome of a spin of the wheel, most of the time.

However, even if you have devised such a method, how do you know it will work? You don’t want to waste any of your money by trying it out before you are sure it will work. What do you do then?

You can follow two different approaches (or both, to cross check the results of the other).

Firstly, you need data to test your method.

Therefore, you can diligently observe the outcome of each spin of the wheel (and a bunch of contextual parameters like time of the day, temperature, and humidity in the room, estimated strength in arm of the person spinning the wheel etc.) for a long time, say over a year and faithfully record all that.

Approach 1: Plug in the values of these contextual parameters in the method you have created, note the outcome calculated by your method and check how often it matches the actual result and if it does not match often enough, tune your method to match them as closely as possible.

Approach 2: Use well established statistical techniques to discover trends and patterns in the observed outcomes and tune your method to match the patterns discovered by these statistical techniques.

I can guarantee that even if your method is “validated” by BOTH approaches above, you will lose your shirt at the roulette wheel in a real casino, if you play long enough!

Yes, you read that right…I guarantee!

Why?

Firstly, the only way to predict what number the wheel stops on, is to apply the laws of physics of moving bodies and calculate the outcome, given the boundary conditions at the beginning of the spin. The wheel (and that means the whole system, including the entire wheel assembly, the person who pushes the wheel to get it moving, the air surrounding the wheel which causes friction etc.) is a deterministic system and therefore in principle, it should be possible to calculate its exact resting state after it stops spinning using Newtonian mechanics.

However, the wheel system is what is called a “Dynamical” system (historically called Chaotic systems). These are systems that are completely deterministic but computationally so complex that there is no known way of computing the final state such a system will be in (given complete information of its initial state) in any time shorter than the time it will take for the system to actually go from the initial to the final state!

The weather systems of the world are a well-known example of a “Dynamical” system and so is the Stock Market!

Most systems which we encounter in real life are in fact dynamical systems and even if there is complete knowledge of the laws which govern the behaviour of such systems, it is impossible to predict their future states in any time less than that which the systems will take to reach that future state!

Firstly, neither of the two approaches I described above are using the physics of the roulette wheel to predict what its final state will be. Secondly, no matter how “scientific” they appear to be – there is no known way that the final state of a system like the roulette wheel can be calculated in time less than the time it will take to reach the final state, anyway. So, any consistent predictions (beyond pure chance or coincidence) of its final state over a long period of time, are impossible.

But what is the point of all this?

The two approaches despite their obvious inability to substantiate ANY method of consistently predicting the future state of a dynamical system – like for example the stock market – ARE regularly used and presented as scientific justification of methods used to predict the future of the markets.

The first approach is popularly called “Back Testing” and the second “Technical Analysis”. And using them for investing in the financial markets is no different from playing the roulette wheel and hoping to consistently win!

This may be useful to a different class of participants in the markets – such as the brokers and the 0.0001% traders but not for 99.999% of the investors who do not want to play the roulette wheel!

But many have been made to believe that these approaches (back testing, technical analysis, forecasting) work consistently…Many naively believe so because we are wired to believe things that might help us make fast money…

Every time a tip or some idea is being given by a broker or market analyst about whether to buy, hold or sell some stock based on “Technical Analysis”, it may be useful to some trader or speculator but certainly it’s of no use to an investor like me who does not want to gamble!

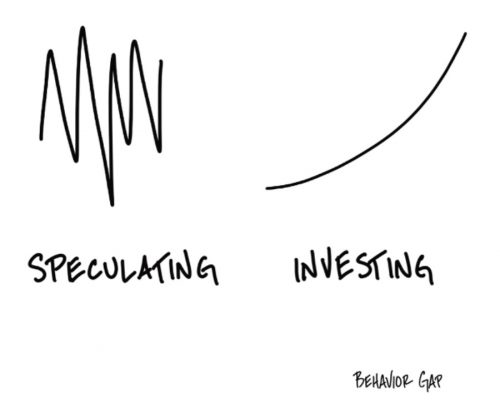

There’s a difference between speculating and investing, and it pays to know what the difference is.

Speculating is exciting, full of breathtaking ups and downs. If you chart it over time, it looks like a heartbeat. Probably an elevated one.

Investing, on the other hand, is slow and boring. In the short term, you may have some ups and downs. But if you chart investing over time (over many years of time), it looks like a long slow curve upward.

Speculating is like a Vegas casino. Investing is like watching grass grow.

Know which game you’re playing.

and then tap on

and then tap on

0 Comments