The Lessons

Last week, the news cycle was all about Silicon Valley Bank (SVB).

Within a week now, the spotlight has been taken over by Credit Suisse. And this is an institution that has been managing money for the rich. In 2006, the market capitalization of Credit Suisse was $ 79 billion. By the end of 2022, it was about $12 billion. In March this year, it was $ 4 billion, but UBS paid a fraction of this to pocket Credit Suisse and avert a financial crisis in Europe (and beyond).

According to Wall Street Journal – Riding on an oil price boom last year, Saudi Crown Prince Mohammed Bin Salman directed the government-backed Saudi National Bank to make a $ 1.5 billion investment in Credit Suisse Group AG. The Saudi investment in Credit Suisse was meant to be the kingdom’s splashy entrance into the global banking sector, cementing its emerging status as an oil fuelled investing powerhouse. The Saudis struck the deal when oil prices were just below $100 a barrel, as Russia’s invasion of Ukraine juiced energy markets. Now, the Saudi investment is almost wiped out after Credit Suisse’s emergency merger with UBS. The steep losses are a reminder of how Gulf states were burned investing in Western banks and hedge funds during the financial crisis in 2007 and 2008.

No matter who the investor is, the person /institution will pay the price for ignoring the principles of risk management. Everyone pays this price no matter the wealth level. Every institution too pays this price no matter the number of smart suits in it.

At this point, I invite your attention to the two posts that I had written in October and November 2022 – The Yes Mandate (citing UBS’s shenanigans) and The Billionaire’s Special (about Credit Suisse). I encourage you to visit/revisit these two posts. This post (a continuation of The Black Swan Season one) however will focus on the lessons you need to deeply understand (internalize) to become a wise investor.

So, what did we learn this time?

Besides this funny WhatsApp message (image given below), many learned some new words too.

New Words and Lessons Learnt:

• Duration

• Interest Rate Risk

• Even Safe Bonds can cause big losses (and get banks to fail)

• Receivership Certificate

What We Need to Learn instead:

• Avoid the Lure of High Returns

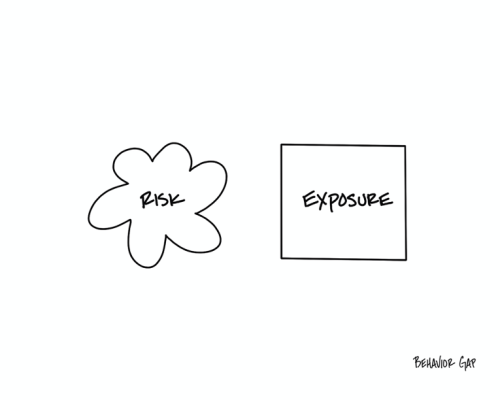

• The difference between risk and exposure (I explain what I mean by this in the paragraphs below)

• How to be less wrong (because we will all go wrong)

• Appreciate Risk Management

• Good Behaviour

• The Importance of having a Real Financial Professional

• Not believing in certainty or the bullshit stories spewed by people (whoever they may be)

• The importance of having a real process to invest your hard-earned money

• Understanding the difference between real investing and gambling/betting/speculation

Now let’s get back to the Risk and Exposure point I made above.

If you’re reading all the news headlines, it’s tempting to think the world is falling apart. I’ve lost track of how many people have asked me about various hypothetical events that may or may not happen—and how that risk should influence their investing strategy.

Let me be very clear about this: simply existing means dealing with risk. Risk is one of the unknown unknowns of the world. It is in the category of things we have little or no control over, making risk something that’s rarely worth our time and attention.

Exposure, however, is easier to define. If a hypothetical event were to happen, we could often get a sense of how it might impact us before it happens. Exposure is easier to measure and control because it’s about us. It’s specific to our situation.

As we deal with a world that feels riskier, understanding our exposure should be our priority. Risk poses the question, “What could happen?” While exposure asks, “What impact would it have on me?”

We can’t always answer the first question. But we have a pretty good idea of how to answer the second. And that allows us to talk about our investment process, asset allocation in our portfolios instead of whether one country is going to invade another. It means we can weigh life insurance options instead of worrying about whether we’ll catch a life-threatening virus.

By understanding and evaluating our exposure, we gain valuable control over our lives in a seemingly out-of-control world.

And that my friend is the most important thing because as I mentioned earlier, we will all go wrong. Maybe not now if you are in the safest of investments but Safety is a Myth. There is nothing Safe…Every investment is exposed to Risk…Maybe a different type of Risk.…It is just that we don’t know what that is or we choose to ignore it…until it comes to bite us…

Thus, Always Be Prepared to Go Wrong…Because We Will Go Wrong…

The Key then is To Be Less Wrong…By understanding the difference between Risk and Exposure.

There is one more important lesson to learn because guess what…there will be yet another Black Swan event at some point of time. We just don’t know when.

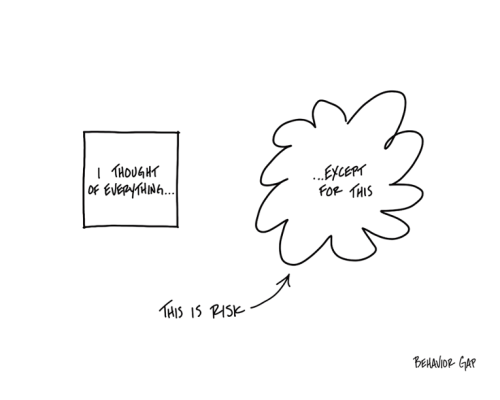

The human reality is we are really good at managing risk by looking backward and preparing ourselves to handle a situation we have already seen. But we’re not very good at managing risk by looking forward and preparing ourselves for something we can’t even imagine.

The problem is, “something we can’t even imagine” is precisely what we need to be prepared for. Because risk is what’s left over after you think you’ve thought of everything.

It’s not the car you see coming that will kill you… it’s the one you don’t.

Bummer, right?

Let me be clear: This doesn’t mean you should cover yourself in bubble wrap and lock yourself in your house.

The point is simply to foster general resilience. You know—like an emergency fund.

And guess what, emergencies will happen. When they do, general resilience provides a margin of safety.

That’s what will protect you from the thing you never saw coming… not trying to predict the future and certainly not bubble wrap (aka going safe).

and then tap on

and then tap on

0 Comments