When to Sell: The Right Moments

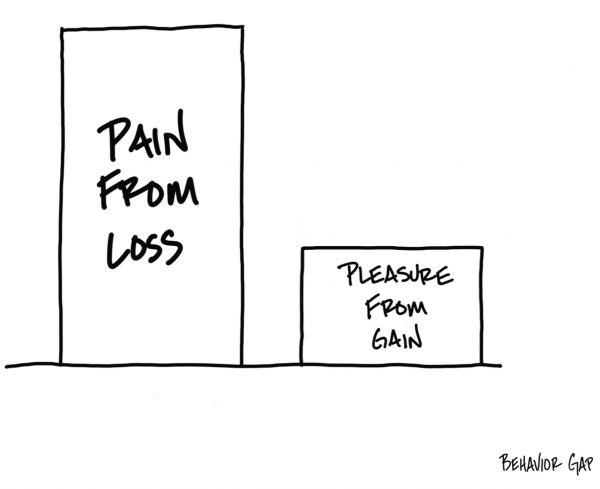

One of the craziest things we do as humans is when we are faced with a loss in an investment. We wait to recover our loss. We wait even when there is no hope. We just want our capital back. On the other hand, when the going is great and we are making significant gains, we feel the urge to book profits. Our smart friends seem to have booked profits. We are told we should too. There is noise of an impending correction. A large broking house issued a report last year (10 months back) saying that the markets will pull back and one should wait. Ten months down the line and with many portfolios up by 30-60%, they are still singing the same song in a recently released report.

Of course, the stock markets correct. It’s in their nature to correct. But as I have mentioned regularly, no one knows when a sharp correction or a bear market is likely to happen. But should you sell? Let’s find out.

When to Sell is one of the most difficult questions you must face.

If you sell early, you end up paying taxes, and you miss out on the gains and the magic of compounding (this is what happens in most cases). The only hope is that the markets correct and that you have the mental strength to invest back without waiting some more and then some more. If you don’t sell, you might have to face a temporary decline. I am assuming the use of a diversified portfolio here and not referring to any single stock.

Isn’t the answer very clear?

I would face a temporary decline any day rather than gamble on the chance of getting out and getting in on time.

My easy answer to the question is – Sell when you need the money…And if you have planned your goals well…this should never be an issue. You will always have money when you need it.

Nonetheless there are technical reasons to sell. We will cover these in today’s post. But next week, I plan to write about when not to sell (or the reasons to not sell). This is actually a 2 part series post, but I might extend it to a third one as well.

Here are 6 reasons on when to sell.

1. Rebalancing Your Portfolio

One of the primary reasons to sell is to rebalance your portfolio. Over time, certain assets may outperform others, leading to an imbalance in your desired asset allocation. For example, if your equity holdings have grown significantly and now represent a larger portion of your portfolio than intended, it may be prudent to sell some of the investments to rebalance your portfolio according to your risk tolerance and investment goals.

Rebalancing is not just about maintaining a specific allocation. It’s a disciplined approach that helps you manage risk. When one asset class significantly outperforms, it can increase the risk level of your portfolio beyond your comfort zone. Selling some of these overgrown assets and reinvesting in underperforming ones can help restore balance and reduce overall portfolio risk. However, you must be prepared to miss out on some future gains (not an easy thing to do emotionally).

2. Achieving Financial Goals

Another appropriate time to sell is when you need to achieve specific financial goals. Whether it’s funding a child’s education, buying a home, or planning for retirement, selling investments to meet these objectives is a legitimate reason. This ensures that your investment strategy aligns with your life goals and financial needs.

For example, if you have a college fee payment due in the next year, you might sell some of your investments to ensure you have the necessary funds available. This is a strategic decision to convert investments into cash to meet a known financial obligation, thereby aligning your investment strategy with your life goals.

3. Changing Investment Thesis

It’s essential to periodically review the reasons why you invested in a particular asset. If the fundamentals have changed and the original investment thesis no longer holds, it might be time to sell. For instance, if a company’s competitive advantage has eroded, or its management has changed and you no longer believe in its direction, selling might be the best course of action.

An investment thesis might include factors like the company’s growth potential, competitive edge, or market conditions. If these factors change, it can impact the future performance of the investment. If you have invested in a mutual fund, and the fund is underperforming for a long time despite all course corrections done, it is a clear sign to exit. Some other reasons include frequent fund manager changes or changes in the investment theme of the portfolio or higher overall risk in the portfolio. Whatever the reasons may be, staying vigilant about the reasons for your investments helps ensure that your portfolio remains aligned with your financial goals and risk tolerance.

4. Tax-Loss Harvesting

In some cases, selling investments can be a strategic move for tax purposes. If you have investments that have declined in value, selling them can help offset capital gains from other investments, reducing your overall tax liability. This strategy, known as tax-loss harvesting, can be an effective way to manage your tax bill while maintaining your investment strategy.

For example, if you have realized gains from some investments and losses from others, you can sell the losing investments to offset the gains, thereby reducing your taxable income. This not only helps manage taxes but also keeps your portfolio in line with your investment strategy.

5. Overvaluation

If a particular asset or the overall market appears significantly overvalued based on historical valuations, it may be wise to consider selling. Overvaluation can indicate that a correction is imminent, and selling at high valuations can lock in gains before potential downturns. However, timing the market is notoriously difficult, so this strategy should be approached with caution and supported by thorough analysis. I am not personally a big fan of this reason because most if not all sins in selling are because of this reason. Everyone gets this wrong at some point of time or most people get this wrong all the time.

Overvaluation can be identified using metrics such as price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and other valuation indicators. If these metrics are significantly higher than historical averages, it might indicate that the asset is overvalued. But remember while valuations can be compared to historical averages, the stock markets are always forward looking. They can remain overvalued because of various reasons. Therefore, be very careful when you attempt to do this. Even professionals don’t get this right.

6. Personal Circumstances

Changes in your personal circumstances may also necessitate selling investments. These changes can include job loss, medical emergencies, COVID-19 type Black Swans or other significant life events that require liquidity. In such cases, having a portion of your investments in easily accessible, liquid assets can provide the financial flexibility needed to navigate these challenges.

For instance, if you face an unexpected medical expense, selling some investments can provide the necessary funds without incurring debt. Ensuring that you have a portion of your portfolio in liquid assets can help you manage financial emergencies without disrupting your long-term investment strategy.

Implementing a Selling Strategy

Set Clear Goals and Criteria

Before making any selling decisions, establish clear financial goals and criteria for selling. These criteria should be based on your risk tolerance, investment horizon, and overall financial life plan. Having a predefined strategy helps ensure that selling decisions are made rationally and align with your long-term objectives.

Examples of selling criteria include reaching a target price, changes in investment fundamentals, achieving a certain level of portfolio imbalance, or meeting specific financial needs. Documenting these criteria and reviewing them regularly can provide a disciplined framework for decision-making.

Regular Portfolio Reviews

Regularly reviewing your portfolio is essential to ensure it remains aligned with your financial goals and risk tolerance. Schedule periodic reviews, such as quarterly or semi-annually, to evaluate the performance of your investments and make necessary adjustments.

During these reviews, assess whether any investments no longer meet your criteria for holding. This process allows you to make informed decisions about selling and rebalancing your portfolio, ensuring it remains on track to achieve your financial goals.

Work with a Real Financial Professional

Working with a real financial professional can provide valuable guidance and perspective on when to sell. Real Financial Professionals have the expertise to assess your portfolio, and provide recommendations based on your financial goals. Regular consultations with your financial professional can help you stay focused on your long-term strategy and avoid impulsive decisions.

They can also help you implement tax-efficient strategies, such as tax-loss harvesting, and navigate complex financial situations. Their objective perspective can be instrumental in making informed decisions about selling investments.

Selling investments is a critical component of a balanced investment strategy, but it must be approached thoughtfully. Understanding when to sell—whether for rebalancing, achieving financial goals, or due to changes in your investment thesis—can enhance your portfolio’s performance and align your investments with your life objectives.

Remember, successful investing is not about reacting to every market movement but about making informed, strategic decisions that support your long-term goals.

Stay focused, remain patient, and trust in your long-term strategy and your real financial professional. Your future self, and your financial well-being, will thank you.

and then tap on

and then tap on

0 Comments