When Not to Sell

Last Tuesday, I wrote about the 6 times when you should think of selling. This post is about 6 times when you shouldn’t. Without wasting any more words, let’s dive right in.

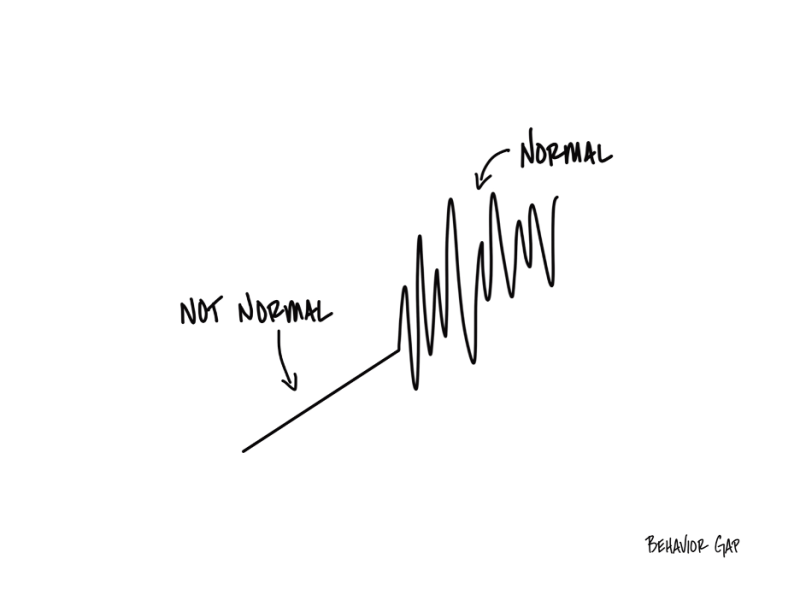

1. Market Volatility

One of the worst reasons to sell investments is reacting to short-term market volatility (or the stock market going up and down).

Stock Markets naturally go up and down. It’s simply the nature of how they behave. Selling in response to temporary declines/downturns can lock in losses and derail your investment strategy. Instead, maintain a long-term perspective and avoid making impulsive decisions based on what is normal for the stock markets.

For example, in the initial phase of COVID-19 pandemic, many investors panicked and sold their investments during the market downturn in early 2020. However, those who held onto their investments saw significant gains as the market rebounded later in the year. Staying invested through the market ups and downs can help you capture long-term gains.

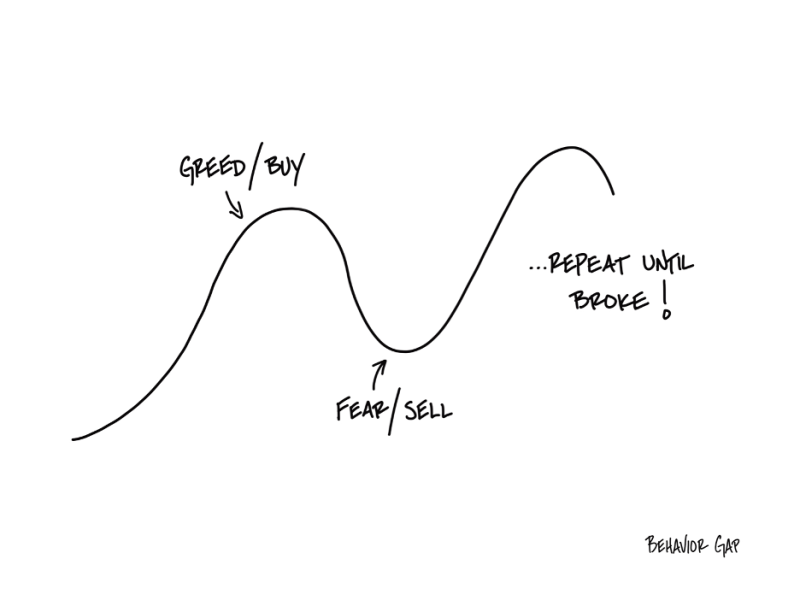

2. Emotional Reactions

Investing can be an emotional journey, but decisions driven by fear or greed often lead to suboptimal outcomes. Selling in a panic during market drops or chasing highs during rallies can harm your portfolio’s performance. Stick to your investment plan and avoid letting emotions dictate your actions.

For instance, during the 2008 financial crisis, many investors sold their investments at the bottom of the market out of fear, only to miss out on the subsequent recovery. By maintaining a disciplined approach and avoiding emotional reactions, you can stay on track with your long-term investment strategy.

My favorite sketch sums up this idea very well.

Most of us make the same mistake with our money over and over: we buy high out of greed and sell low out of fear.

Just look at equity mutual funds.

At the top of the market, we can’t buy fast enough. At the bottom, we can’t sell fast enough. And we repeat that over and over until we’re broke.

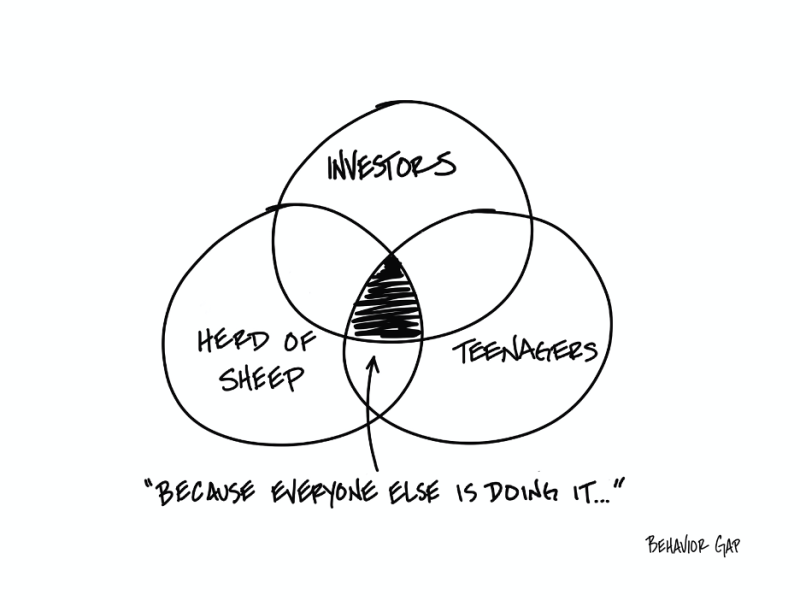

3. Following the Crowd

Peer pressure is for kids, right?

When teenagers do it, we call it dumb.

But when we do it, we call it “research.”

Look, I get it. Being in the herd feels like the safest place to be.

But when it comes to investing, doing the same thing as everybody else is riskier.

It leads to things like buying high and selling low.

And, of course, we all know how stupid that is.

A common mistake is selling because everyone else is. Herd mentality can drive irrational market behavior, and following the crowd (your friend, or your favorite investment guru) can lead to poor decision-making. Instead, base your decisions on a thorough diagnosis of your situation and your investment strategy, not on what others are doing.

For example, during the dot-com bubble in the late 1990s, many investors followed the crowd and invested heavily in technology stocks. When the bubble burst, these investors suffered significant losses. By avoiding the herd mentality and making informed decisions based on your own analysis, you can protect your portfolio from market bubbles and crashes. This is exactly what many young people are doing today by chasing small cap stocks or by excessive trading.

4. Short-Term Performance

Evaluating investments based on short-term performance can be misleading. Good investments can have bad months or even years, but that doesn’t mean they are poor long-term holdings. Avoid the temptation to sell based on short-term underperformance and focus on the long-term fundamentals of your investments.

For instance, a high-quality portfolio may experience a temporary decline. However, if the long-term fundamentals of the underlying companies remain strong, selling based on short-term performance can result in missed opportunities for future gains.

5. Media Influence

Financial media can be sensationalist, often highlighting extreme market movements and predictions. Making investment decisions based on media reports can lead to reactionary moves that may not align with your strategy. Be cautious of media influence and focus on your long-term goals.

I had written a short post on July 27th, 2021, based on a tweet.

“2012 – Markets are High Don’t Invest

2013 – Markets are High Don’t Invest

2014 – Markets are High Don’t Invest

2015 – Markets are High Don’t Invest

2016 – Markets are High Don’t Invest

2017 – Markets are High Don’t Invest

2018 – Markets are High Don’t Invest

2019 – Markets are High Don’t Invest

2020 – Markets are High Don’t Invest

2021 – Markets are High Don’t Invest

I still went ahead and invested. I still stay invested and invest whenever I have surplus money.”

I do not know what you think of it, but I loved it.

All the media noise (even if you call it research) over the last 10 years in financial markets has been summed up in this one tweet.

Do we not hear the below mentioned points all the time?

- Something is going to happen

- Markets are High

- Markets will correct. Do not Invest

Well, something will happen all the time. There is no single year where something has not happened and there will not be any year where something will not happen. Something has happened all the time. The media thrives on this.

Based on the trend we have all witnessed, I can make an educated guess on what we might hear going forward.

2022 – Markets are High Don’t Invest

2023 – Markets are High Don’t Invest (Didn’t you hear this last year?)

2024 – Markets are High Don’t Invest (Aren’t you hearing this now?)

2025 – Markets are High Don’t Invest

2026 – Markets are High Don’t Invest

2027 – Markets are High Don’t Invest

2028 – Markets are High Don’t Invest

2029 – Markets are High Don’t Invest

2030 – Markets are High Don’t Invest

I am in the camp where I will continue to invest as per my plan and be invested. I will surely take out money for my personal goals when required but will let compounding do the job that it is supposed to be doing.

I know of people who have been waiting to invest…I know of others who have sold or booked profits thinking about a decline ahead…

Financial news outlets often publish sensational headlines that can create panic among investors. Your success as an investor is a function of your ability to avoid this constant media noise. Stay focused on your long-term investment strategy and, make informed decisions (along with the support of your real financial professional) that support your financial goals.

6. Small Corrections

Market corrections, typically defined as declines of 10% or more, are a normal part of the market cycle. Selling during these corrections can lock in losses and prevent you from benefiting from the market’s eventual recovery. You can at least expect 1-2 every year. Maintain confidence in your investment strategy and avoid selling during these routine market corrections.

Selling investments is a critical component of a balanced investment strategy, but it must be approached thoughtfully. Understanding when to sell—whether for rebalancing, achieving financial goals, or due to changes in your investment thesis—can enhance your portfolio’s performance and align your investments with your life goals. Similarly, it’s super important to understand when not to sell.

Patience is a virtue in investing. While the urge to sell can be strong for various reasons,holding steady is often the wiser choice.

and then tap on

and then tap on

0 Comments