This is something every Business Owner Must DO

I had met an interesting group of business owners in March 2020 (before the lockdown) and a couple of them said these lines “We don’t believe in the stock market. We invest in our own business. My business delivers a higher return. I can control the outcomes of my business.” Some of these lines were so naïve but were loaded with overconfidence.

This is not the first time I was hearing them, and you would have come across someone with similar thoughts. Most business owners, some fashionably called entrepreneurs (or even Techpreneurs) are self-made people who have a lot of belief in what they do. Business is based on confidence and you will find most business owners to be very confident. When I hear the lines mentioned above, I ask a few questions:

- Can you guarantee me that your business will continue to do the way it is for the next 10 years?

- Can you guarantee that all the RISKS that your business faces will be comfortably managed?

- Are you aware of all the RISKS that your business faces?

I did not see a lot of confident answers to these questions.

No one can guarantee what will happen tomorrow or this very moment. So “Investing outside of your business is not about returns. It is also not about how smart you are. It is first about the basic principles of Risk Management. It is first about protecting what you have and growing that in a meaningful manner.”

Let me elaborate a bit on this.

Every business today faces many risks. Additionally, the pace at which these risks hit you knock even the best and largest of businesses (Think Nokia, Blackberry, Kodak, Thomas Cook globally. Even locally you will find hundreds of names such as Vodafone Idea, Talwalkar’s, Cox & Kings, Yes Bank and many others ).In short, something or the other is always coming for all business owners (whether it is Regulation, Technology, Changes in Consumer Preferences, Competition and many others).

Look at the biggest risk that has hit most businesses. Who would have imagined that the entire world will be in some sort of a lockdown for so many months? How many had thought of supply chain risk and even words such as social distancing and flattening the curve (The only curve we thought of flattening was the one on our waists).

The world is changing very rapidly and now it is more uncertain than ever.

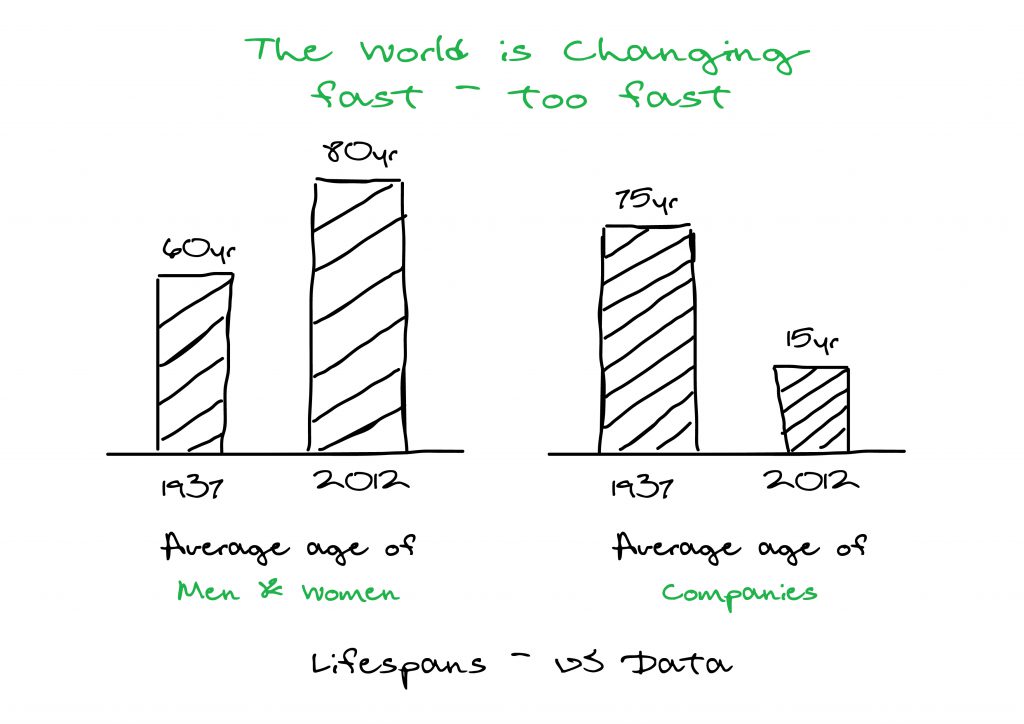

Look at this chart (with data of several years ago).

The average lifespan of businesses is going down and down because of all the risks that we face. COVID-19 has accelerated the demise of weaker businesses or one simply relying on venture capital drugs.

Thus, it is always a prudent strategy to separate business finance and personal finance. It is extremely important for a business owner to have personal investments beyond his business. This strategy is called Diversification (a very simple one – Do not put all your eggs in one basket).

You diversify to manage Risks and to protect you and your family from going back to the initial struggles you had when you started this business. You diversify because most private businesses beyond many of the risks that I shared also have 1 additional Risk – Liquidity Risk.

I know of so many Asset Rich, Income Poor business owners that they have assets of Rs. 100 Crore yet cannot cut out a cheque of Rs. 1 Crore. Your business will be a significant part of your net-worth, but it is illiquid and so is Real Estate (another huge part of business owner’s investments).

Liquidity is the other main reason you should have a separate portfolio that will come in handy for all your personal needs whether sending your child to Wharton, taking vacations, and most importantly maintaining your current lifestyle.

Protecting current Lifestyle is one of your key goals and you should not allow the risks that your business is exposed to – to impact your lifestyle. You love your business and are dependent on your business for your income and Future Wealth but do not Expose your and your family’s Future by being naïve and Overconfident.

and then tap on

and then tap on

0 Comments