Corrections, Crashes, and Clickbait

On January 4th, I read a moronic headline on the website (of a financial news channel), “Brace for correction in 2024.” I will explain why I used the word moronic or rather it will become evident to you as the post progresses. The next day, there was another (moronic) one in an international business and finance magazine, “Worst One Day Drop Since October.” Before I get deeper into the post, let me tell you that these headlines are not new.

There are “Brace for a Correction” headlines every year.

There was a bonus word added to this headline in 2023. If you have not guessed it by now, it was the word “recession.”

Brace for a correction and a recession in 2023.

Likewise, we see such alarmist headlines every single year.

Brace for a correction in 2022, Brace for a correction in 2021, And so on for every new year.

These headlines will not stop until people stop consuming them. We will continue to see such headlines “Brace for a correction in 2025” early next year too.

What about the other headline – Worst One Day Drop Since October?

Now if you waste a lot of your time (like I did), you will likely find thousands of such headlines over the last 10 years. There are so many of these that you will start believing that there is something seriously wrong with the stock market or with investing in general. The best part is that there is literally no relevance of this headline (more importantly what does it even mean in the context of real investing) or this 1-day time frame.

One Day Return is an unimportant number when it comes to stock market investing.

But why are these headlines written?

Because people consume them.

The financial media often employs a business model that hinges on clickbait and sensationalism, aiming to capture the fleeting attention of an audience in an information-saturated environment. This strategy involves crafting headlines and content that promise explosive revelations or insider insights, often exaggerating the significance or certainty of financial news and trends. The allure of such content can be irresistible, as it plays on the innate human desire for quick, lucrative information that could potentially lead to profitable investment decisions.

However, as you know, this approach can have several drawbacks. It can lead to a myopic focus on short-term fluctuations rather than long-term trends, fostering a reactionary culture among investors who may make hasty decisions based on the fear of missing out (FOMO) or the hope of quick gains.

Furthermore, sensationalized content can often oversimplify complex financial matters, leading to a misinformed public that may not fully understand the risks involved in certain investments or strategies.

Sensationalism in financial reporting can also contribute to market volatility, as dramatic headlines can prompt waves of emotional trading. The ultimate goal of this business model is not to educate or inform but to drive traffic, which in turn drives advertising revenue and profits for the media outlets. As a result, the quality of information can be compromised, and the interests of the audience can become secondary to the pursuit of clicks and views.

But let’s forget why the media does this for a moment…

As I wrote in last Friday’s Nano “This is Normal”, waves (corrections) and storms (crashes) are an integral part of the stock markets.

In this context, Brace for a correction is like telling someone in India to Brace for a Rainfall.

We know it’s going to rain…We expect it (and we even welcome it). We must simply prepare for it, by making sure we have raincoats, umbrellas, appropriate shoes, and many other things…We don’t run to a country that does not rain only to come back when it has stopped raining.

Likewise, you must brace for a correction every year. You must expect one every year.

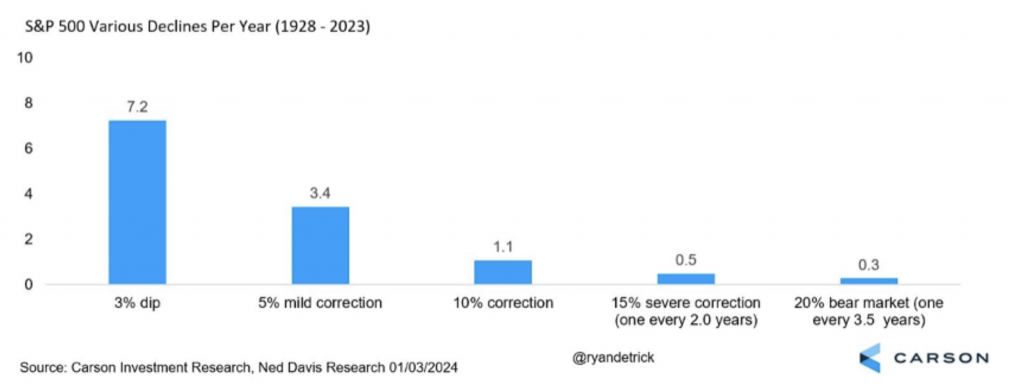

Look at the chart below from @RyanDetrick.

The chart shows what the US S&P 500 sees in a typical year. There are seven dips of at least 3 %, three separate mild corrections of 5% and one correction of at least 10%. There is a severe correction every 2 years and a bear market with 20% or more every 3.5 years. These numbers are much higher for the Indian Stock Markets. I mean there will be far more 3%, 5% and 10% dips every year. In fact, there will be a 15% and 20% decline every year.

Another interesting data point – Since 1980, the average annual intra-year drawdown (biggest sell-off from the highest point of the year) for the US S&P 500 is 14%. Despite this, the US S&P 500 has delivered positive returns in 33 of 44 years (75% of the time).

The average annual Sensex drawdown since 1979 is 28.52%. This means the annual Sensex drawdown is almost 2 times that of the US S&P 500. While the annual drawdown was significantly higher, the compounded annual returns of the Sensex was 15.83% (as on 5th April 2022 at a Sensex level of 60000 – 20% lower than the current level), significantly higher than the typical S&P 500 returns. The point is that drawdowns are consistent with the returns. The higher the drawdown, the higher the returns.

Like the US S&P 500, (despite this average annual 28.52 % drawdown), Sensex has delivered positive returns in 33 of the last 44 years. Only in 11 years did the Sensex deliver a negative return. This means the Sensex was up 75% of the time (years) like the US S&P 500.

These basic facts have remained the same. Despite the few negative years and significant annual drawdowns, the stock markets have delivered superior positive returns over the long term.

The point is – This Normal Volatility is the toll/tax that we all must pay, because if you suppress volatility, you suppress your returns – full stop.

Even if there are no drawdowns, mild corrections, corrections, or crashes in a year, expect them to happen at some point of time. It’s just how the stock market is. The key thing here is that you must prepare for it. The question then is how you prepare for it.

Stay tuned for Part 2 of this post, where I will delve into the strategies and mindsets that can fortify you against market volatility. We’ll explore the tools and techniques that can not only safeguard your portfolio but also position you to capitalize on the opportunities that such fluctuations present. Preparing for volatility isn’t just about defence—it’s about making intelligent, calculated moves that align with your long-term financial goals. So, expect actionable insights in our next conversation, where we turn uncertainty into a clear path forward.”

and then tap on

and then tap on

0 Comments