These are the 3 Key Drivers of Performance

I got some interesting responses from readers for this Tuesday’s post “The 20 Best Days in the Last 20 Years”. Some people just could not believe that even after staying invested 99.61% of the time, just missing 0.39% (20 days out of 5112 trading sessions) had such a dramatic impact (7-8% p.a.) on performance. What was even more surprising to readers was that the best 19 days came during the worst times of the market. Read the post if you had missed it earlier.

Warren Buffett’s brilliant quote gels perfectly with the above data “Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance”.

The 1 guarantee when it comes to investing is this “There will always be some worrying news around every year”. Look at the last 20 years (go as far as 40 years) and there won’t be a single year where there was no worrying event or news across the globe.

Let me take one from 2011 when the world suddenly learnt 2 new words Debt Ceiling. How many of you even remember this? 99%+ (it is my educated guess) will not even recollect it, yet when this was happening, there were gloom-doom reports all over and many even delayed investing because of this.

Beyond COVID-19 now, the focus will also be on the US Presidential election, US-China Cold War & Tensions and Economic Recovery etc.

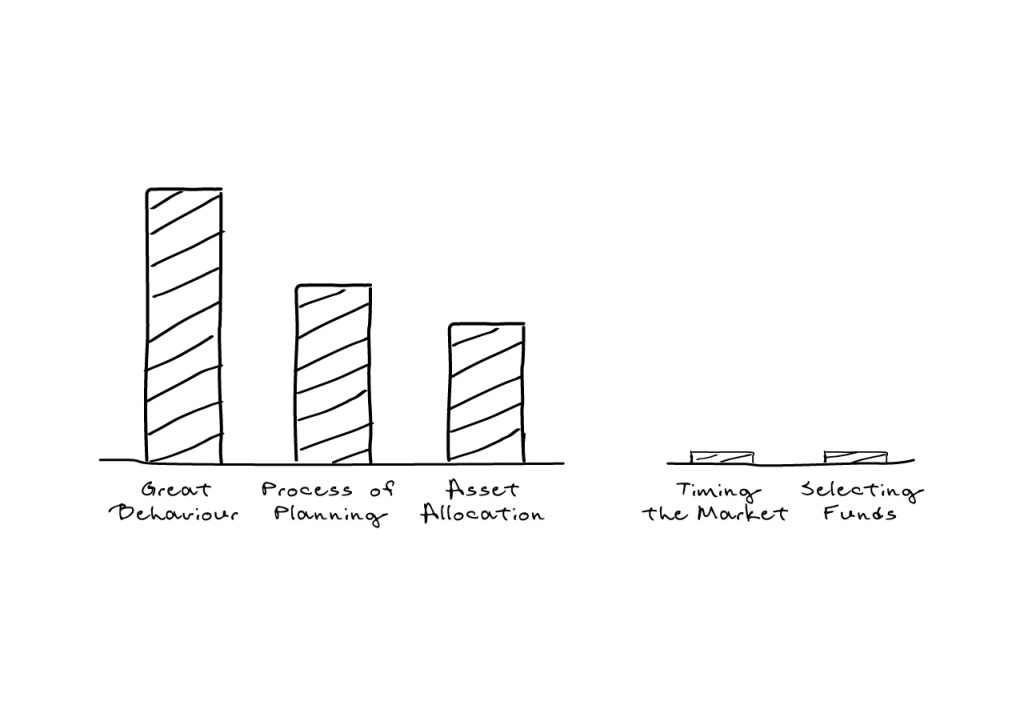

The successful investors understand this and focus on very simple but key things (an acronym GPA- no it is not Grade Point Average but yes you can think of it more like your Investing GPA).

- Great Behaviour

- Process of Planning

- Asset Allocation (Sell High, Buy Low as this includes Rebalancing)

and then tap on

and then tap on

0 Comments