The Lollapalooza Effect

What did you think of this word “Lollapalooza”?

Sounds like a cute word. Doesn’t it?

While you are thinking, let me clarify that I am not referring to the world’s largest global music festival (that will be held this year in Mumbai – January 2024, in case you were curious). This post is rather about the wisdom of the late Charlie Munger (Warren Buffett’s friend, partner, and confidant) who died on November 28th, 2023 (at the age of 99). I had first heard of this concept from one of Charlie Munger’s speeches and found it to be super fascinating.

Webster defines Lollapalooza as: one that is extraordinarily impressive…also: an outstanding example. For example, a huge birthday bash that promises to be a lollapalooza of a party. However, the term, Lollapalooza Effect was coined by Charlie Munger, and it meant a confluence of factors coming together to drive investment psychology. In fact, Charles Mackay had written about this concept without giving it this specific name in his 1841 book, “Extraordinary Popular Delusions and the Madness of Crowds.”

In simple words, we (human beings) have beliefs, biases, and blind spots… When several of these come together and drive us to behave and act in certain ways, we get a Lollapalooza Effect.

Let me explain this concept with something you can relate to.

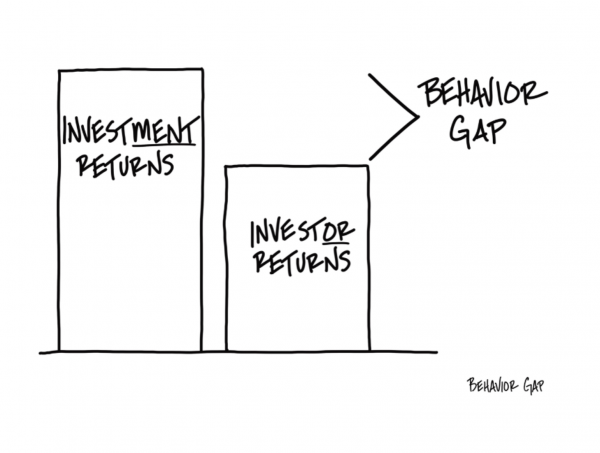

There’s a difference between investment returns and investor returns… and only one of them matters.

If a mutual fund yields 10% a year for 10 years, that is the investment return.

Now, let’s talk about investor returns. The only way you’re getting that 10% a year for 10 years is if you don’t touch that investment for the whole 10 years. No adding, no subtracting. Buy it and leave it.

The problem is, very few people invest that way. On average, we only hold long-term investments for two to three years, and then we get distracted by the next hot investment. Investors almost never earn the same return as investments because we don’t hold on to the investments long enough.

The return happens… we just aren’t there to get it. The stock market delivers. The investment delivers but we aren’t there to receive it. And the only reason for that is our own behaviour.

As Nick Murray wrote “Permanent Loss in a broadly diversified portfolio of quality equities held for the long term is a MYTH. That in fact when permanent loss occurs, it is always a human achievement, of which the equity market itself remains incapable.”

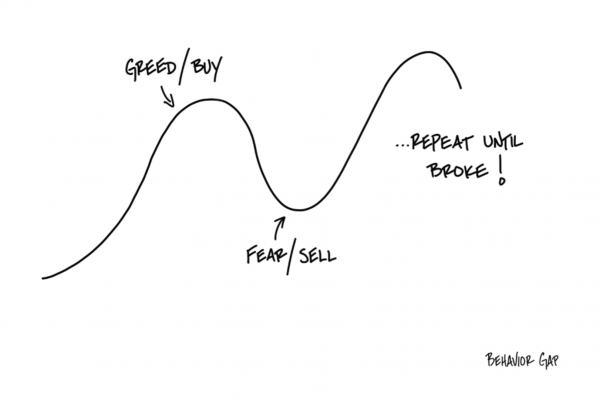

We think the job of any self-respecting investor is to constantly be searching for the best investment. But that well-intentioned behaviour consistently leads us to buy investments that have just done well and to sell investments that have recently done poorly.

In other words, we buy high and sell low, over and over again. And it’s that repeated behaviour that leads to the difference between investment returns and investor returns.

There’s a name for this phenomenon.

It’s called The Behaviour Gap.

Why do we then not plug the behaviour gap by buying low and selling high. Why do we keep doing the opposite. Isn’t this something a seven-year-old would understand too. Isn’t this simple sense…Well this simple sense is not very common…but I bet you knew that already…

Remember the Dogecoin Mania of recent times. I am not picking on Crypto here but simply highlighting an example of the current Lollapalooza Effect at play. You can go back to 2007/2008 (global financial crisis) or 1999/2000 or 1992 or pick up any period where there has been a mad rush for picking up certain types of investments.

People who had no clue about crypto wanted to buy Dogecoin. Why? Because the price kept going up…and more importantly everyone around them was buying it (or so it seemed). Social Media had gone wild with it. The Fear of Missing Out (FOMO) was simply too much and it weighed heavily on investor emotions… The mania had reached such an extent that many simply wanted to buy it before Elon Musk came on a Saturday Night Live show in the US. The hope was that prices would explode upwards during and after the show. People rushed to buy. The show happened. In fact, the price crashed. Now the very same people who wanted to buy Dogecoin desperately, didn’t want to buy any more even when the prices collapsed. In fact, people were rushing for the doors…

When the prices were going up, many wanted a piece of the action. People wanted to buy high no matter what the price was. There wasn’t enough supply. When prices crashed, everyone was rushing for the exit. No one wanted to buy.

I know what you are thinking at this point. This applies to the Crypto bros not me. Well, I hate to prick this intellectual bubble. This applies to human behaviour in every asset class… whether it is real estate, gold, stocks, mutual funds, or alternative investments. This equally applies to each and every investor (including the legendary Warren Buffett).

Recently one of the headlines of most newspapers and media outlets were – Warren Buffett’s Berkshire books Rs.630 Crore loss after holding Paytm shares for five years… The point here is why would someone as seasoned as Buffett invest in a loss-making company. Additionally, this company was outside the circle of his (technology) competence (a concept that Buffett evangelizes). There are so many amazing companies in India so what was it about Paytm that made him invest. Well, I can’t specifically answer this question but one thing that is certain is that the Lollapalooza Effect was at play here.

Just look at the mutual funds data globally.

At the top of the market, we can’t buy fast enough. At the bottom, we can’t sell fast enough. And we repeat that over and over until we’re broke.

When everyone else is buying, it feels like if we don’t join them, we’re going to get eaten by the financial version of a sabertoothed tiger.

But it doesn’t take a genius (or Warren Buffett) to see that this behaviour is terrible for us when it comes to investing. As Munger said, “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

As an investor, it is important to recognize when this effect is at play the correct answer is: All the Time.

and then tap on

and then tap on

0 Comments