The First PV

Does the headline seem confusing?

It might seem so because I have not mentioned “what PV” is yet.

To many financial smarties, PV means Present Value. Well, this is not what I am referring to in the headline.

There is one PV that every investor understands and thinks it’s the most important thing.

That PV = Portfolio Value.

However, this is not the most important PV in your or any investor’s life. It is to a certain extent, but it always comes after the first PV.

The PV that comes way before

Portfolio Value is Personal Values.

Well, this is not a war between Portfolio Value and Personal Values. It’s not a choice between these 2 PV’s either.

Your Personal Values reflect what is truly important to you.

To give you an example – Many say that the security of my family is very important to me. Yet the life insurance cover they have tells a different story. Many of them will not even know the number they need to ensure their family’s security. Same is the case with Wills. The story repeats itself all the time.

We are all told to beat some stupid benchmarks or to follow some absolute return strategy reserved for special people. How will doing this ensure security if you are not saving enough or if you are losing your mind and health in the process of beating irrelevant benchmarks?

When we are disconnected from our values, “what’s important to us” gets separated from our actions. And we end up doing things just because someone else is doing it.

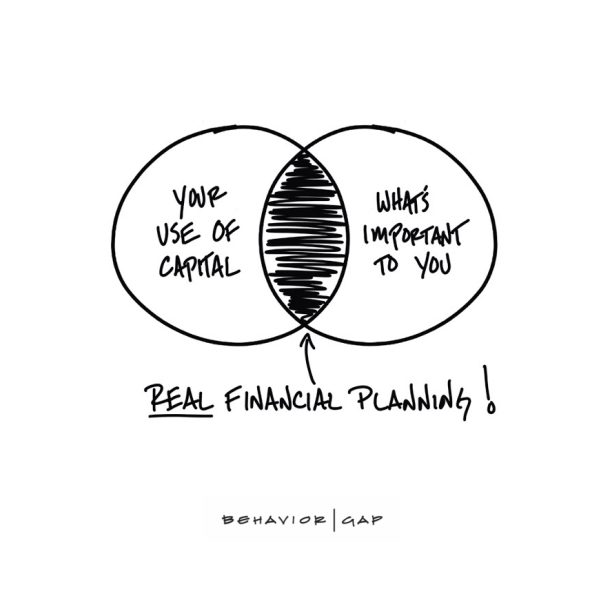

Personal Values (what’s important to you) should drive your use of capital which in turn will determine your investment choices. This will in turn get you the investment outcomes (aka Portfolio Value) that are truly aligned to your Personal Values.

and then tap on

and then tap on

0 Comments