The Crocodile Hunter

Do you remember Steve Irwin?

I loved this guy.

If you still cannot recollect who I am talking about, watch this video.

In this Animal Planet video, Steve passionately says, “I want to be remembered for my passion and enthusiasm…Conservation is my job, my life and my whole persona.”

He is simply too good.

Don’t you think so?

Are you wondering if the above has any connection to investing or if I have lost the plot?

Well, the correct answer (if you have not guessed already) is the former one. There is indeed something insightful that I want to share in today’s post…and it will be revealed as you patiently progress through the post.

Coming back to Steve, he was an Australian conservationist, television personality and wildlife educator. He rose to international fame in the 1990s from the wildlife television show “The Crocodile Hunter” and became a household name. He had many unbelievable encounters with (poisonous) wild snakes, and the largest and most dangerous crocodiles. But on 4th September 2006, he was filming in the Great Barrier Reef. Because of some inclement weather, Steve decided to snorkel in shallow waters. While swimming in chest deep water, he approached a sting ray from the rear, in order to film it swimming away. According to Wikipedia – “At that time, the stingray’s barb pierced his chest, penetrating his thoracic wall and heart, causing massive trauma. He initially believed he had only a punctured lung; however, the barb pierced his heart, causing him to bleed to death.”

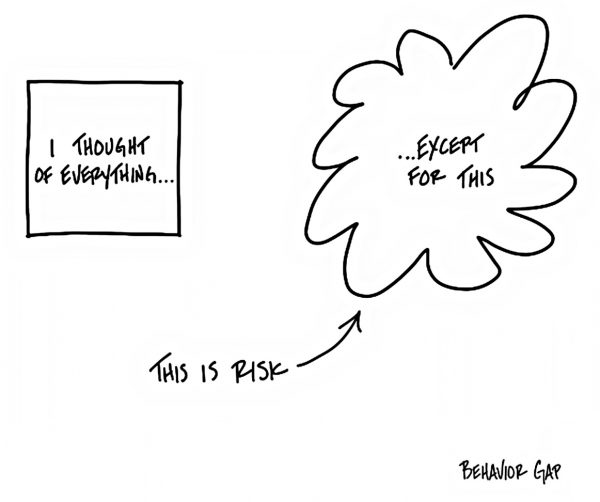

By the way, stingrays are not considered dangerous and do not attack people unless in self-defence. It is also a shy and gentle creature that would rather swim away than engage or strike. Therefore, there was absolutely no threat to Steve from this stingray. Yet this unfortunate incident happened…and this brings me to the main point of this post – Risk is what’s left over after you think you have thought of everything – Author Carl Richards.

According to me, this is the finest definition of Risk – what’s left over after you think you have thought of everything.

We never see real risk coming…and even if we see it coming, we believe it is not coming for us. We think it’s meant for others. Therefore, we ignore it…but because we ignore it doesn’t mean it doesn’t exist or it’s not coming for us.

In fact, risk is one of our biggest blind spots.

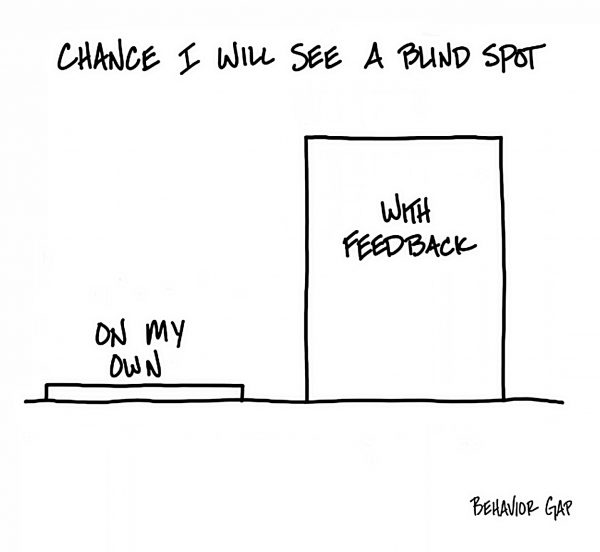

The important point to understand here is that we can never see our own. You cannot see yours. I cannot see mine…just like Steve could not see his.

Steve was prepared for the largest and wildest animals but was he prepared for the risk coming from a usually shy stingray (which is not known to kill humans)? In fact, Steve’s was only the second case recorded in Australia since 1945. He probably didn’t see that coming and might not have been prepared…And this was his biggest blind spot that led to the biggest risk.

In investing, this is far more common than we think it is…It affects everyone …even the so-called stars.

There was an interesting post in Bloomberg – “Hedge Fund Stars Who Got China Wrong Are Paying a Big Price – For veteran hedge fund investor Chua Soon Hock, 2024 was supposed to herald a multi-year rise in Chinese stocks and the opportunity of a lifetime.” To add some context, the past three years were a frustrating period for investors in Chinese equities and therefore valuations were considered super attractive. This Chinese origin gentleman had thought that 2024 would be great. And this is what happens in the first 25+ days into the new year.

“Chua’s fund told investors this week the $330 million fund would close after it was badly burned by wrong-way bets on Japan, and by falling Chinese markets that he largely blamed on inaction by policy makers, including President Xi Jinping.

I am writing to you with a heavy heart and utmost regret, Chua said in a letter to clients saying their cash would be returned after an almost 19% plunge this month. My confidence as a trader is lost, “wrote Chua.

I am not making the point that this is the end of Chinese equities…in fact the Chinese stock market will certainly come back at some point of time in the future…It’s just that we don’t know when. I guess I digressed from the point that even the most experienced investors are unable to see their own blind spots…the risks in their thinking.

Daniel Kahneman, a renowned psychologist, and Nobel laureate has made significant contributions to our understanding of human judgment, decision-making, and behavioural economics (and thus investing). Despite his extensive research and deep insights into cognitive biases and heuristics, Kahneman has openly admitted to falling prey to the very biases he has studied and written about.

In his groundbreaking book “Thinking, Fast and Slow,” Kahneman presents a wealth of research on systematic errors in the thinking of humans, showing how we are not as rational as we might believe. One of the key insights of his work is that knowing about biases does not immunize us against them. This is because these biases are not just mistakes in our thinking; they are deeply ingrained in the architecture of our cognition.

Kahneman has spoken candidly about his own susceptibility to biases such as overconfidence, confirmation bias, and the planning fallacy — the tendency to underestimate how much time will be needed to complete a task, even when we know about this bias and have previously experienced delays. He points out that understanding a bias intellectually does not necessarily mean one can outthink it in practice because these biases often operate automatically and are part of the intuitive system of thought he labels “System 1.”

The humility with which Kahneman approaches his own vulnerability to cognitive biases is both refreshing and instructive. It serves as a powerful reminder that awareness is only the first step. Active effort and certain techniques, such as slowing down our thinking and consulting with others, are necessary to mitigate the effects of these biases. Kahneman’s own experiences highlight the importance of designing systems and checks that help counteract our biased tendencies or to see our blind spots more clearly.

Risk, especially in the context of investing, behaves much like the stingray in Steve Irwin’s tragic encounter – it’s often unassuming, lurking in places we least expect. Steve’s legacy teaches us that risk can be inherent in even the most controlled environments, and as such, it should never be underestimated.

In the world of investment, risk takes on many forms. It could be the volatility of the market, an unexpected economic downturn, or a sudden change in interest rates. Investors often operate with a calculated understanding of these risks, employing strategies to mitigate them. However, as Steve’s fate starkly illustrates, there can always be factors beyond our control or foresight.

This brings us to an important concept in investing: the Black Swan theory by Nassim Nicholas Taleb. Black Swan events are those that are extremely rare, have severe impact, and are only obvious in hindsight. Steve’s encounter with the stingray was such an event – rare and unpredictable, and with a devastating outcome.

As investors, how do we protect ourselves against financial stingrays?

The first step is acknowledging that they exist and that we are not immune to them. Ignoring the possibility of such events can be injurious to your financial life.

Steve Irwin’s legacy is not just in the love for wildlife he imparted on the world, but also in the stark reminder that the unexpected can and does happen. Just as Steve was an expert in handling wildlife, yet met with an unforeseen event, investors, regardless of their experience, can encounter unanticipated financial risks. This is where the role of a world class financial professional becomes invaluable.

A real financial professional behaves much like a knowledgeable guide in the wilderness of the market. They bring expertise, experience, and an outside perspective that can reveal and illuminate the blind spots that we, as investors, may not even be aware of. They help us navigate through the complexities and uncertainties of investing, much like a conservationist understands the subtle signs of the wild.

Moreover, a real financial professional doesn’t only help with spotting blind spots and risks; they also assist in preparing for them. They help diversify investments, recommend insurance and other protective measures, and create a plan that is robust yet flexible enough to adapt to the unpredictable. Their objective is to build a portfolio that can withstand shocks, just as Steve Irwin wore protective clothing while interacting with wildlife.

Importantly, they also help with the emotional side of investing. In times of market distress, where the instinct might be to react hastily, these professionals provide a steady hand, guiding clients away from potentially rash decisions that could lead to long-term regret. They keep the journey focused on long-term objectives, not short-term fluctuations.

In conclusion, the unpredictable nature of risk in both the wild and in financial markets requires a level of expertise and foresight that most individuals simply do not possess. Real financial professionals fill this gap, offering a service that is not just about growing wealth, but also about protecting it. The presence of risk is an unavoidable part of investing, but with a trusted real financial professional, investors can approach their financial goals with greater assurance, turning the journey through the financial landscape from a walk in the wilderness into a path toward financial success.

and then tap on

and then tap on

0 Comments