The Confirmation Bias Prevention Program

This post rubs off on last Tuesday’s post “The Real Cost of Noise”.

The UK’s Financial Times had an interesting headline today – “Japan’s 2nd quarter economic growth outpaces expectations.”

Who would have predicted Japan’s outperformance? Experts and analysts didn’t. By the way, the analysts didn’t miss the mark by 1 or 2%…They missed it by almost 100%. I don’t want to get into the details of this one as the key message is far more important. And what is that?

Nobody knows a thing about the future…

The best part is that we are not even talking about long term projections…No one can even accurately predict a quarter of economic performance. Forget a quarter, we don’t even know what’s going to happen tomorrow or for that matter the very next moment. There are too many known unknowns and too many unknown unknowns.

But many who are a part of the financial pornography network and bullshitters industrial complex claim to know the future. They keep making projections. In that very act, lies the secret sauce of the prediction business. Make dire projections and one of them will hit the bullseye or at least come close.

The truth is that no one can consistently forecast the economy or time the stock markets. No one can. Didn’t you know this already? Yes, you did…

But we still like to believe that someone knows…The bullshitters take advantage of this human desire (of certainty/guarantee) by claiming to know some secret sauce… These sauces come in various flavors, but you can easily identify them when you hear words such as frameworks (mostly acronyms), back testing, proprietary investment strategies, correlations and others. Needless to say, many investors (including ultrahigh net-worth individuals, family offices, banks and financial institutions) fall for such bullshit.

Why?

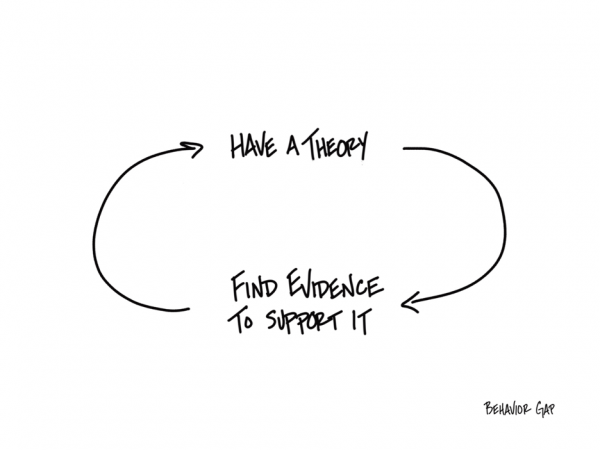

It’s because humans make decisions first and then do their research. That’s backward.

For years, I didn’t even know I was doing this. In fact, there’s even a name for this behavior. It’s called Confirmation Bias—the process of making a decision, then gathering evidence that supports what you’ve already decided, and summarily dismissing anything that disagrees with you. It’s a pretty stupid (but human) way to operate.

The tricky bit is how hard it is to break this behavior pattern. But I have found one thing that seems to help. I call it the Confirmation Bias Prevention Program. Here’s how it works:

1. Find someone who disagrees with a decision you’re about to make.

2. Ask them why they disagree with you.

3. Carefully listen to what they have to say.

4. Continue listening until you can honestly say, “I understand why you believe that.” This is the most important step.

The Confirmation Bias Prevention Program isn’t an ironclad guarantee that you won’t fall into this trap. But what I’ve noticed is that it does seem to provide me the space to consider the possibility that I might be wrong, and every once in a while, that realization stops me from making a costly mistake.

When it comes to your money and financial life, this someone is a world class real financial professional who cares…Just having this person in your life is invaluable…This person can stand between you and your confirmation bias … between you and your costly mistakes…between you and your behavior…This is the most important decision well ahead of products, strategies and everything else.

There is an amazing Anthony De Mello quote that comes to mind – “Wisdom tends to grow in proportion to one’s awareness of one’s ignorance”.

Being aware about one’s ignorance is actually a superpower.

What do you think?

As always, I would love to hear from you…

and then tap on

and then tap on

0 Comments