The 500 Year Plan – Part 2

I received many shocked responses to last week’s post “The 500 Year Plan”. “Is this really possible?”, wrote one. “Where is the catch?”, wrote another. Many said they just couldn’t believe the number of Rs.41,934 Crore. “Never in my wildest dreams would I have guessed the number despite 10 tries”, was the sentiment echoed by many. In case you haven’t checked out Part-I yet, I would strongly encourage you to do it now.

I ended the previous post with the following lines – “Any person and I say anyone can become financially successful (beyond her/his wildest imagination) if the person can let compounding work for her/him. There can be a Crorepati in every house of India. Har Ghar Crorepati is then the Mantra. While this is simple, it’s not all that easy. Because…”

Can you guess the reason?

If compounding is so powerful (and magical) and freely available to everyone, why doesn’t it work for everyone?

Because as Nick Murray said, “Human Behaviour is a failed investor.”

The short answer is we get in the way.

We get in the way with our biases, emotions and behaviours.

We don’t let compounding work for us. We get in its way.

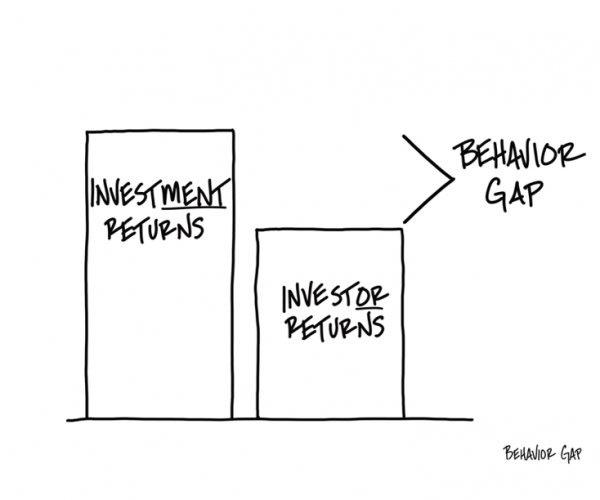

There’s a difference between investment returns and investor returns… and only one of them matters.

If a mutual fund yields 10% a year for 10 years, that is the investment return.

The only way you’re getting that 10% a year for 10 years is if you don’t touch that investment for the whole 10 years. No adding, no subtracting. Buy it and leave it. In short, letting compounding work for you.

The problem is, very few people invest that way. On average, we only hold long-term investments for two to three years (or even shorter), and then we get distracted by the next hot investment. Investors almost never earn the same return as investments because we don’t hold on to the investments long enough.

The return happens… we just aren’t there to get it. And the only reason for that is our own behaviour.

“The 200X Fund” post I wrote in October 2021 is a perfect example of this behaviour at work. Less than 1% of the original investors in Nippon India Growth Fund (the erstwhile Reliance Growth Fund) earned the return this fund delivered. This fund went all the way from Rs.10 NAV in 1995 to Rs. 2000 in October 2021. But there was a huge gap between the investment returns of this fund and the investor returns of this very fund.

Why does this happen?

Because we think the job of any self-respecting investor/ financial professional is to constantly be searching for the best investment. But that well-intentioned behaviour consistently leads us to buy investments that have just done well and to sell investments that have recently done poorly.

In other words, we buy high and sell low, over and over again. We buy investments that are likely to underperform, and we sell investments that are likely to do well in the future. And it’s that repeated behavior that leads to the difference between investment returns and investor returns.

There’s a name for this phenomenon.

It’s called the Behaviour Gap.

That’s not all.

We also get in the way by believing bullshit by professional bullshitters (who claim to know the future). Thus, we keep interrupting compounding all the time either because we want to time the markets or because we want to identify that one investment that will take us to the moon.

The conversation in our head goes something like this (while there are many, I cover a few here).

1. “The market is too high. Let me wait for the right time to invest.” Even if there is no evidence to support this wishful thinking, we still get in the way. And we wait. We continue to wait even when there is a correction. We now wait because we think the stock market will correct more. And guess what, the stock market turns around and goes up. We then wait until we can’t anymore thanks to Fear of Missing Out (FOMO). Sounds familiar. Looks like it is!

2. We can’t sit tight even when the stock market makes a new high. We are tempted to book profits. We feel an itch to do something. Needless to say, there is a lot of noise that we keep hearing. The financial pornography networks are screaming “Sell, the market is overvalued. The smart money is selling. You should too.” Professional Bullshitters know how to leverage the smart money selling story. On the other hand, they also have one more story in their arsenal.

3. It’s the product selection story aka the best investment. It goes as follows. We know which stocks will work and which won’t. Therefore, instead of picking 30-60 stocks the way mutual funds do, we only have 15 stocks in our portfolio. We are going to double down on our best ideas. After all, we know what we are doing. Look at our star portfolio manager. He knows his stuff. If there is no star portfolio manager to parade, then look at our performance. And if there is no performance to tout, look at how our genius strategy works with past data (back testing). By the way you need to keep this a secret because we are making this strategy available to a select few like you. If this is still not enough, look at the names of some big investor names with us. This is often enough to encourage many to ditch compounding as well as the financial professional who keeps singing its tune.

We see this in action on a regular basis.

And it happens because bullshit is delivered with the same conviction as wise counsel is. Many investors don’t know how to differentiate between the two.

Even billionaires can’t sit tight (and find it difficult to leave compounding alone). They are told to leverage or borrow against their shares and do stuff. “Elon Musk does this too,” a freshly minted billionaire is told. If other billionaires are doing it, I must do it too, feels the nouveau riche.

The point is everyone (no matter who you are) keeps interrupting compounding.

What about you?

Are you interrupting it too?

and then tap on

and then tap on

0 Comments