NVIDIA’s Soaring Value: A Lesson in Expectations Investing

“NVIDIA is printing money” – read a headline…

Another read “NVIDIA can print money as long as TSMC can make their chips.”

Yet another (3rd among thousands of such headlines) read – “Wall Street says NVIDIA future is even brighter.”

Here is a tweet my colleague shared –

What do these headlines and messages/tweets/memes have in common?

Is there a theme you can sense? (Hint – It’s in the headline of this post)

“Expectations” is the answer you are looking for.

There are expectations that NVIDIA will continue to print money…There are expectations NVIDIA will continue its mind-blowing growth trajectory…There are expectations and more expectations…

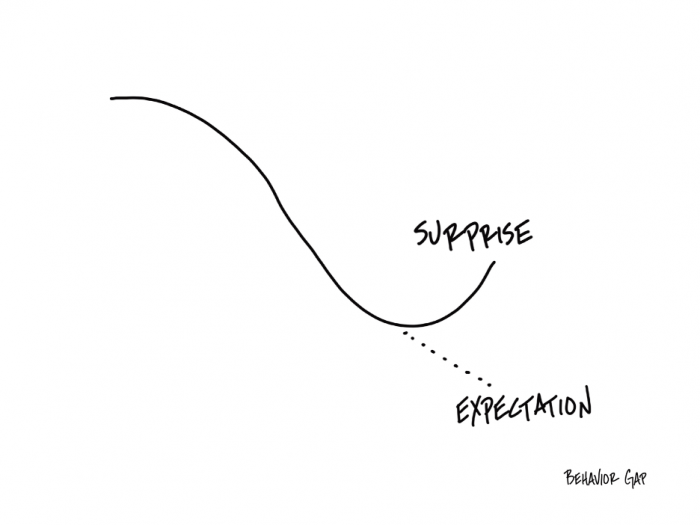

One of the craziest things we do as humans is take the recent past and project it indefinitely into the future.

We think if things are going terrible, they are going to continue being terrible forever. If your portfolio value seems to be dropping, it’s tempting to say, “At this rate, if this continues, I won’t have any money [insert number of months] from now.”

On the other hand, if things are going well, we expect them to continue going well forever.

Investing, at its core, is about expectations. This post is an attempt to explain this super important concept of expectations…

Investing, fundamentally, is an exercise in anticipation. Every investor, whether consciously or not, engages in a form of expectation investing. You do it, I do it, we all do it…

We place our capital behind an investment/security/asset with the belief, or expectation, that its future performance will justify our investment today. The price of any security at any given time reflects a collective agreement of what the market anticipates about its future. This means that the current trading price of stocks, bonds, or other financial instruments represents what investors collectively expect to happen with that security in the future. It’s like a consensus prediction.

When investors buy or sell securities, they do so based on their expectations of what’s to come — profits a company might make, changes in interest rates, economic conditions, etc. All these individual expectations come together to form the security’s price at any moment. If most believe the company’s prospects are good, they’ll buy the stock, driving up the price. If they believe the opposite, they’ll sell, and the price will drop.

This price is a real-time snapshot of the market’s collective beliefs and sentiments about the future performance and risks associated with that investment/security/asset.

Expectations are not just about what earnings a company will report next quarter or whether it will beat the analysts’ predictions. They encompass a broader view, considering long-term prospects such as how a company will grow, innovate, and respond to competitive challenges over time. It’s the investor’s job to assess these potential outcomes and determine whether the market’s current price for a stock accurately reflects them.

The truth is this is hard…very hard…

This perspective requires a forward-looking approach, one that evaluates the present value of future cash flows and factors in both the probability and the impact of those outcomes materialising. It demands of investors a rigorous analysis of not just financial metrics but also qualitative aspects like management quality, industry trends, and broader economic indicators.

In this context, investors become akin to detectives, piecing together clues from various sources to build a picture of the future. They monitor product launches, regulatory changes, and geopolitical events, understanding that these can have profound implications for a company’s performance. The best investors, therefore, combine their understanding of a business’s fundamentals with a nuanced view of its broader context.

Moreover, expectations investing is inherently about managing risk. When investors have a firm grasp on what is already expected, they can better gauge the likelihood and the impact of those expectations not being met. This allows them to position their portfolios to balance potential returns with the risks taken, leading to more strategic decision-making.

Ultimately, investing based on expectations is about understanding that markets are forward-looking mechanisms that price in future prospects, not just current realities. As such, it is critical for investors to develop a clear thesis about how the future is likely to unfold and to make investment decisions that are in sync with this view. It’s a dynamic and challenging approach, but one that can be incredibly rewarding for those who master it.

Authors Michael J.Mauboussin and Alfred Rappaport in their book , “Expectations Investing” wrote, “Stock prices are the clearest and most reliable signal of the market’s expectations about a company’s future financial performance. The key to successful investing is to estimate the level of expected performance embedded in the current stock price and then assess the likelihood of a revision in expectations. Most investors (and the authors here are talking about professional investors) agree with these ideas, but very few execute the process properly.”

Flip on CNBC or read any popular business magazine and you will get a familiar story. The growth money manager will explain she looks for well-managed companies with rapid earnings growth that trade at reasonable price-earnings multiples. The value manager will extol the virtues of buying quality companies at low price-earnings multiples. It happens every day.

But think for a moment about what these investors are really saying. When the growth manager buys a stock, she’s betting that the stock market isn’t fully reflecting the company’s growth prospects. The value manager bets that the market is underestimating the company’s intrinsic worth. In both cases, they believe that the market’s current expectations are incorrect and are likely to be revised upwards.”

At least, one of them is likely to be wrong at any given point of time…

The excitement around NVIDIA, a titan of the tech industry, isn’t just about impressive current profits; it’s the vision of what lies ahead. The flurry of headlines and social media buzz all point to a market that’s betting big on NVIDIA’s future, particularly in the realm of artificial intelligence. The stock price today isn’t just a number—it’s a tapestry of predictions, hopes, and calculated guesses about the future of technology and NVIDIA’s role in it.

What do you think would happen if these expectations are not met at some point of time?

Stay Tuned for Part II…Coming Next Tuesday…

and then tap on

and then tap on

0 Comments