Investing in Wisdom

This is such an important topic that I decided to write a second part of last Friday’s Nano.

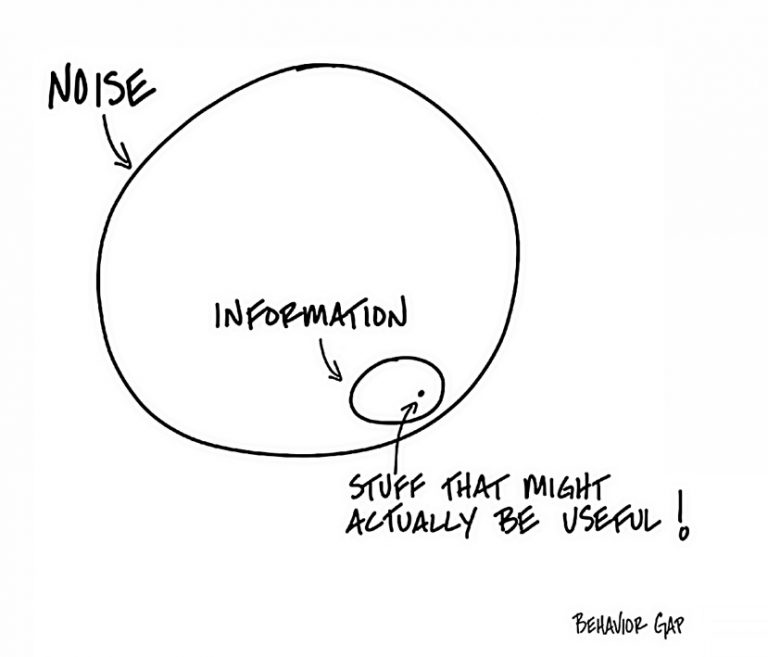

In this era, characterized by the rapid exchange of information, the challenge lies not in the mere acquisition of data and even knowledge, but in cultivating the discernment and wisdom to apply it meaningfully. This is especially true in the realm of investing, where the abundance of information can be both a boon and a bane.

The wisdom to navigate this landscape does not come from consuming every piece of data available but from understanding the deeper principles and the fundamental truths of the stock market.

Charlie Munger’s insight into the value of wisdom in an age of cheap information serves as a guiding light. In investing, wisdom involves recognizing the difference between short-term noise and long-term trends, between speculative bubbles and genuine value. It’s about seeing the forest for the trees, understanding that the principles of sound investment transcend the latest market movements or the newest financial products.

This wisdom is hard-earned. It comes from years of experience, from the successes and, perhaps more importantly, the failures that teach us about risk, reward, and the virtue of patience. It is cultivated through a commitment to learning—not just about finance, but about human behaviour, economics, and the world at large.

As investors, we must remind ourselves that while the internet can provide us with data, it cannot grant us the wisdom to interpret it wisely. That comes from within, from our willingness to engage deeply with information, to question and challenge our assumptions, and to learn from both our experiences and those of others.

Because if all we needed was information, data, and knowledge, we would all be billionaires.

Let us, therefore, prioritize the cultivation of wisdom in our financial endeavours. Let’s seek out voices that offer not just information but insight, that challenge us to think more deeply and act more prudently. In a world where information is abundant, but wisdom is scarce, let us be investors who recognize the true value of the latter and endeavour to enrich ourselves with its wealth.

Socrates said, “I cannot teach anybody anything, I can only make them think.” In this spirit, I hope I can do the same for you – to make you think in a world that is drowning in noise, information, and data.

and then tap on

and then tap on

0 Comments