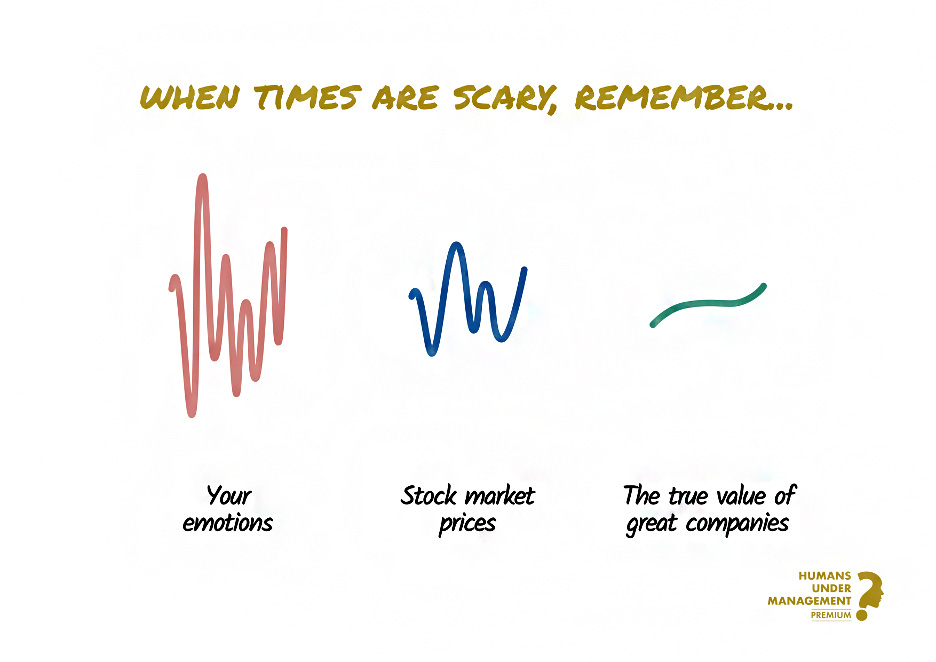

Emotions, Stock Prices, and True Value of Great Companies

When times are uncertain, fear takes over. Emotions run high, stock prices swing wildly, and every headline seems to scream doom. It’s easy to feel overwhelmed, to believe the worst is yet to come. But in these moments, it’s critical to pause and reflect on what truly matters.

Your emotions are natural. They rise and fall, reacting to the noise around you. But emotions are not facts. They’re temporary. The key is not to let them dictate your decisions. Acting on fear often leads to mistakes—selling at the wrong time, chasing the wrong trends, or abandoning a well-thought-out plan. Recognize your emotions, but don’t let them control you.

Stock prices can seem like chaos. They bounce up and down, reflecting every hope, fear, and rumor in the market. But prices are just a snapshot in time. They’re not a measure of the intrinsic value of great companies. Overreacting to these fluctuations is like judging the weather by a single raindrop. Stock prices move wildly in the short term, but in the long term, they follow the trajectory of the underlying businesses.

Great companies endure. They innovate, adapt, and grow. Their true value is not in day-to-day price movements but in the steady compounding of their earnings and potential over time. When you invest in great companies, you’re investing in resilience, in progress, in the future.

In times of fear, remember this: Emotions are fleeting. Stock prices are volatile. But the value of great companies, built on sound fundamentals and strong leadership, remains. Stay focused on what matters. Tune out the noise. And trust in the power of disciplined, long-term investing. That’s how wealth is built, even in uncertain times.

and then tap on

and then tap on

0 Comments