Destination, Co-Pilots, and Parachute Training

Imagine you are sitting in a comfortable private jet and heading to your destination…

Image generated by Dall-E (the Open AI application)

The jet is cruising at a certain altitude.

Out of nowhere, someone sends this message to your pilot – “Move the flight 20 degrees to the west, and head to this Destination of Dreams…Forget your current destination …it’s not that important, you go to this dreamland.”

Oh! I forgot one more character here – the Co-Pilot…

The Co-Pilot tells the pilot to stick to the flight path for the current destination…But the pilot is tempted with the magic of dreamland because everyone seems to be going there. The Co-Pilot pleads and argues but to no avail. The Pilot has made up his mind. He immediately turns the jet to this new destination and makes this announcement.

You are sipping a glass of wine or a sip of hot green tea and you suddenly hear the announcement that the flight is now heading to some unknown destination.

What would you tell the pilot while the co-pilot is sitting there helpless?

Will your response be – Great, Let’s go to the new destination, or would you do something else?

If you are like most or all people, you will direct the pilot to take you to your original destination. If the pilot does not cooperate, you will ask the co-pilot to take over.

Am I on the right path with your response? I believe I am …But why am I telling you this story? Does this have any connection with investing?

Needless to say, it does…We see this pilot’s behaviour at work every day in the world of investing.

Now imagine (for a moment) you were the pilot on that flight. If someone had whispered in your ears about the magic at dreamland, what would you have done? I like to believe that you would have stuck to your destination and flight path. But is this what you or we do in the world of investing where you are the pilot of your financial life.

You follow a certain investment philosophy, investment strategy, investment policy and an investment plan (with clearly outlined steps for actions, and course corrections in case of turbulence and bad /greedy weather). You even have a world class co-pilot with you to help you take informed financial decisions.

Suddenly out of nowhere (or in your club), your friend or your brother-in-law/brother/some expert in the financial media chimes in. He has a hot alternative investment just for you. He also has made money in options. You are then told a fancy story. And mind you there are some super intelligent people spreading this financial garbage. You are now tempted. Who is not by the gains and glory of making quick big money? We all are… After all, this is simply being human…

On the other hand, many voices keep shouting about magic that lies somewhere, recessions, crashes, and corrections all the time. There are conspiracy theories, and gloom and doom stories floating everywhere. There is no single year in the last 50 years where you would have read news such as “The world is doing better… Poverty is declining, and the middle class is rising…Loads of positive things happening in the world.” We never hear such news…It’s always about something bad happening in some part of the world.

However, this is where wise investors shine. And I modify a lovely Rudyard Kipling quote to make an important point – “If you can keep your head when everyone around you is losing theirs, you will be a successful investor.”

Keeping your head when others are losing theirs is key.

But this is where most people falter. We give in to the temptations. We forget our destination. We worry about the turbulence ahead of us. We ignore the counsel of our trusted real financial professional. We don’t listen to our co-pilot. We even jump from our airplane, abandoning our destination…

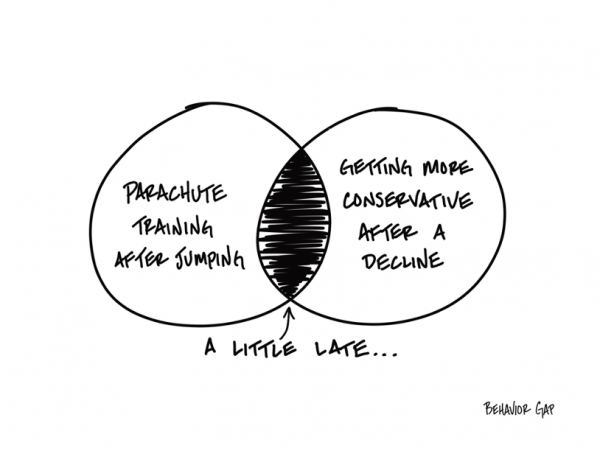

The best part is that we start looking for a parachute after jumping from an airplane.

Every time a scary market shows up, the media overreacts, we overreact, and everyone runs around like it’s such a shock.

Why are we so surprised? Didn’t we learn this lesson the last time?

No, we don’t.

A sophisticated investor I know personally lost several crores in options trading. But guess what his lesson was – I need to recover my losses by doing this in a better way (and guess what – he is still losing but as we all know Ego is the Enemy) .

We all know that the time to prepare for a crisis is long before you find yourself in one. Just like it’s a bad idea to try to figure out how your parachute works after you jump out of the plane, it’s too late to do anything now about what just happened in the market. You can’t hedge against an event that’s already occurred.

We don’t need to know why markets do what they do. In fact, we will never know exactly why they go down. Markets rarely make sense because ‘’the market’’ is nothing more than the collective representation of what we’re feeling right now. And now. Now, too.

Just look at how teenagers’ feelings change based on irrational stories they tell themselves about something that happened at school or on TikTok. Now multiply that by a million! That’s the market.

So instead of trying to predict market behaviour, put a plan in place for your financial life. Have a Real Financial Co-Pilot…Recognize that big declines and turbulence happen in markets, and you shouldn’t be surprised. Know that there will be a lot of bullshit and tempting destinations thrown at you. Keep your head when everyone around you is losing theirs, focus on your destination, and get as much parachute training as needed.

and then tap on

and then tap on

0 Comments