Why the Sensex of Tomorrow Doesn’t Matter—But the Sensex of 2030 and 2047 Does

Where will the Sensex be tomorrow? Or next week? Perhaps even next month? Is this the right time to invest? Investors ask these questions all the time. But the truth is, these questions are mostly irrelevant—unless, of course, you’re a day trader or a gambler.

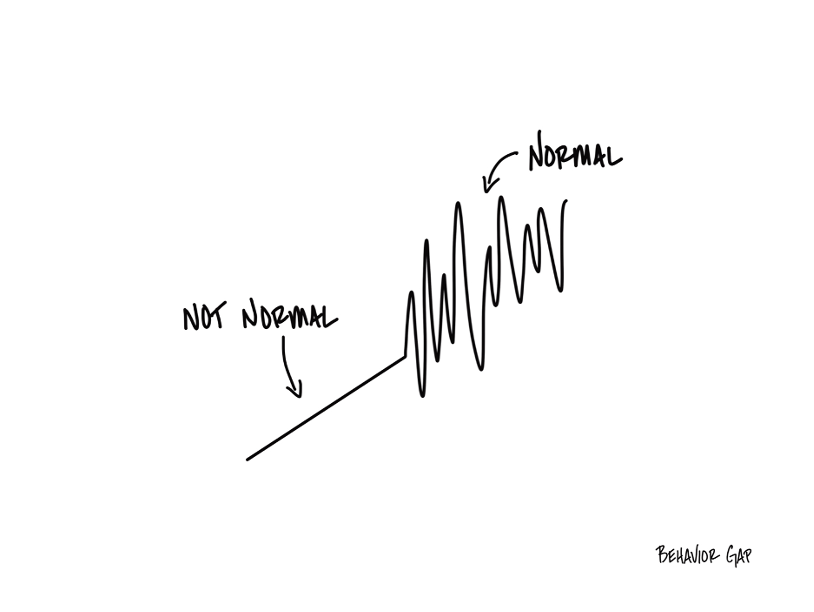

If you’re a long-term investor, short-term market moves don’t matter. Not one bit. They are noisy. They may cause you stress. They may even make you doubt your strategy. But they do not impact the trajectory of a long-term, disciplined investment plan.

So, What Really Matters?

What matters is where the Sensex will be in 2030. More importantly, where will it be in 2047, when India turns 100? These are the timelines that align with real wealth creation. Not daily, weekly, or monthly (or even yearly) shifts.

Today, the markets have been correcting for over a month. There are people screaming FIIs (Foreign Institutional Investors) sold Rs.99000 Crore. Let’s set the context first. How much is this number in dollars? It’s $ 12 billion. What is the total value of FII holdings in India? It’s $900 billion. So how much have they really sold? $12 billion/$900 billion = 1.33%

News headlines will continue to scream about losses. Experts will talk about risk. But in the grand scheme of things, this correction is just a blip. A tiny blip on the road to India’s economic potential. The real opportunity lies ahead.

The Power of Long-Term Growth

India’s growth story is undeniable. In less than a decade, India is set to become the third-largest economy in the world. Think about that. The third largest. This growth will bring transformative changes to the market. The Sensex, which reflects India’s top companies, will ride this wave.

If you’re worried about where the Sensex will be tomorrow, shift your focus. Look to 2030. Think about 2047. These milestones will define the future.

In the next six years (rather quicker), India’s economic size will outshine all but two countries (US and China). That means more growth for Indian businesses. More innovation. More wealth creation. And a higher Sensex.

But What About Today’s Market?

Let’s talk about the elephant in the room—the market correction. Yes, the Sensex has been down for over a month. The sentiment feels low. Headlines suggest gloom. But remember, this isn’t new. Market corrections happen all the time. They are part of the investment journey.

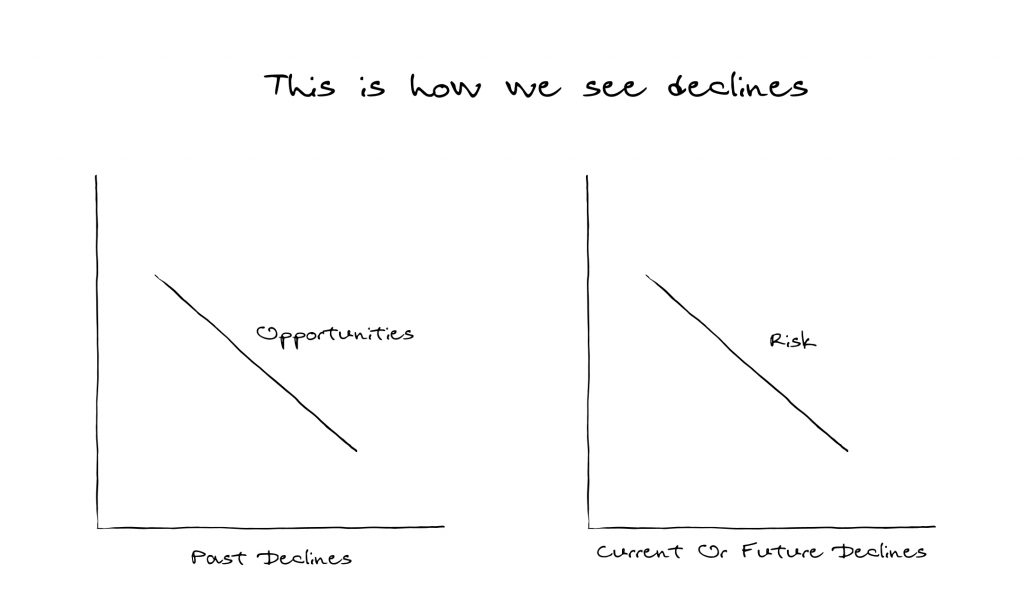

In fact, corrections are healthy. They help cool off markets. They set the stage for the next phase of growth. If you look at history, each correction has been followed by a rally that surpasses previous highs. Every dip has been an opportunity in disguise (even though it might not seem so when you are in going through it).

The Sensex will make a new high when this correction is over. And in the future, this correction too would seem like a missed opportunity.

Think Back to Past Market Levels

Consider this: in the year 2005, the Sensex was hovering around 5,000. Today, it is over 16 times that level, despite all the corrections, crashes, and crises along the way.

Why? Because India’s economy grew. And so did the market. Short-term noise didn’t change the long-term trend.

Now think forward to 2030. Where do you think the Sensex will be then? How about in 2047? Lower than today? Higher than today? My money is on higher. Way higher. And I believe yours will be too.

What Does It Take to Get There?

Long-term investing requires patience. It requires discipline. Most of all, it requires a clear vision. Corrections, bear markets, and volatility—they are all distractions. They are bumps on a long, prosperous road.

If you are investing for the long term, these dips are not obstacles. They are opportunities. Buying at lower levels increases your chance of future gains. Corrections give you a chance to accumulate units in top companies at discounted prices. In other words, they are moments to be seized, not feared.

India in 2030 and Beyond: The Big Picture

Let’s take a step back and look at the big picture. By 2030, India is likely to be a $7 trillion economy. It will stand shoulder-to-shoulder with the world’s largest economies. This growth isn’t just an economic stat. It translates to more jobs, more infrastructure, and more consumption. Every sector—from technology to consumer goods to finance—will benefit.

The companies that drive the Sensex will be at the forefront of this change. They will grow as India grows. And as they grow, so will the Sensex. Short-term corrections and volatility will pale in comparison to the gains that await.

Imagine the Sensex in 2047: India @ 100

2047 will mark 100 years of India’s independence. Think about what India will look like by then. A bustling economy. A global powerhouse. And a thriving stock market.

Long-term growth is not just a possibility—it’s a probability. The Sensex is poised to reflect that growth. So, ask yourself: is it worth worrying about where the Sensex will be tomorrow? Or is it more meaningful to focus on the long-term?

Lessons from Other Global Markets

If we look at markets like the U.S., the trend is clear. Over the past century, the S&P 500 has seen ups and downs. But its overall journey has been one of tremendous growth. The same is true for other major indices worldwide.

India’s Sensex is on a similar trajectory. It may be younger, but the fundamentals are strong. Just like the S&P 500 has grown despite wars, recessions, and crashes, the Sensex is expected to rise, driven by India’s growth story.

The Temptation to Time the Market

Many investors try to time the market. They want to buy low and sell high. It sounds simple. But, timing the market is nearly impossible. Even the best investors struggle with it.

Instead, the better approach is time in the market. Staying invested through the ups and downs allows your portfolio to benefit from long-term compounding. The earlier you start, the more time your investments have to grow. And make investing Boring.

When you’re thinking about 2030 or 2047, timing today’s market becomes irrelevant. What matters is that you’re in the market, ready to capture the gains that come with India’s growth.

Focus on Your Financial Goals, Not Market Fluctuations

As an investor, your primary focus should be on your goals. Are you investing for retirement? For your child’s education? For a better future? To maintain your lifestyle and protect your purchasing power? To build multi-generational wealth? These goals are long-term. They are not affected by what happens in the market tomorrow or next week.

Keeping your eye on your financial goals helps you stay calm during market corrections. It reminds you that short-term volatility doesn’t impact your long-term strategy. Instead of checking daily market levels, focus on building a portfolio that aligns with your vision for the future.

What Should Investors Do Now?

With the market in correction, some investors might feel the urge to sell. They might want to wait until the market stabilizes. But by doing so, they risk missing out on potential gains. Often, the best market days come immediately after a correction. Missing those days can hurt long-term returns.

Instead, consider using this time to strengthen your portfolio. Revisit your asset allocation. Look for opportunities in quality investments that may now be undervalued. Reinforce your commitment to a long-term strategy.

Remember, you’re investing for 2030, for 2047, and beyond. These are the milestones that matter. Today’s fluctuations do not.

Patience, Perspective, and Progress

The market will have ups and downs. Corrections are a part of the journey. But over time, markets grow. Economies expand. And long-term investors benefit.

The Sensex of tomorrow doesn’t matter. Nor does next week’s level. What matters is the Sensex in 2030, in 2047. India is on the cusp of unprecedented growth. As an investor, you have a front-row seat.

Stay focused. Stay invested. And remember: your wealth is built not on today’s market moves, but on tomorrow’s growth. The road to 2047 may have bumps, but the destination is bright.

On that note, I wish you and your family a very HappyRich Diwali…filled with loads of great health, amazing relationships, love, and peace. Happy Dhanteras!!!

and then tap on

and then tap on

0 Comments