Whose goal is it anyway…

“There are key moments in life when we ask ourselves questions,” Sebastien Bras says. Questions such as ‘What have we done in the past, where are we today and what do we want for tomorrow’. Now you might be wondering who this gentleman is.

Author Luke Burgis in his book “Wanting” wrote, “Bras is a celebrated chef whose flagship restaurant, Le Suquet, draws crowds in spite of its location in the middle of nowhere. In response to my questions, he says that he wants to tell me about three key moments in his career: first, when his father, Michel Bras, opened the restaurant in 1992 on the Aubrac plateau in the south of France; second, when Michel first earned three Michelin stars in 1999; and third, the day in 2009 when Sebastien first sat down in the chair he’s sitting now, behind what used to be his father’s desk, marking the transition of the restaurant from one generation to the next.

But now there was a fourth important moment. In June 2017, Sebastien told the Michelin Guide- the hallowed, 120-year -old institution that had awarded Le Suquet its highest distinction, three stars, for nineteen straight years – that he was no longer interested in their stars or their opinion. He asked them to remove his restaurant from the guide.

How does someone cease to want something that they wanted their entire life?”

You can probably start answering this question by asking where goals come from in the first place.

It seems that most people are not fully responsible for choosing their own. They get their goals from others (from models). Models are people or things that show us what is worth wanting. It is models – not our objective analysis or central nervous system – that shape our desires. With these models, people engage in a secret and sophisticated form of imitation termed mimesis, from the Greek word mimesthai (meaning to imitate).

Isn’t this true?

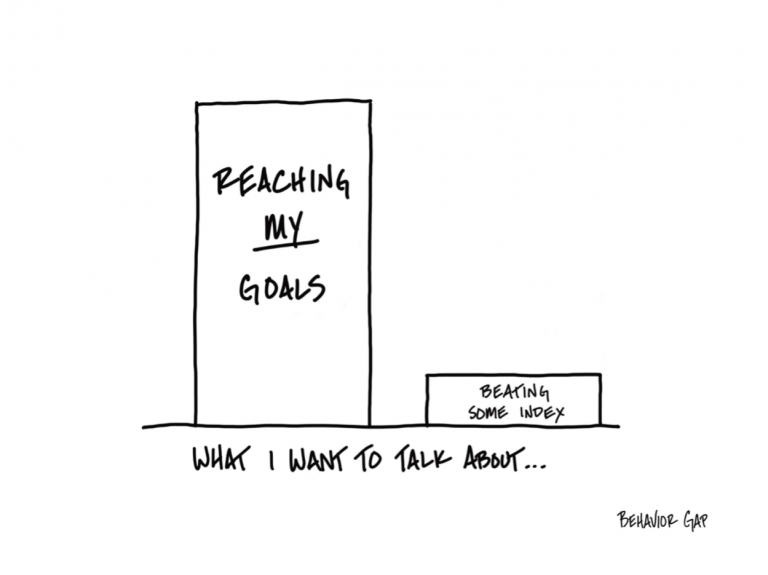

In the context of investing, many investors want to beat the benchmark.

They have seen others (intelligent sounding) pursue this stupid and disastrous activity. Therefore, they want to do it too. They have adopted someone else’s goal as their own goal. The truth is that we all are wired to copy the goals, dreams, desires and accomplishments of others.

What about you?

Did you want to beat the benchmark too?

If this thought has ever crossed your mind, let me give you the first dose of benchmarkitis vaccination (you will need to take this without fail every year to protect yourself from the morons going around infecting people with their benchmark bullshit).

“Imagine, you live in some magic world where all your dreams according to the financial services industry come true and you actually beat an index every quarter for your whole life. I hate to burst your bubble that even in that unlikely scenario, you don’t meet any of your financial goals.”

Why? Because beating the benchmark has nothing to do with meeting your personal financial goals. That has everything to do with sound financial life planning.

Now let’s flip that scenario on its head. “You slightly underperform the index every quarter for your whole life. But because of careful planning, you meet each of your goals.”

Doesn’t this sound a lot better?

It certainly does because the purpose of investing is to help you achieve your goals whether that means sending your children for further education, caring for parents, retiring, or giving back to the world.

Unlike the benchmarks, your personal goals are your own. Not your neighbours or that fellow in your Rotary. Yours. And since they’re yours, you don’t have to worry about them being wrong.

Each of us has our own version of the benchmark or Michelin star system. And it’s very difficult to extract ourselves from the game once we start playing it. Luke wrote, “We can easily find ourselves, like a French chef, wanting stars- marks of status and prestige, badges of honour. Mimetic desire is the unwritten, unacknowledged system behind visible goals. The more we bring that system to light, the less likely it is that we will pick and pursue the wrong goals.

Bras was able to extract himself because he changed his relationship to the game. We live in a society where we are always being asked for more. To be stronger, to go higher, to get bigger numbers…But I think there is a deep desire in people to reconnect with true life values. Values that we tend to forget sometimes.”

Thus, there is a very important question that we need to ask ourselves from time to time. Annually.

Say it with me …Why?

Why is money important to me? Why do I invest the way I do? Why do I spend the way I do? Why do I save so much (or so little)? Why do I spend so much (or so little)?

After all, the moment we start asking, “Why?” is the moment we are likely to discover that our behaviour isn’t in line with our values. And this is the time when like Bras we might reconnect with our values.

This type of introspection though is never easy. And I suspect it’s one of the key reasons we do stupid things with money. We are afraid to know why we do what we do, so we never take the time to understand.

But here’s the thing: Asking ourselves why we make a certain money decision is integral to our financial success, even if it takes a bit of time and effort to reach an answer.

So, go ahead…ask yourself: Why?

Here’s another great question: Whose goals are these anyway?

and then tap on

and then tap on

0 Comments