Risk: It’s Not What You Expect, It’s What You Overlook

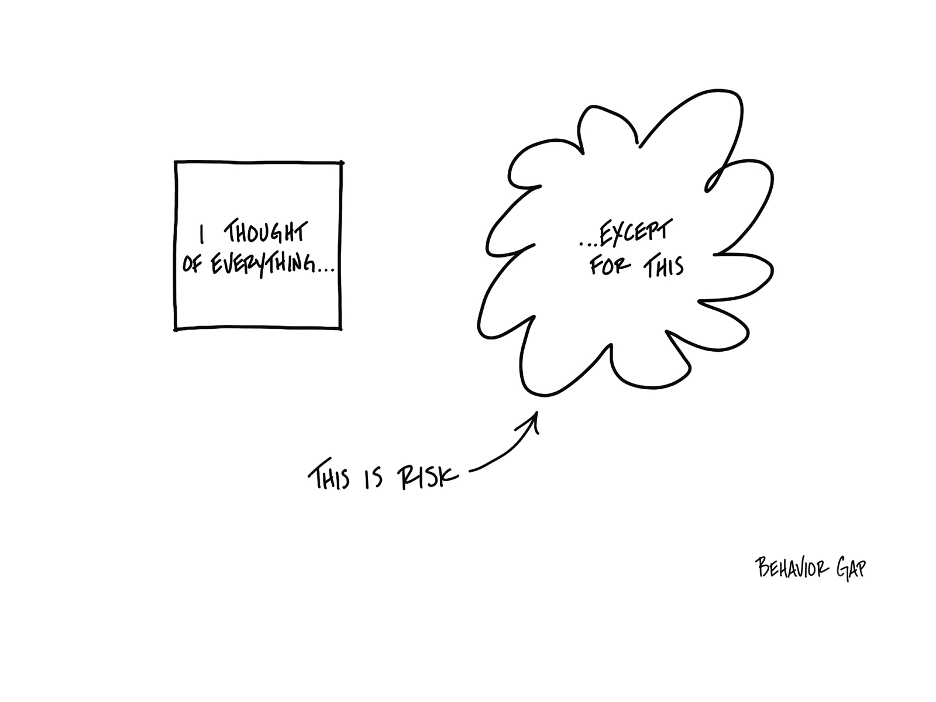

This sketch perfectly captures a concept that is critical for all of us to understand: risk is often what we don’t see or expect.

We plan. We strategize. We think through every possible scenario that might impact our investments. We tell ourselves, “I’ve thought of everything.” But then, there’s always something we didn’t anticipate. Something that falls outside our neat little box of expectations. That “something” is risk.

Risk isn’t just about the obvious market crashes or interest rate changes. It’s about the unexpected. The things that don’t seem likely or haven’t been considered.

In investing, it’s crucial to accept that no matter how much planning or research we do, there will always be an element of the unknown. This doesn’t mean we stop planning, but rather that we need to be prepared for uncertainty.

A well-thought-out plan for uncertainty helps manage some of this risk. Being prepared for such events (whatever they are and whenever they happen) helps address this risk. Having a long-term mindset can also help you weather unforeseen events. But most importantly, we need to remain humble in our understanding of the world, economies, markets, and our own behavior. Overconfidence often blinds us to potential dangers lurking just around the corner.

Remember: the greatest risks are often the ones we didn’t see coming. Embracing this reality doesn’t make us powerless; it makes us better prepared to navigate the twists and turns of investing.

In the end, it’s not about predicting everything. It’s about being prepared to adapt when things don’t go according to plan.

and then tap on

and then tap on

0 Comments