This Garbage Is Costing You

Last week the news was all about Apple crossing the $3 trillion valuation mark decisively…Apple was the first company to achieve a $1 trillion valuation in 2018 and became the first company to achieve the $2 trillion valuation feat just 2 years later in 2020 (the first trillion took 42 years). While it briefly flirted with the $3 trillion valuation mark in January 2022, Apple decisively scaled up the $3 trillion valuation peak last week. Exactly 16 years and 1 day ago (June 29, 2007), the first iPhone had gone on sale for $499.

Here is what the experts had predicted back then…

Steve Ballmer (the then CEO of Microsoft) laughed and dismissed it outright. It’s the most expensive phone in the world, and it has no keyboard, so no business user will want it, he said. He didn’t stop there. He went on to brag about his mobile strategy and how Microsoft was selling millions of devices and Apple selling zero.

Video of Steve Ballmer attached here.

There were others who predicted that the iPhone would fail miserably. There were reasons given why the iPhone will fail and why you should not buy one. Most experts literally had no clue where this revolution was headed yet it didn’t pause or stop them from confidently making dire predictions.

16 years later and the iPhone is in the hands of more consumers than any other phone…

The point I wish to make – No one knows a thing about the future…The future is uncertain and can take any of the following paths

While I was reading Apple’s feat in the Financial Times, I also came across another headline “Nasdaq records best start to year in four decades.” The authors wrote, “Tech dominated index rises 32% in the first half of 2023 as investors bet on AI. The Nasdaq composite has finished its best first half of the year since 1983, after investors flocked to companies in the tech-heavy index that they expect will benefit from the growth of artificial intelligence. US stock markets have powered past a series of challenges since January including turmoil among regional banks, brinkmanship over the government debt ceiling and higher interest rates implemented by the Federal Reserve and other monetary policymakers.”

At the start of 2023, who would have even thought this outcome was possible?

The correct answer is no one…

Everyone was bashing tech stocks in 2022…In November 2022, CNN wrote “The great bull run for tech stocks may finally be over.” The same post has an expert note in his report, when tech stocks imploded in 2000 as the dot-com bubble burst, it wasn’t until after the 2008 financial crisis before tech resumed a role as a market leader. Tech could be in for a long winter ahead noting that tech could take a backseat for the next several years.

An expert from Morgan Stanley (in February 2023) wrote, “With slowing growth rates combined with premium valuations, it may be wise to reduce exposure to mega-cap tech stocks.”

There were hundreds of other such pessimistic views. Every year, the financial media continues to confidently throw alarmist headlines at us. There is no dearth of experts predicting gloom and doom. One such post that comes to mind is a ‘Fortune.com’ post of August 2022. The headline was “John Hopkins economist predicts ‘whopper’ of a recession in 2023.”

The post further read, “Americans are worried a recession is looming—and according to a top economist, they ought to be.”

Steve Hanke, a professor of applied economics at Johns Hopkins University, said this week that he believes the U.S. is heading for a “whopper” of a recession next year.

In an interview with CNBC’s “Street Signs Asia” on Monday, Hanke argued that a major economic downturn had been made inevitable due to U.S. money supply soaring and stagnating.”

Now imagine the plight of someone reading this and taking this stuff seriously. And many seem to take such catastrophic journalism seriously. The best part is that such garbage sells.

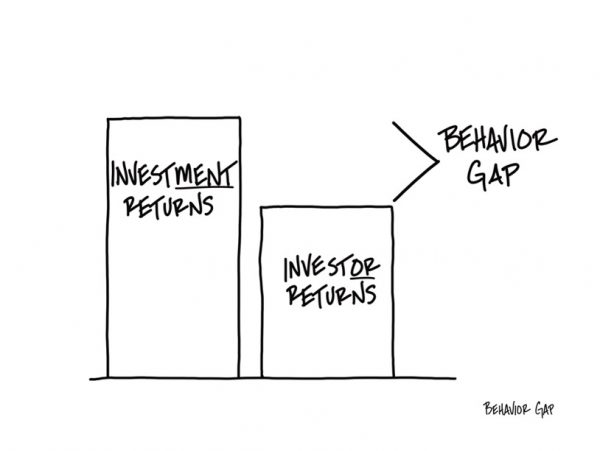

But this garbage is injurious to your financial health. While reading it costs you your time and peace of mind, believing it and acting on it costs you real money…and many times a lot of it. The expense ratio of this garbage is huge. And there is even a name for this expense ratio. It’s called the Behavior Gap.

The stock market is not like gravity or even the weather. It doesn’t follow set laws.

On any given day, the stock market represents the collective feelings of all of us. More often than not, those feelings are based on emotions (rational or not). And it is only in hindsight that we recognize our mistakes.

So, while on one level, human behaviour seems predictable (e.g., we get excited and buy stocks when they are flying high; we get scared and sell when stocks decline), it’s awfully hard to know what we’re doing until it’s too late.

The basic facts have remained the same. Over time (think 10, 15, or 20 years), stocks typically do better than bonds, and bonds typically do better than cash. We know that a diversified portfolio will help protect you from the variability of the stock market. Typically. We also know that typically the stock markets are up (will share an interesting chart on this soon) 70% of the time. We also (also) know that compounding is the secret sauce to creating long term wealth (and that we should not unnecessarily interrupt compounding).

Beyond that, stock market timing is just a guessing game, and everyone is pretending to know something they (and we) don’t.

I stopped pretending a long time ago. Have you?

and then tap on

and then tap on

0 Comments