There will always be reasons for not investing or being out of the market

In the month of September, I wrote a couple of columns on compounding and how we can never feel its power unless we leave it alone. However, it is so difficult to leave compounding alone as there are always reasons to not leave it alone. I mean there are always reasons to not invest or exit or wait for the right time because of all the creative horrifying headlines thrown at us. The negative headlines seem endless in 2020 with one after the other. Despite all of this, the market has gone up beyond what one would expect. In less than a month, the US election noise will be over but there will be other headlines that will hog the limelight. The point is that there will never be a period when there are no reasons to not invest (except during a bubble when there is madness all over). There will always be something or the other.

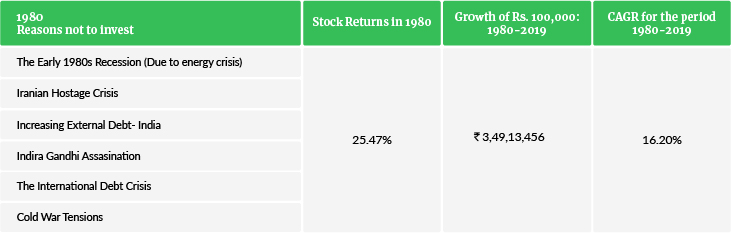

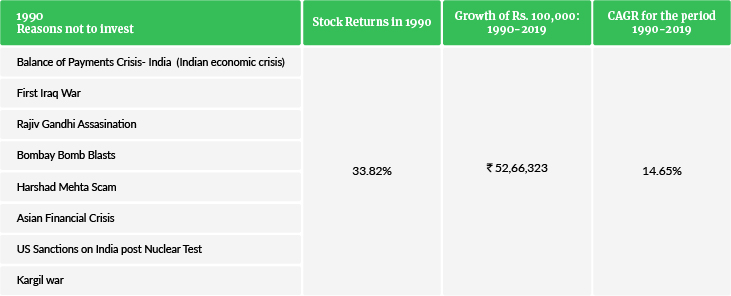

Do not believe me? Look at the table below over the last 40 years from 1980. I have broken it down into decades and given reasons to not invest in every decade. The reasons are not in any particular order but some of the ones that we could relook back and capture. I am sure I have missed many which most of you might recognize depending on your age.

Disclosure: This table assumes an initial investment of Rs.100,000 (1 Lakh) in the Sensex stocks at the beginning of the period January 1 and held through December 31. CAGR is Compounded Annual Growth Rate. Results will vary for other time periods. Assumes reinvestment of dividends and no taxes or transaction costs Past performance does not guarantee future results. For illustrative purposes only.

It is hard to ignore the reasons. If you believed in any of the reasons to not invest or to exit and did not leave compounding alone, your outcomes would have been sub optimal and very different than what was realistic possible

In Berkshire’s 2016 annual report, Warren Buffet wrote “Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold”. This was early 2016 and no one was expecting a Trump Win. Yet Trump won, and there was a lot of noise around how this meant DOOM. Four years later, on February 19, 2020, the US indices were on record highs. Then the markets saw the fastest erosion of 34% in a matter of 4-5 weeks. Despite this, the US indices are at record highs.

If you let your investment philosophy and investment policy/financial plan be guided by these reasons or market movements, there are 3 things for sure.

- First, you have no investment philosophy or investment policy but more importantly you do not have the mindset of an equity investor.

- You are not investing. You are speculating.

- Your investing experience is likely to be poor and you will be disappointed with the outcomes more often than not.

Thus, it is best to not invest in the equity markets if you are going to let the market movements (volatility) and headlines guide your investment strategy.

I repeat there will always be reasons to not invest. In fact, these very reasons cause volatility (ups and downs), and you are compensated at a much higher rate than bonds to bear this volatility. The easy (but difficult in your mind) way to look at it “I get 2 times (plus in a tax efficient way) of what I would get in a fixed deposit or 10 year bond just to ignore the normal volatility of the markets”. Volatility will always be a part of the market. There is no way to remove it. You can get out of the market, but volatility will not. If you decide to suppress this volatility in your mind by staying out of the market, you end up suppressing your returns and this is exactly what happens. So, people who want to suppress volatility and cannot bear the volatility should not expect to get market returns but be happy with the fixed straight line returns of bonds and fixed deposits.

I must share yet another gem by Buffett “Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.”

Investing is a decades long marathon. When you invest, you must look several decades ahead because you are not investing for 10 days or 10 months. You are investing for 20 + years (Read last weeks’ Time Horizon post in case you missed it). Yes, there will be times when you will see investment values down but choosing to ignore the noise will pay off handsomely in the long run.

P.S. My updated 4th book has now hit the stores. I have received many appreciation emails and calls about the book. To order copies for you and your loved ones, https://www.amazon.in/

and then tap on

and then tap on

0 Comments