The Worst Market Timer

This is a slight deviation from many of my previous posts. In that sense, this post will have many numbers in it. But I will try to make it interesting without you really getting drowned in the numbers.

Let’s say you are the worst market timer in Indian history. Pardon me for saying this but let’s assume for a moment you are. By the end of this post, you will be glad you are. There is a reason for this, and it will be very evident to you by the end of the post. I promise.

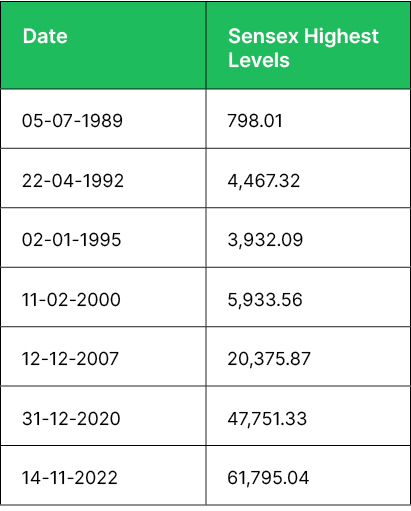

Let’s now look at the table below.

What do you think are these dates?

I assume you would have guessed from the headline and the table headings. But let me write it anyway. The date in the first column is the one when the Sensex (the index of the largest 30 stocks) was at the highest level before it started to go down.

This is where you come in. Think for a moment it’s the year 1989. Your name is Avinash and you are 35 years old. You can only invest in a diversified portfolio of stocks (Sensex). No individual stocks allowed.

Somehow you mustered the courage to invest a one-time lumpsum amount of Rs.10 Lakh on 5th July 1989. The Sensex took a downturn from that moment, and you swore to never invest again. You woke up again in 1992 during the Harshad Mehta boom and saw everyone making money. You were tempted to invest again, so you go ahead and invest another Rs.10 Lakh in the same diversified portfolio of Sensex stocks. The market tanks again. Rather it crashes now. You once again swear never to invest again. You even tell yourself that you don’t have the luck needed to make money in the stock market. You convince yourself fixed deposits and real estate are safe. And your life powers on.

Fast forward to 1995 and you once again invest Rs.10 Lakh. The same cycle repeats. You swear to not invest again but find yourself investing yet again at the highest Sensex levels in 2000 and 2007. You are 53 now and have a decade to retire. All in all, you have invested Rs.50 Lakh over the last 18 years. All the 5 investments of Rs.10 Lakh each made at the worst times to invest. That gives you the crown and title of the Worst Market Timer in History. So, you think. And you don’t even bother to look at your portfolio.

Fast forward today and the Sensex is 62000+. You are 68 years old. You say to yourself, let me at least look where my portfolio is.

Can you guess the value of the Rs.50 Lakh invested?

I am going to wait a few seconds and have a sip of my tea.

Did you come up with a number?

I have asked this to more than 100 people and none of them were even close.

The number is Rs. 12+ Crore.

The exact number is Rs.12,04,31,934.

Now tell me will you be happy with this outcome?

Who wouldn’t be?

This is the first reason why you would be glad that you invested. You are glad because of the outcome. And you are glad that you did not wait for a correction as you know you wouldn’t have invested otherwise. You pat yourself on the back for pressing the button irrespective of the stock market levels.

The worst market timer did extremely well by simply investing and not interrupting compounding. All of this was possible because you invested when you had the money. You didn’t wait. You didn’t wait for a prediction. You simply invested and let your money compound. This goes to show yet again that timing the market does not matter. In fact, it’s a fool’s paradise.

As the above sketch shows, you are better off investing earlier than later. A finer point to note here is that the time horizon for your investment has to be decades and not days or months or even a few years. It takes decades for compounding to show its magic.

The stock markets are generally up 70-75% of the time and they are down 25-30% of the time and/or range bound. So, by waiting for a bell to ring or the right time, investors actually end up betting (instead of investing) with very poor probabilities of winning.

But some stupid fellow has told you it’s better to wait. The stock markets are high. His so-called research says so. “I know it”, he says. He comes across as your friend because this is what you want to hear. He also comes across as intelligent because he wears a suit and rattles off numbers even before your brain has the ability to process some of them. He tells you he can get you more. This “MORE” is yet another enemy of an investor. And there are many who will take advantage of this desire of yours. But this is a post for another day.

Now that you know the outcome of the worst stock market timer in India, wouldn’t you think it’s better to be one than second guessing when to invest or simply waiting.

and then tap on

and then tap on

0 Comments