Will You Master This?

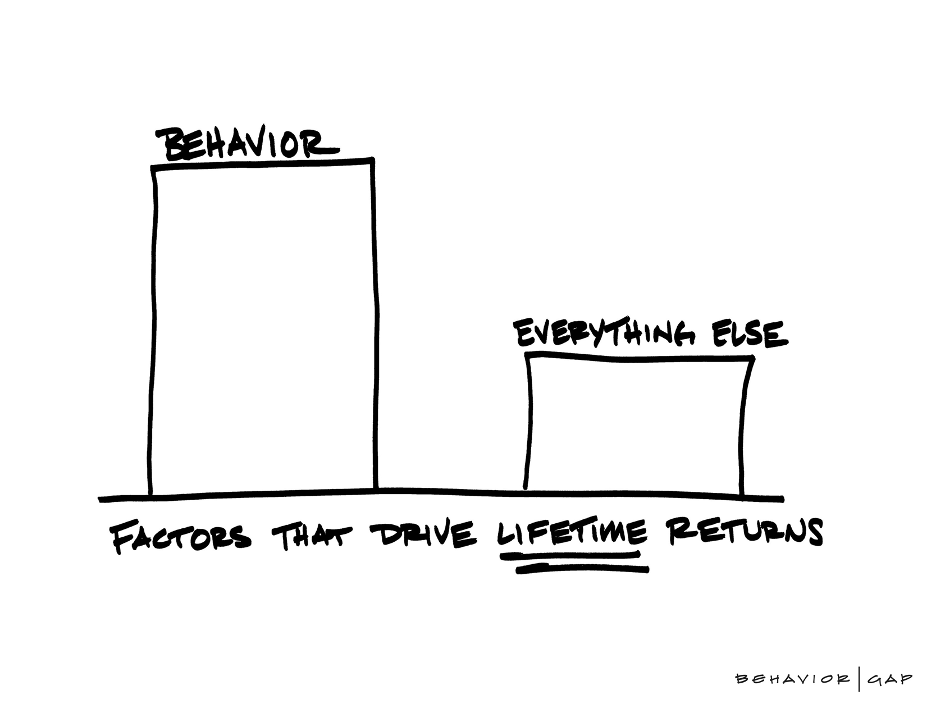

Your investment returns have little to do with the market.

They have everything to do with your behavior.

This is the truth most investors don’t want to hear.

They want to believe that picking the right stock, the right mutual fund, the right alternative investment, or timing the market correctly will lead to superior returns.

It won’t.

The data is clear. Over decades, markets go up. Businesses grow. Innovation happens. The economy expands. The only thing that gets in the way of your returns is you.

Think about the biggest investing mistakes people make.

They panic when the market falls. They chase after the hottest investments. They try to time the market. They follow media headlines. They trade too often. They let emotions drive decisions.

None of these are issues with the investments themselves.

They are behavioral issues.

A well-diversified portfolio held for decades will build wealth. It’s simple to know but difficult to implement and stick to. It requires patience. It demands discipline. And that’s exactly why most investors can’t do it.

They look at a falling market and feel the urge to sell. They look at a rising market and feel the need to buy. They see a new trend and believe they must participate.

Consider the long-term track record of equities.

The Sensex has seen crashes of 20%, 30%, 50%, and even 60%. Yet, it has gone from 100 to 85,000 in four decades.

It wasn’t the investors who jumped in and out that made the most money. It was the ones who stayed put and continued investing.

The same applies to every successful investment strategy.

The investors who benefited from real estate weren’t those who bought and sold every few years. They were the ones who held through cycles.

The best venture capitalists don’t trade in and out of startups. They invest and wait years to see returns.

Yet, people continue to believe they can outthink the system.

This is where behavior becomes the single biggest driver of returns.

When a correction happens, do you panic? Or do you see it as an opportunity?

When a bubble forms, do you chase it? Or do you stay disciplined?

When the media screams about a crisis, do you react? Or do you stick to your plan?

The difference between the investor who builds wealth and the one who struggles is not intelligence. It’s behavior.

This is why having a world class real financial professional on your side matters.

Not because they pick better investments. Not because they have a crystal ball. But because they help you make better decisions. They don’t let you come between you and your goals.

They stop you from making fear-driven decisions. They remind you why you invested in the first place. They bring perspective when emotions run high.

Your portfolio’s success is not about finding the best fund. It’s about sticking to the plan when it’s hardest to do so.

Think of investing like a rollercoaster.

There are ups and downs.

Some investors panic when the ride goes down and try to jump off. Others hold on and enjoy the ride back up.

The difference in outcomes is massive.

Investing is simple, but not easy.

The rules are well known.

Diversify. Invest consistently. Stay the course.

Yet, few can follow them.

Because investing is not about numbers. It’s about psychology.

And psychology is messy.

The best investors are not the ones who know the most.

They are the ones who master their emotions. They are the ones who have real financial professionals. They are the ones who have someone between them and their emotions.

They understand that the real enemy is not the market.

It’s their own behavior.

The question is—will you master it?

and then tap on

and then tap on

0 Comments