The Rise of Investainment

It’s hard to miss all the investing advertisements during IPL. It’s even harder not to get confused among the terms investing, trading and playing (aka gambling). It seems like all the three terms are one and the same. Let’s go through a tale of 3 such advertisements.

One is from a Fantasy Sports Firm. According to Wikipedia – Fantasy sports are generally considered to be a form of gambling though they are far less strictly regulated than other forms of sports betting. Unlike traditional sports betting, fantasy sports are generally viewed as games of skill, rather than a game of chance thus exempting them from gambling bans and regulations in many jurisdictions. Its advertisement features Bollywood celebrities and cricket stars. After all that is said in the ad, there is a cute disclaimer – This game may be habit-forming or financially risky. Play responsibly.

The next one is from a (broking) firm that says Invest Right. Even the commentators keep repeating Invest Right and Invest Now. If you go to their website to find out about ‘Invest Right’, you are told to Open a Demat + Trading Account and Enjoy.

Since when did ‘Invest Right’ = Open a Demat + Trading Account and Enjoy…

What kind of bullshit is this?

Seems like the one many like or find entertaining.

If this was not enough, another firm (which is actually a part of a giant media company) tells us “Better Returns Ke Liye Download Our Mobile App and Get Started.”

What does this even mean?

Never Mind, it’s actually not important.

But this nonsense doesn’t stop here.

It is everywhere on social media and traditional media including billboards.

One billboard had a West Indian cricketer telling us One Game, One Passion – Play Now. But this company was at least clear – they were in the business of betting.

Another billboard had a celebrity touting a betting app. But the word used in this billboard was play. This is nothing compared to the gem on the website of this firm. “Among the sports bonuses, you can find the IPL kickback bonus. This is a great option for those who are into cricket betting.

Each user will receive 15% of their losses on their IPL bets on a weekly basis. This is very beneficial because in this case, even losing bets are beneficial.”

Read this gem again, please. It’s so good I am going to type this again.

Each user will receive 15% of their losses on their IPL bets on a weekly basis. This is very beneficial because in this case, even losing bets is beneficial.

Can you believe our luck that we found this firm that not only helps us lose money but also makes our losses beneficial?

With all of this happening (and more), the word investing seems like some sport or a form of entertainment.

And that’s one of the biggest mistakes we make with our money.

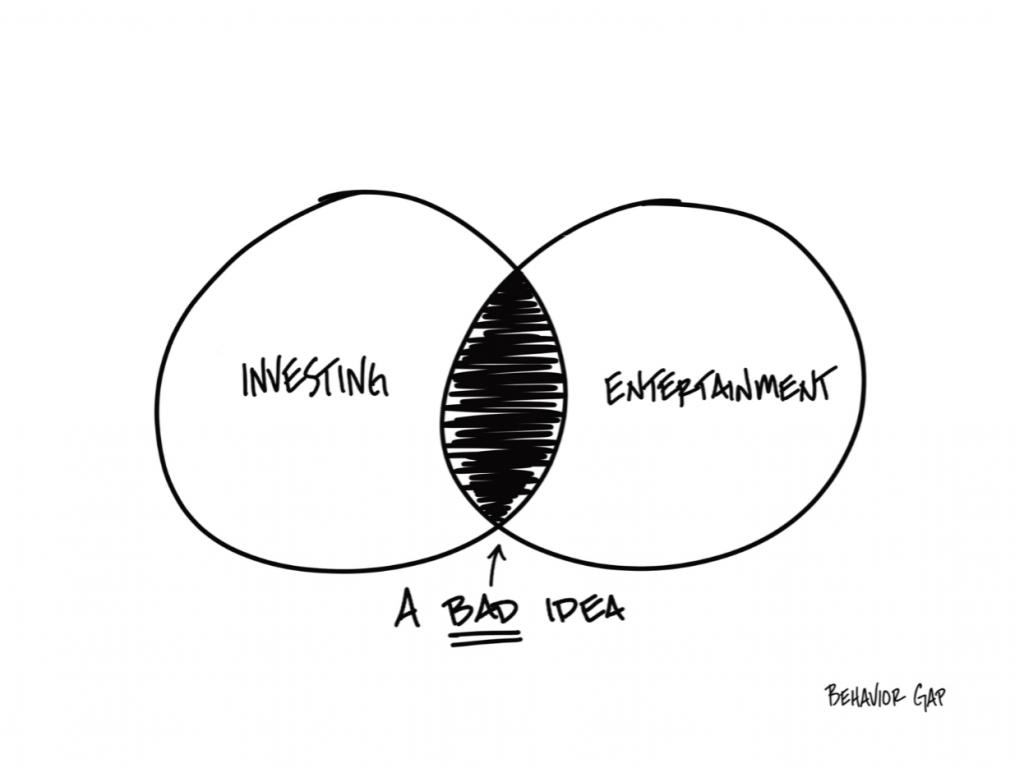

We confuse investing with entertainment (aka investainment).

The reality though is that it is neither investing nor entertainment.

But somewhere along the line, investainment has become one of our favorite spectator sports.

On social media, in your newsfeed, billboards or at the IPL match—it seems like everywhere you look; someone is talking about finding the next hot stock, mutual fund, or alternative investment – from cryptocurrency and tech funds to startups and beyond.

And we get sucked into this hole. Because we forget the basics – There are no shortcuts in investing. The faster you make…the faster you lose.

Real investing actually has very little to do with the kind of bold, swift actions people tend to yell about on these financial pornography networks. Rather real investing is about as boring as watching grass grow.

The idea that investing is fun and entertaining can lead us to make costly mistakes. Despite knowing at some level that market timing, stock picking, day trading, and betting are hazardous to our wealth, so many of us end up engaging in that kind of behaviour. And needless to say, this behaviour is addictive. That is why these generous firms even have a cute disclaimer: It’s Financially Risky…Play responsibly.

Sure, investing can be fun sometimes. But bear markets serve as a painful reminder that it’s not always fun. This isn’t monopoly we’re playing. It’s real life.

We’re dealing with real money and real goals. And by confusing investing and entertainment (investainment), you almost always end up with bad results.

At some point, we need to take a deep breath and ask ourselves a question:

Am I investing my money to meet my most important financial goals, OR

Am I investing as a form of entertainment?

Hint: For almost all of us, it can’t be both.

and then tap on

and then tap on

0 Comments