All that Glitters is not Gold even if it is Gold

The headlines these days scream Gold, Gold and Gold. As I write this post, Gold is trading around Rs.56400 for 10 grams. It seems that people are not getting enough of it. A popular Trading App in the US has seen its users holding Gold Funds going up significantly this year. According to the World Gold Council, Gold-backed ETFs have attracted $39.5 billion net inflows in the first half of 2020 (99% of this money is global money and not money from Indian investors buying gold), up from $5 billion in last year’s first half, a record. Gold is, of course, having a moment right now and is attracting much money on an unparalleled scale globally.

I thought of doing a very simple post, explaining a simple perspective. It is very important to understand these key concepts.

- Gold returns for Indian investors are dependent on the Dollar

Gold is normally priced in Dollars and thus when someone in the US buys gold, his/her returns are linked to Gold prices (only) going up or down.

In India, when we buy gold, our returns are linked not only to Gold Prices going up or down but also to dollar prices going up or down. Thus, Gold for us is not just a call on gold but also on the dollar. So, if gold goes up but the dollar goes down, this will nullify any gains made when gold prices go up. - Gold prices move in Cycles

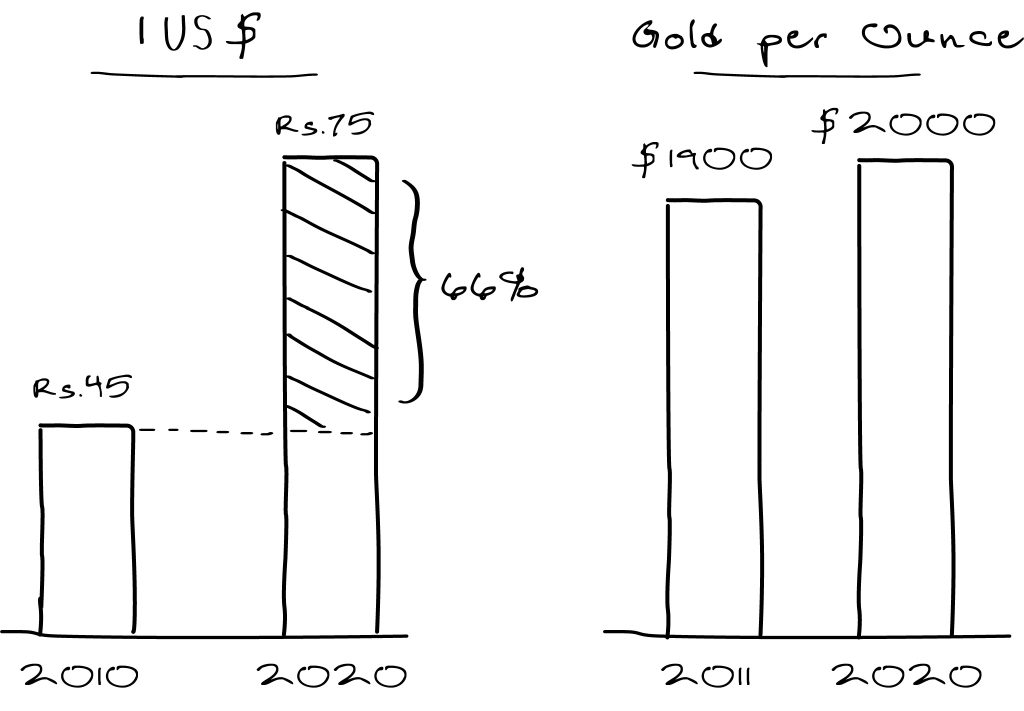

Gold shone during the 1970s and rose to $850 in 1980. Then over the next 20 years, gold lost 75% and was down to around $255. In short, even not factoring inflation, one would have lost 75% by 2001. The next 10 years gold went up and by 2011 it had hit a peak of $ 1920. This followed a steep correction again to $1050 in 2016. The last 10-year return of gold was Zero or even negative if we exclude the last 7-10% rally. The point I am making is Gold prices move in Cycles and thus for years the prices could go up or down. Indian investors in gold were saved in the last correction because the dollar went up in value from Rs.45 to Rs.75. This is a 66% appreciation in the dollar. In fact, most of the returns that you are seeing in Gold today is also because of dollar appreciation and rupee depreciation.

This is because of point 1 and the calculation given above. Price dollar at Rs.45 and you see gold should be at Rs.33000+ levels.

Gold does not generate any economic activity or value and thus its price is dependent on demand /supply, fear, and speculation. Today with interest rates nearing zero in the US, negative in Eurozone and Japan, global investors have driven up the price of gold. Governments are printing and pumping money worldwide and this is finding its way into Gold besides the Equity markets that are also going up. Additionally, gold is seen as a stable alternative to the dollar which is ironic for the Indian investor for reasons explained in point 1. Does Gold have room to go up? Seems likely and we do not know whether it would go to Rs.70000 or beyond. I would never speculate, and you should not too.

4. Indians buying gold are not driving up prices (Indian Gold Consumption is at the Lowest)

Everybody is enjoying the party, and the Fear of Missing Out is evident because it has finally caught the fancy of retail investors thanks to the front-page headlines. When it comes to India, the import of Gold is at its lowest in decades, coupled with a slump in jewellery demand. It is also important to note that lockdown has hampered the physical sales of Gold due to most of the retailer shops being closed. However, the same is getting compensated with the rise in convenient and digitally choices of purchases such as Gold ETFs, and Gold Fund of Funds.

The higher prices of gold might keep more buyers out of the market but speculative buyers and retail investors wanting to make a quick buck might join the party too.

Do not let Fear of Missing Out make you buy Gold. Prices going up are never the reason to buy an asset. Be disciplined about your Financial Plan, and do not look beyond a 5-10% allocation to Gold if you are keen to invest.

Remember the quote “All that glitters is not Gold”? The reality is “Even if Gold Glitters for the short run, it might not be Gold for your long-term Portfolio.” Understand this and make wise choices.

P.S. Point 4 has been contributed by my colleague Ankur Mahajan.

and then tap on

and then tap on

0 Comments