The Perennial Wisdom

On January 3rd, 2023, I wrote the post, “The Thing To Focus On In The New Year”. I was going to publish the same one this year too, as this is a super important post that must be read every year. If you don’t (and even if you do) recollect this, I strongly encourage you to read this one now. We will not move ahead unless you read it…Ok, I believe you will do it, so let’s move on to the first post of 2024. This is again one that I like you to read every year (2025 and 2026) without fail.

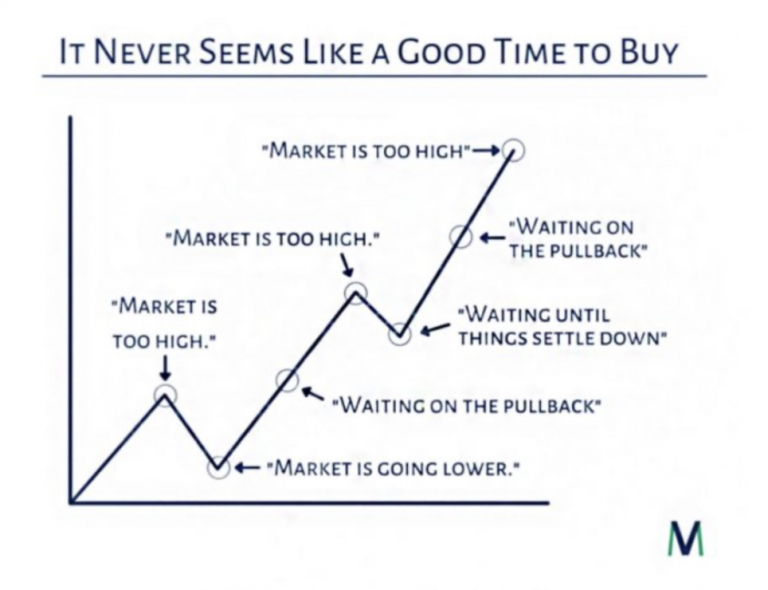

Here is a brilliant visual that probably captures the sentiment of the moment – the stock market is too high:

The truth is it never seems like a good time to buy.

Because when the stock markets are going up…they can always correct…so it feels right to wait instead of buying.

And when the stock markets are going down…they can always go down more…so it feels even more right to wait instead of buying.

And the best part is there will always be reasons for the stock markets to correct or go down…and some intelligent people somewhere across the globe will be ringing the gloom doom bell all the time.

2012 – Markets are High, Don’t Invest

2013 – Markets are High, Don’t Invest

2014 – Markets are High, Don’t Invest

2015 – Markets are High, Don’t Invest

2016 – Markets are High, Don’t Invest

2017 – Markets are High, Don’t Invest

2018 – Markets are High, Don’t Invest

2019 – Markets are High, Don’t Invest

2020 – Markets are High, Don’t Invest

2021 – Markets are High, Don’t Invest

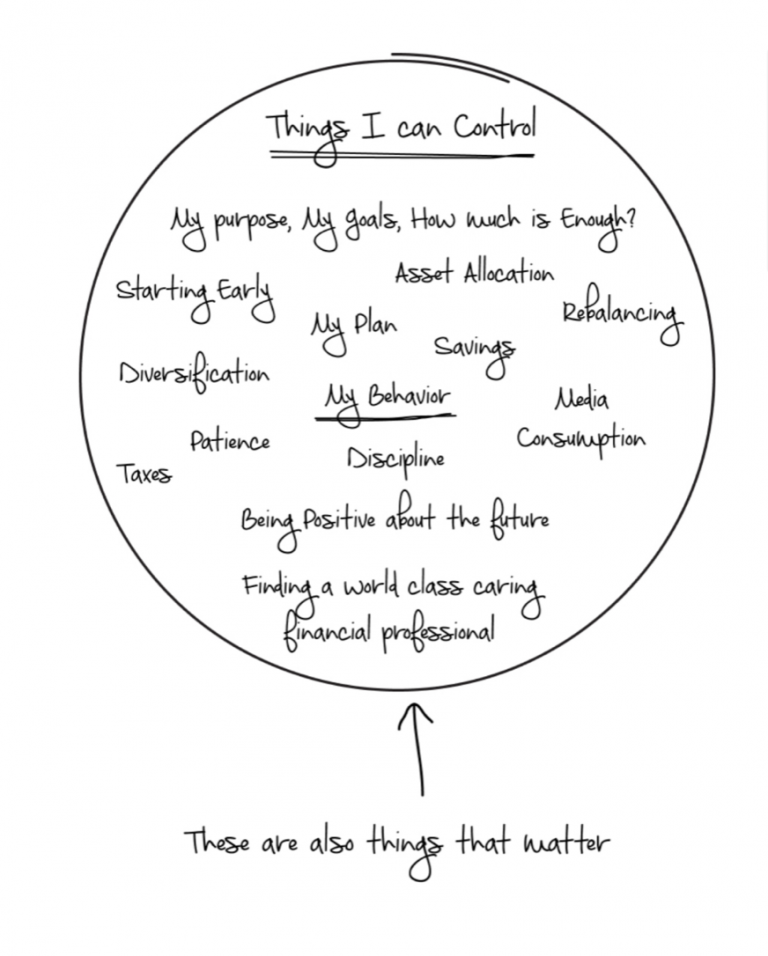

I still went ahead and invested. I still stay invested and invest whenever I have surplus money.

The best part of this tweet is the line in bold and green.

This is exactly what I and many real investors across the world do…I would only add one line to it.

I still went ahead and invested. I still stay invested and invest whenever I have surplus money. I sell when I need the money, otherwise I simply stay invested.

Take a print of this line and put it somewhere you can see it regularly…In fact make it your investing mantra.

The one forecast that is likely to remain consistent over the next 100 years is this:

2024 – Markets are High, Don’t Invest

2025 – Markets are High, Don’t Invest

2026 – Markets are High, Don’t Invest

2027 – Markets are High, Don’t Invest

2028 – Markets are High, Don’t Invest

2029 – Markets are High, Don’t Invest

2030 – Markets are High, Don’t Invest

2031…

Another variation of this is – Markets will correct, Don’t Invest (Wait till things settle).

Did we not hear this in 2022 and even as recently as a few weeks ago when the Sensex crossed 70000+ (it’s 72271 as I am writing this on January 1st, 2024)? I have been hearing this for the last several decades.

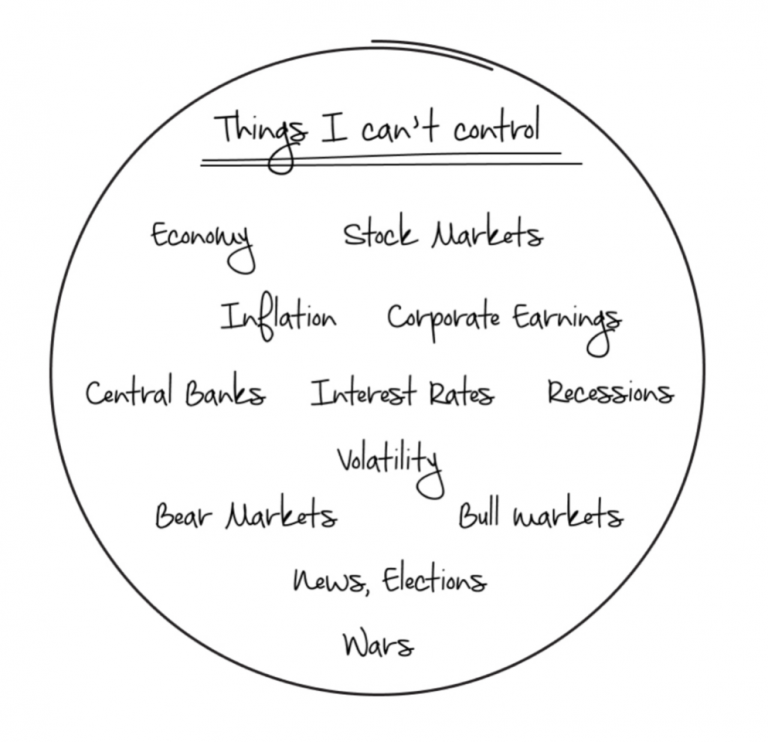

What have we not seen in the last four years?

A global pandemic, Russia invading Ukraine, the highest inflation of the last four decades in the US, severe interest rate hikes, a banking crisis threatening to take down the financial system, the forecasted collapse of the US dollar, and now war in the Middle East…As Arnold Toynbee wrote, “History is one damned thing after another.”

But as we have seen throughout history (including the past four years), forecasts are useless in general…no one knows a thing about the future…While there is a separate post on forecasts that I will write this year, here is a fascinating forecast by a Goldman Sachs expert. On November 15th, 2023, this gentleman wrote that he expected the US S&P 500 to end 2024 at 4,700. Guess what, the S&P ended 2023 at 4,771…The best part, just one month after his previous forecast, he changed (revised) the S&P target to 5,100. The point is no one knows a thing about where the stock market is headed…Yes you can sound intelligent, but you still don’t know.

Despite all that is happening in the world or will happen in the future, the truth is that the stock market usually (not always) goes up.

And why do they go up?

It’s not because they feel like going up.

There is a fundamental reason – Earnings Growth of Companies in the Stock Market. Earnings are the most important driver of stock prices. In simple words. Earnings Drive Stock Prices (and thus the stock markets). There are three important things to note here – the company’s earnings, the future expectations of these earnings and the uncertainty of these future expectations of earnings. There are countless variables at play in terms of these future expectations and the uncertainty of these expectations.

But as we have seen time and again that managers and executives of these companies will do whatever needs to be done to protect their earnings and thus their stock prices.

Just in anticipation of a recession, not even an actual one, companies such as Google, Meta and many others laid off several thousand people simply to protect earnings. Google parent Alphabet laid off 6% of its workforce or 12,000 people, as it grappled with economic uncertainty that hit the company’s bottom line last year, especially its core advertising business.

I can go on with hundreds of such examples across the world, but the point I wish to make is that executives and managers of companies will not simply sit and do nothing… They will take steps to protect earnings, margins, and growth…and any long term move in the stock markets can thus be explained by the underlying earnings of companies, expectations around these earnings and uncertainty about those expectations.

2024 will not be any different…There will be enough and more reasons to not invest.

But here’s the thing about the stock market – it’s like a rollercoaster that doesn’t really care about the short-term screams. The market has its ups and downs, sure, but in the grand scheme of things, it keeps chugging along because companies and people behind them are always pushing forward, no matter what.

Now, I’m not saying the market’s immune to bad days – we’ve all seen it take some hits. But it’s like a boxer; it takes a punch, stumbles, but eventually, it gets back up. And over time, it’s those comebacks that really count.

Let’s not get caught up in the daily gossip of the market, predicting the next big drop or jump. Our focus should be on the long game – investing with a cool head, based on solid facts, not just the mood of the moment.

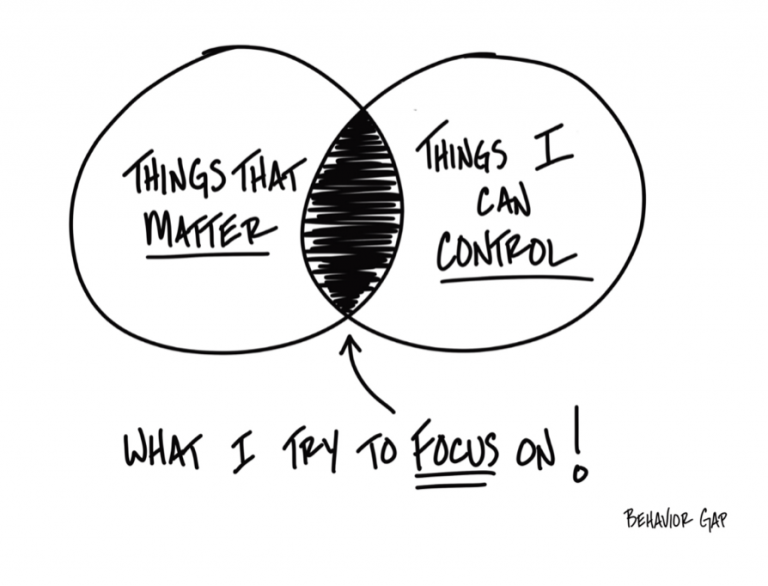

As we step into 2024, remember that the market is all about looking ahead. There is a Soren Kierkegaard quote that comes to mind here – Life can only be understood backwards, but it must be lived forwards…So are the stock markets…It seems like you can understand them backwards and with back testing, the reality is that the stock markets too must be lived forward…And while no one can promise smooth sailing, we simply need to stick to our plan and focus on the things that matter along with things that we can control.

So, let’s not sing along with the doomsday choir. Instead, let’s tune into the steady hum of progress and play the long game. Invest with purpose and patience, and let the future do its thing. Here’s to making smart moves and sticking to our guns in 2024 – no matter what the market’s singing, we’ve got our own tune to play.

On that note, I wish you and your family a Very Healthy and Happy New Year 2024.

and then tap on

and then tap on

0 Comments