The Need to Embrace Uncertainty

In the world of investing, one thing is certain: uncertainty. Markets fluctuate, economies go through cycles, and unexpected events can throw even the most well-thought-out plans into chaos. Yet, despite this inherent uncertainty, many investors still crave the idea of certainty—predictable returns, guaranteed outcomes, and a smooth, untroubled path to financial success. While selling the promise of certainty is easy, delivering it is impossible.

This post will explore why certainty is such an alluring concept for investors, why it’s often an illusion, and how embracing uncertainty can actually lead to better investment outcomes.

The Allure of Certainty

Humans are hardwired to seek certainty. We all love it. Guaranteed this…Guaranteed that. In an unpredictable world, certainty offers a sense of security and control. For investors, the idea of a guaranteed return or a foolproof strategy is incredibly appealing. It promises peace of mind, the comfort of knowing that their financial future is secure, and the assurance that they’re on the right track.

Financial products that offer guaranteed returns, such as fixed deposits, government bonds, and certain life insurance products, are popular for precisely this reason. They provide a clear, predictable outcome, which is attractive to those who think they cannot take risks (it’s another matter that they end up taking a bigger risk by going after certainty) or who have specific financial goals that require a high degree of certainty.

However, while these products can play an important role in a diversified portfolio, they come with their own set of limitations and risks. The certainty they offer often comes at the cost of lower returns, which may not keep pace with inflation or help investors achieve their long-term financial goals.

The Reality: Uncertainty is the Only Certainty

The truth is, no investment is completely free of risk or uncertainty. Even the most conservative investments carry different types of risk, whether it’s inflation risk, credit risk, or the opportunity cost of missing out on higher returns elsewhere.

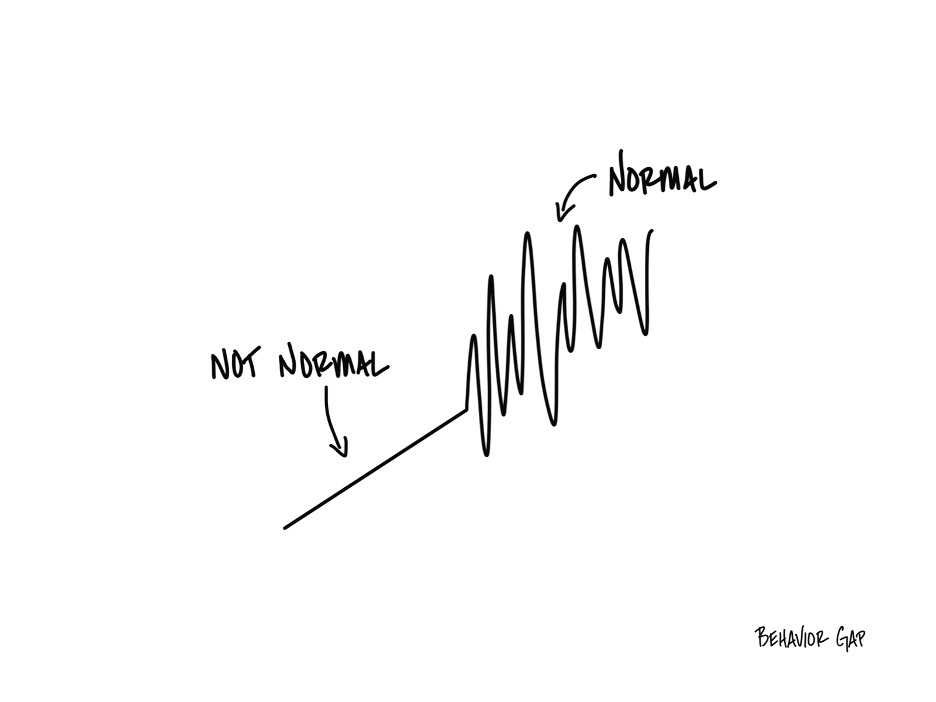

The stock market, which has historically offered higher returns over the long term, is particularly prone to short-term volatility (the stock market going up and down). Prices can fluctuate dramatically in response to economic data, corporate earnings reports, geopolitical events, and even investor sentiment. For those who crave certainty, these fluctuations can be unsettling.

But it’s important to recognize that this volatility is not necessarily a bad thing. It’s normal. In fact, it’s the very thing that makes higher returns possible. There is a need to sacrifice certainty. By sacrificing certainty and accepting some degree of uncertainty, investors open themselves up to the potential for growth and wealth creation over time.

The Cost of Chasing Certainty

Investors who seek certainty at all costs often end up making decisions that are counterproductive to their long-term goals. For example, they might:

- Over-Allocate to Low-Risk, Low-Return Investments: To avoid uncertainty, investors might put too much of their portfolio into low-risk, low-return investments, such as bonds, fixed deposits, or cash. While these investments offer stability, they may not generate the returns needed to achieve long-term financial goals, particularly after accounting for inflation and taxes.

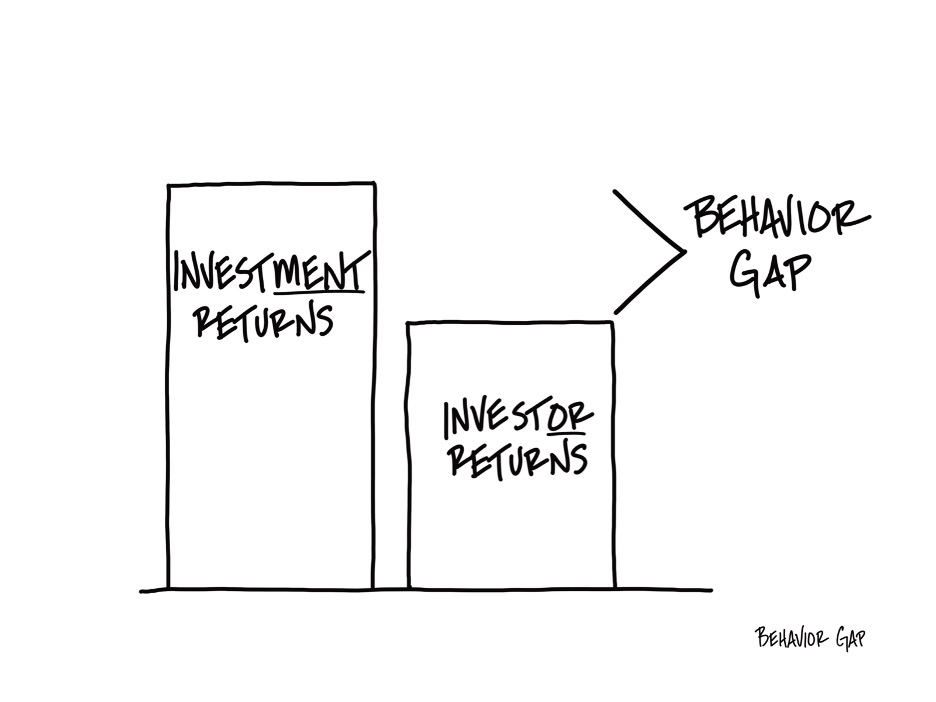

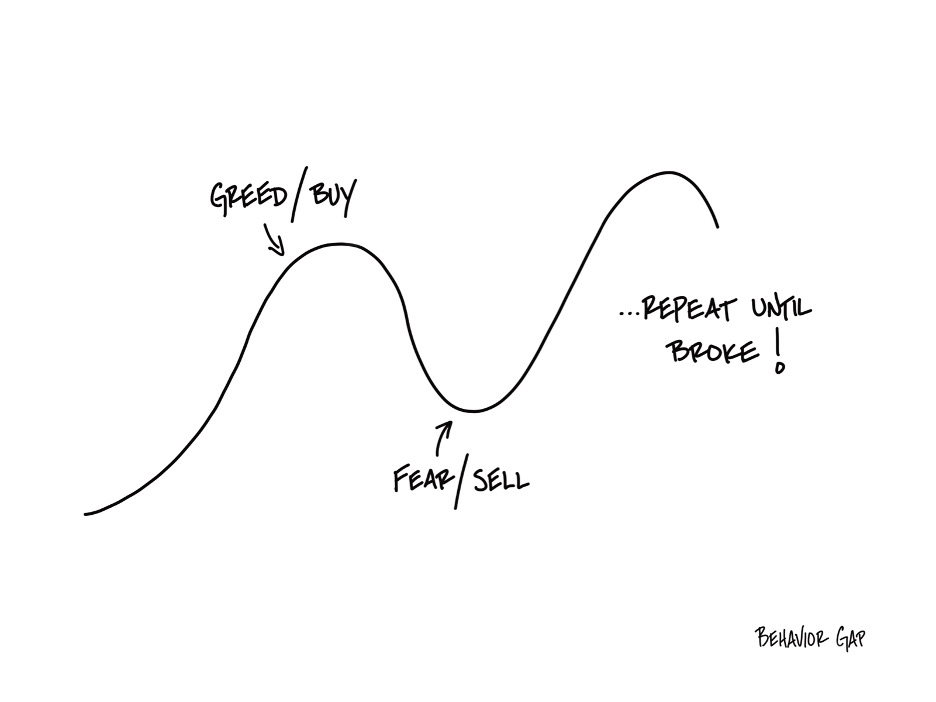

- Time the Market: Some investors try to time the market, buying and selling in an attempt to avoid downturns and capitalize on upswings. However, this strategy is notoriously difficult (rather impossible) to execute successfully all the time. Studies have shown that even professional investors struggle to time the market effectively and missing just a few of the market’s best days can significantly impact long-term returns. The below sketch perfectly captures what happens when you try to time the market.

- Fall for “Guaranteed” Products: The financial industry is filled with products that promise “guaranteed” returns or “safe” investments. While some of these products can be valuable, most are designed to play on investors’ desire for certainty, often at the expense of high fees, low returns, or hidden risks.

- React Emotionally to Market Volatility: When markets decline, investors who crave certainty may panic and sell their investments at a loss, locking in their losses and missing out on the eventual recovery. This behaviour is often driven by the fear of uncertainty and the desire to avoid further losses.

Embracing Uncertainty: A Path to Better Investment Outcomes

Rather than chasing the illusion of certainty, you would be better served by accepting that uncertainty is a natural part of the investment process. By embracing uncertainty, you can make more informed, rational decisions that align with your long-term goals.

Here’s how:

1. Focus on the Long Term

One of the best ways to deal with uncertainty is to adopt a long-term perspective. While markets may be volatile in the short term, they have historically trended upward over the long term. By focusing on your long-term goals rather than short-term fluctuations, you can ride out the inevitable ups and downs of the market and avoid making impulsive decisions based on fear or uncertainty.

2. Diversify Your Portfolio

Diversification is a powerful tool for managing uncertainty. By spreading investments across different asset classes, sectors, and geographic regions, you can reduce the impact of any single event or market downturn on your overall portfolio. Diversification helps to smooth out returns and reduce risk, making it easier to stay invested during periods of uncertainty.

3. Understand and Manage Risk

All investments carry some degree of risk, but not all risks are created equal. You should take the time to understand the risks associated with your investments and consider how those risks align with your financial goals and risk tolerance. By managing risk appropriately, you can build a portfolio that balances the need for growth with the desire for stability.

4. Stay Disciplined

One of the most important aspects of successful investing is discipline. It’s easy to get caught up in the noise of the market but sticking to a well-thought-out investment plan is crucial. This means avoiding the temptation to time the market, resisting the urge to chase the latest investment fad, and staying the course even when markets go down or up sharply.

5. Reframe Uncertainty as Opportunity

Rather than viewing uncertainty as something to be feared, you can reframe it as an opportunity. Market downturns, for example, can provide opportunities to buy quality investments at a discount. By adopting a contrarian mindset and staying open to opportunities that arise during periods of uncertainty, you can position themselves for long-term success.

The Role of Real Financial Professionals

For many investors, managing uncertainty can be a daunting task. This is where a trusted financial professional can play a crucial role. This professional can develop a personalized investment strategy for you and provide the guidance you need to stay on track during periods of uncertainty.

A real financial professional will also help you set realistic expectations and understand that while certainty may be appealing, it’s not always attainable. Instead, the right professional can help you focus on what you can control—such as your financial goals, asset allocation, savings rate, and investment horizon—rather than trying to predict or control market outcomes.

The Myth of the “Safe” Investment

It’s worth noting that the concept of a “safe” investment is often misunderstood. While certain investments may be perceived as safe because they offer guaranteed returns or lower volatility, they are not without risk. For example:

- Bonds: While bonds are generally considered safer than stocks, they still carry risks such as interest rate risk, credit risk, and inflation risk. In a rising interest rate environment, bond prices can fall, leading to losses for investors.

- Cash/Fixed Deposits: Holding large amounts of cash may seem like the safest option, but it comes with the risk of inflation eroding purchasing power over time. Additionally, cash does not generate the returns needed to grow wealth or achieve long-term financial goals.

- Life Insurance: While they seem to be providing a guaranteed amount, they often come with high fees, limited flexibility (low to no liquidity), and the risk of not keeping pace with inflation. It’s important for investors to carefully consider the trade-offs before committing to an investment-oriented life insurance policy.

The key takeaway is that no investment is entirely free of risk, and the pursuit of absolute safety can actually expose investors to other types of risks, such as inflation risk or opportunity cost.

Embrace Uncertainty for a Better Financial Future

Investors often crave certainty because it provides a sense of comfort and security in an unpredictable world. However, the reality is that uncertainty is an inherent part of investing and trying to eliminate it can lead to suboptimal decisions and missed opportunities.

Rather than chasing the illusion of certainty, you should embrace uncertainty and focus on building a well-diversified portfolio that aligns with your long-term goals. By adopting a disciplined approach, understanding and managing risk, and reframing uncertainty as an opportunity, you can achieve better outcomes and build wealth over time.

Ultimately, the key to successful investing is not finding a way to eliminate uncertainty but learning to take advantage of it with confidence and clarity. By accepting that uncertainty is a natural part of the investment process, you can make more informed decisions, avoid common pitfalls, and stay focused on what truly matters: achieving your financial goals and securing your financial future.

and then tap on

and then tap on

0 Comments