The Key to Mastering Patience

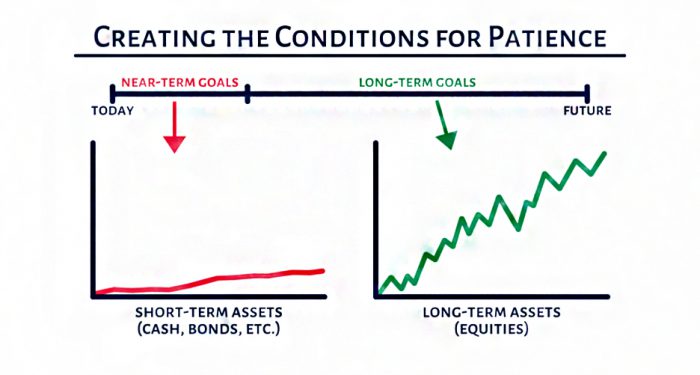

In the world of investing, understanding the relationship between your assets and your goals is crucial for cultivating patience—a vital trait for any successful investor. The visual above simplifies how different asset classes align with varying time horizons.

For near-term goals, it’s wise to focus on short-term assets like cash and bonds. These are represented by the flat line in the graphic, indicating stability and less volatility. This approach safeguards your capital when you know you’ll need access to it soon—perfect for upcoming expenditures or emergency funds.

Conversely, for long-term goals, equities (stocks) are more appropriate. The upward trajectory in the graph underscores the growth potential of equities over time. Although they come with higher volatility, their potential for substantial returns aligns with future needs like retirement or long-term wealth accumulation.

Warren Buffett once said, “The stock market is designed to transfer money from the Active to the Patient.” This highlights the importance of patience in achieving significant returns. Furthermore, John Bogle said, “Time is your friend; impulse is your enemy.” By strategically allocating your assets according to the timeline of your goals, you create a balanced portfolio that not only fosters financial growth but also nurtures patience, enabling you to withstand the ups and downs of the stock market without panic.

Align your investments with your financial goals to ensure that each decision contributes positively to your future stability and growth. Remember, a patient investor is often a successful one.

and then tap on

and then tap on

0 Comments