The Hard Truths Learned with Trillions of Dollars and Thousands of Companies…You Can Learn it Here…

Even as the US stock markets are going up, some people are arguing about this not being a bull market. They are pointing to the fact that much of the stock market’s gains have been driven by a few stocks. Regardless of whether the stock market went up or down, there are people who will always come out with their version of the “wolf wolf – the world is going down” story. Why? Because as you know pessimism sells.

As Professor Diedre Mcloskey’s said – “For some reason, people want to believe the world is going to hell.” Therefore, there will always be some reason for the economy and the stock market to go to hell. As the stock market is inching upwards, the cry is now about how narrow (confined to a few stocks) this rally is. This post then is about discrediting the narrow breadth theory and to share the ultimate truth (s) about investing that very few people actually understand (means that mostly no one else gets it).

Let me straightaway get to the first truth…

Most stocks underperform…

Most stocks do not deliver…

Most stocks do not work in a portfolio the way they are expected to deliver…

80% or more companies in a stock market index deliver ok to disastrous results…It’s the other 20% or the 5% that deliver outstanding returns…Many times it’s just five to 10 stocks that do so well that they make up for the poor performance of every other stock…These outstanding performers pull up the entire market with them. A Part of this is by design. While this is the appropriate moment to introduce a concept called market capitalization weighted index, I would rather write about this in a separate post as I might otherwise digress a lot from today’s topic. But a line or two on it goes here. The S&P 500, and Sensex/Nifty along with many other stock indices people track, are market capitalization weighted. This means that bigger companies get a higher weighting in the index calculations, so it’s simply natural that they drive returns.

I know what you are thinking…

Why not just have these winners in our portfolios? Why have the losers?

The PMS (Portfolio Management Schemes) and AIF (Alternate Investment Fund) Industrial Complex would like you to believe they know how to do both (this magical feat).

Thus, many institutions are making a simple pitch to you. We know how to select the outstanding stocks. We also know how to avoid ‘losing’ stocks. Not just this, we also know to time the markets. We can get out at the right time and get in back as the rally starts again.

While it’s a great story…it’s still a fictitious story…Because it does not work for even the legendary Warren Buffett. Despite his and his partner Charlie Munger’s wisdom, they still get it wrong. And that is perfectly fine (we all will) …

In the private markets too, it’s the same story…Most stocks do not deliver…It’s even more difficult to pick or back great businesses here…In a recent Wall Street Journal article, “He Spent $140 Billion on AI With Little to Show. Now He is Trying Again”, the writer Eliot Brown wrote, “After global tech investor Masayoshi Son launched the world’s biggest private investment fund six years ago, he said his SoftBank Group was ploughing money into companies based on a single strategy. ‘We are not just recklessly making investments,’ Son told investors in 2018. We are focusing on one theme, which is AI.”

More than $140 billion spent on 400 + startups and Son has very little to show. He even missed out on the frenzy in generative AI (ChatGPT as an example in this category), in which products learn from huge datasets to create unique text and images. The most shocking part is SoftBank missed out on huge gains on its holding of Nvidia. In 2017, SoftBank invested around $ 4 billion into Nvidia but sold its shares in 2019. The Nvidia stock is up 10 times since this sale.

Even bucketloads of capital spread across different areas of the industry and in some 400+ startups/companies didn’t help…The truth is picking winners is an elusive game. The other truth is that staying with winners is even more challenging.

These truths can be paraphrased as –

No one can select consistently…

No one can time consistently…

This is true of the private markets as well as the public markets. To create your winning investment strategy, you need to understand (and accept) these truths along with the first one I shared at the beginning of the second paragraph – Most stocks underperform.

Don’t believe the bullshit of the PMS/AIF industrial complex…Don’t believe anyone telling you otherwise.

Remember you are playing the Losers Game as explained by Charles Ellis in his book “Winning the Loser’s Game”.

Charles Ellis writes about how Doctor. Simon Ramo (a scientist) identified the crucial difference between a winner’s game and a loser’s game in an excellent book on game strategy, Extraordinary Tennis for the Ordinary Tennis Player. He wrote “Over many years, Doctor. Ramo observed that tennis is not one game but two: one played by professionals and very few gifted amateurs, the other one played by all of us. Although players in both games use the same equipment, dress, rules and scoring and both conform to the same etiquette and customs, they play two very different games.”

Ramo then summed it up: “Professionals win points; Amateurs lose points. In expert tennis, the ultimate outcome is determined by the actions of the winner. Amateurs seldom beat their opponents. Instead, they beat themselves. The actual outcome is determined by the loser.” The person who makes fewer mistakes wins amateur tennis. Investing (Professional and Amateur) is a Loser’s Game and it’s just like Amateur Tennis. The person (or institution) that makes as few mistakes as possible will win in Investing too.

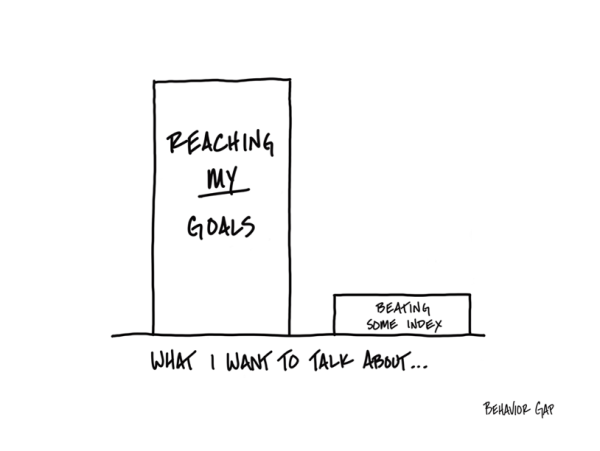

Therefore, here comes the final hard truth – when it comes to personal finance, what matters is not about selecting winning stocks/investments or beating some index. It does not matter whether the rally is narrow or broad. What matters is meeting your goals.

An index, of course, is just a broad measure of how a particular market has done. Think of it as the average. The investment industry seems to think that their entire purpose in life is to convince you that the best thing you could ever do is hire someone to help you beat an index.

Whether that’s even possible is debatable, but let’s just focus on why it doesn’t even matter.

Pretend you live in some magic fantasy world where all of your dreams (according to the investment industry) come true, and you actually beat an index every quarter for your whole life. I hate to burst your bubble, but it’s completely possible—even in that unlikely scenario—that you don’t meet any of your financial goals.

Why? Because beating an index has nothing to do with meeting your personal financial goals! That has everything to do with careful financial life planning.

Now let’s flip that scenario on its head. You slightly underperform the index every quarter for your whole life. But because of careful planning, you meet every one of your financial goals.

Doesn’t that sound a heck of a lot better?

and then tap on

and then tap on

0 Comments