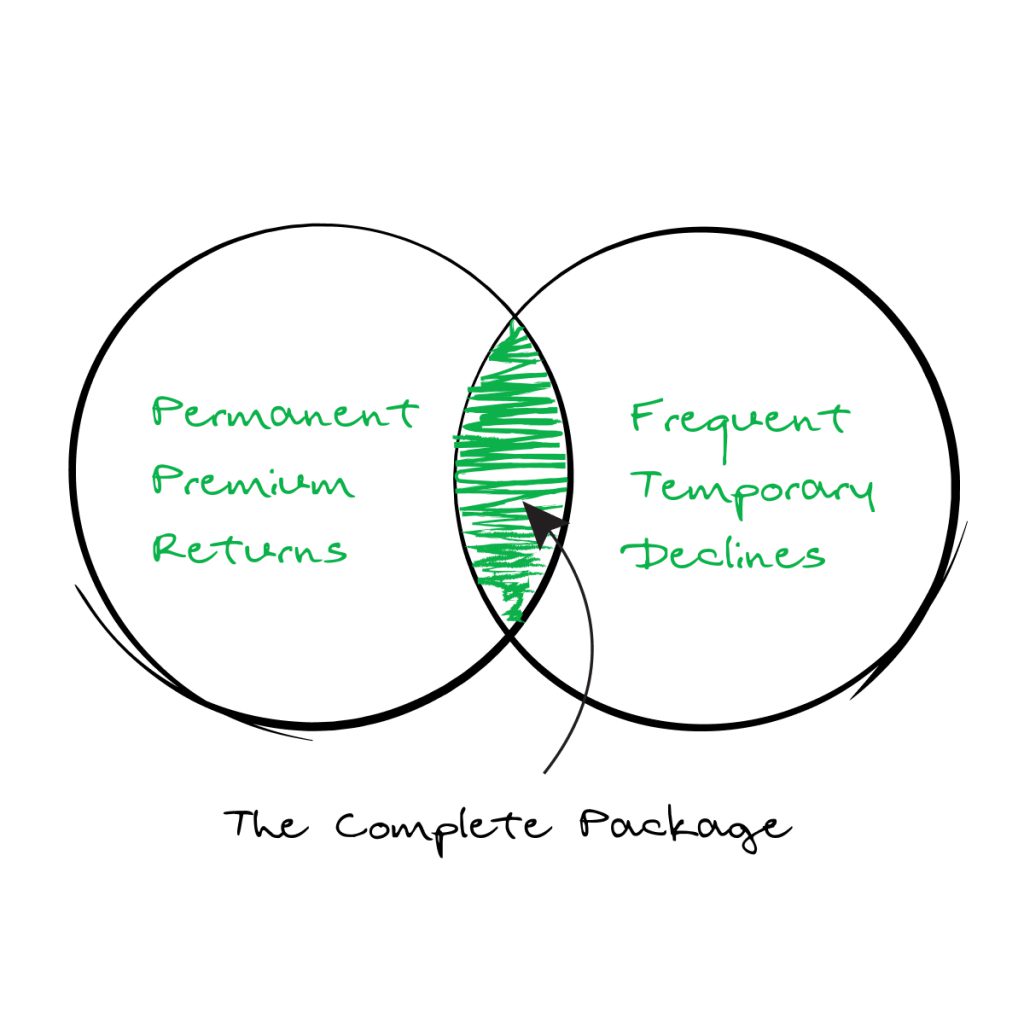

The Complete Package

Everyone wants the gains.

No one wants the decline.

But here’s the truth.

You cannot separate them.

You cannot have one without the other.

Stock market returns come with stock market declines.

They are part of the same package.

One does not exist without the other.

Yet people keep searching for a way to get only the gains.

They want the upside without the downside.

They want growth without volatility.

They want certainty in an uncertain world.

But that is not how markets work.

The Illusion of Smooth Returns

Some claim they can eliminate declines.

They say they have strategies to capture only the gains.

They promise protection without sacrificing growth.

It sounds perfect.

But it is a lie.

Because every real investment with real long-term returns has volatility.

If you remove the volatility, you remove the returns.

If you remove the declines, you remove the gains.

It is that simple.

The Price of Premium Returns

The stock market rewards investors with long-term premium returns.

But there is a price.

The price is in frequent temporary declines.

Not occasional declines.

Frequent ones.

Not mild declines.

Sometimes painful ones.

And yet, they are always temporary.

They are part of the process.

They are the reason the market pays a premium.

If investing were easy, returns would be lower.

If there were no volatility, there would be no reward.

The market pays those who can live through its nature.

It punishes those who try to time it.

What Happens When You Avoid Declines?

There are only three ways to try to avoid declines.

One, you sit in cash.

But cash does not grow wealth.

It does not compound.

It does not protect against inflation.

It guarantees safety in the short term.

But it guarantees loss of purchasing power in the long term.

Two, you chase so-called “safe” investments.

But low-risk investments mean low returns.

They do not create real wealth.

They do not beat inflation. Real returns after taxes and lifestyle inflation is negative.

They do not build financial freedom.

They do not deliver the long-term compounding that equities do.

Three, you jump in and out of the market.

Trying to time the crashes.

Trying to buy low and sell high.

Trying to avoid the pain.

But no one gets this right consistently.

And missing even a handful of the best market days destroys returns.

More importantly you end up paying unnecessary exit loads, and taxes.

Avoiding declines means avoiding the very thing that creates wealth.

The Hard Truth About Investing

Most people want guarantees.

They want certainty before they invest.

They want assurance that things will work out exactly as planned.

But real investing does not come with guarantees.

It comes with probabilities.

And the probability is that markets rise over time.

They do not rise in a straight line.

They move up, then down, then up again.

But the long-term trend is always up.

Not because of luck.

Not because of hope.

But because human progress continues.

Innovation drives growth.

Businesses adapt.

Economies expand.

The Winners and the Losers

The winners in investing are not the smartest.

They are not the fastest.

They are not the ones chasing the next big thing.

The winners are the ones who stay.

The ones who understand the complete package.

The ones who accept the declines as part of the process.

The losers are those who panic.

The ones who sell when things look bad.

The ones who get scared by short-term noise.

The ones who believe they can get the gains without the declines.

But no one can escape the rules of the market.

The Complete Package

Permanent premium returns come with frequent temporary declines.

They are inseparable.

They are not problems to be solved.

They are features of the system.

Every market crash in history looked like the end of the world.

But every single one of them was temporary.

Every dip felt like a reason to sell.

But every dip was a chance to buy.

The market does not reward fear.

It rewards patience.

It does not pay those who try to outsmart it.

It pays those who stay invested.

Investing is not about avoiding declines.

It is about understanding them.

Accepting them.

Living gracefully through them.

Because that is the only way to get the returns that matter.

That is the only way to build real wealth.

and then tap on

and then tap on

0 Comments