Patience is Not Passive; It’s This

Investing requires patience. But patience isn’t automatic. It’s created by having the right strategy and structure.

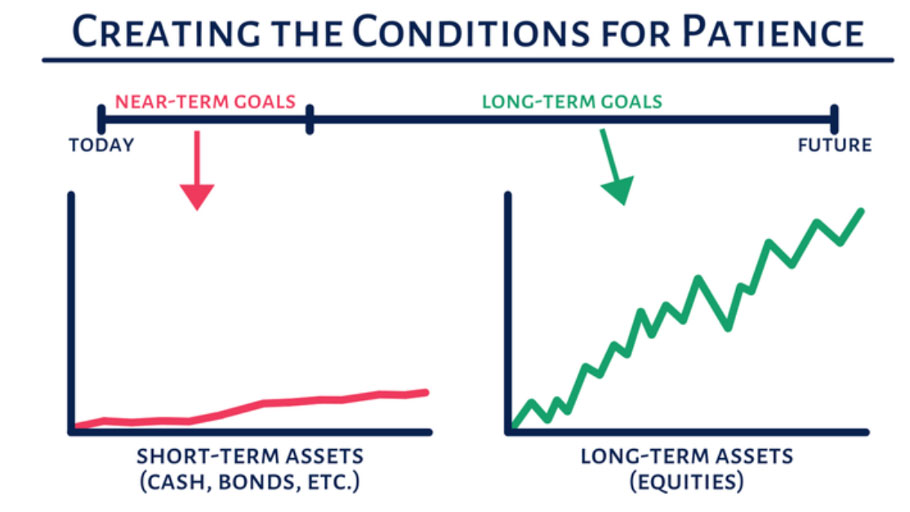

This visual tells a simple yet profound story. It separates your financial life into two parts: near-term goals and long-term goals.

For near-term goals, your focus should be on stability. These are things you need money for soon—emergencies, planned expenses, or short-term objectives. To achieve these, you use short-term assets like cash or bonds. These assets don’t grow much, but they also don’t decline suddenly. Their purpose is peace of mind, not growth.

Now look at the long-term side. These are your big dreams—lifestyle, retirement, generational wealth, or long-term financial freedom. These goals require long-term assets such as equities. Equities grow over time, but they come with ups and downs. The key to benefiting from them is patience.

But here’s the trick: patience only works if your short-term needs are secure. If your near-term goals are not covered, you’ll panic when markets dip. You might sell your long-term investments at the worst time. That’s why balancing short-term stability with long-term growth is essential.

Equities are predictable in the long run. Over decades, they grow. But they are unpredictable in the short run. Without a structure that separates your goals, emotions will take over.

This is why financial strategy matters. It aligns your investments with your goals. It creates the conditions for patience. It gives you the confidence to stay invested when others are panicking.

The market rewards the patient. But patience isn’t passive—it’s intentional. Create it by structuring your finances wisely.

and then tap on

and then tap on

0 Comments