I Bet You Didn’t Know This

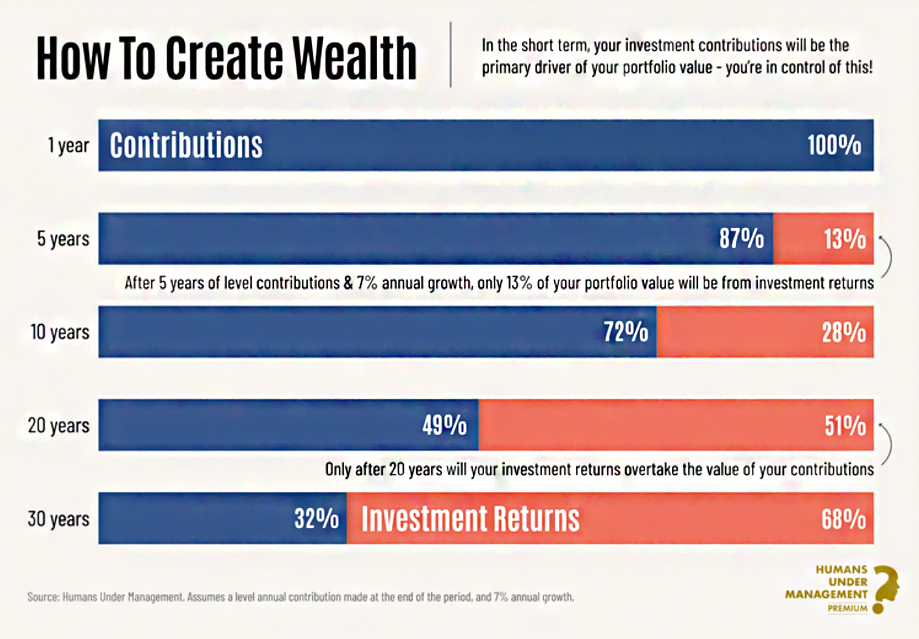

Wealth creation is a journey, not a sprint. This visual shows a truth that most investors underestimate. It’s a reminder that in the short term, your contributions matter more. But in the long term, your investment returns take over.

In the first year, your portfolio is 100% dependent on your contributions. This is the stage where your actions make the biggest difference. How much you save and how consistently you invest will determine the foundation of your wealth.

After five years, something amazing begins to happen. Investment returns start contributing to your portfolio. But they remain small—only 13% of the total value. This shows that in the early years, consistent savings are the primary driver of growth, not market returns.

By year 10, the balance begins to shift. Investment returns now make up 28% of your portfolio. This is the power of compounding starting to work. Still, your contributions dominate, which means your focus should remain on disciplined saving.

At year 20, something remarkable happens. Investment returns overtake your contributions. They now make up 51% of your portfolio value. This is the point where time and compounding start to reward your patience and discipline.

By year 30, the picture flips entirely. Contributions are just 32% of your portfolio value. A staggering 68% comes from investment returns. This is the magic of compounding at full force. The longer you stay invested, the greater the role returns play in growing your wealth.

If we extend this timeline to year 40, the power of compounding becomes even more extraordinary. By year 40, the vast majority of your portfolio’s value—likely over 90% or more—will come from investment returns rather than contributions. Then as years go by, almost your entire portfolio value comes from returns. By year 40, your portfolio isn’t just working for you—it’s working for your family and future generations.

The lesson is clear. In the beginning, your discipline matters most. Save consistently, invest wisely, and give time a chance to work. Over decades, your returns will outpace your contributions. But only if you stay the course.

Wealth is not built overnight. It’s built through consistent effort and patience. Start now, stay disciplined, and let time do the heavy lifting.

and then tap on

and then tap on

0 Comments