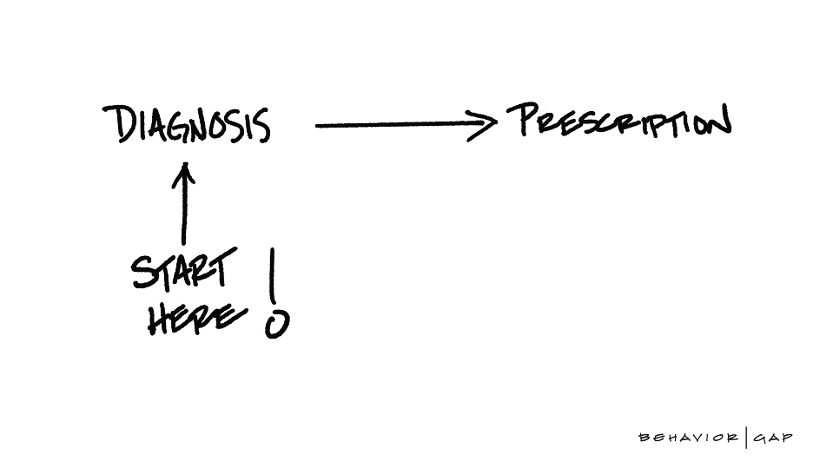

Are You Prescribing?

Imagine this: A patient walks into a doctor’s office. Before the doctor can speak, the patient starts prescribing their own treatment. “I need antibiotics,” they insist. “Give me 500 mg, twice a day.”

What would the doctor say? Most likely, they would pause, raise an eyebrow, and question the patient’s self-diagnosis. “What makes you think this is the right treatment? Let me assess your condition first. Let me diagnose you.”

Now take this same scenario and shift it to the world of investing. It happens far too often. Investors, who are essentially the patients, walk into their financial professional’s office and begin prescribing their own solutions. “Buy this stock,” they say. “Sell that mutual fund. Everyone’s talking about it.”

The financial professional, much like the doctor, is left wondering: Why hire me if you don’t trust my expertise?

The Problem with Information Overload

In today’s world, information is everywhere. You can open an app and see the stock market live. You can read endless headlines, articles, and tips. You can watch videos of “finfluencers” giving advice with exaggerated confidence.

With so much information, investors start to feel empowered. They believe they have the full picture. But there’s a difference between having access to information and truly understanding it.

Reading about investing doesn’t make someone an expert, just like Googling symptoms doesn’t make someone a doctor.

A doctor’s training takes years. So does a real financial professional’s. Doctors study the human body; financial professionals study investing, risk, and investor behavior.

More importantly, a doctor’s work isn’t about symptoms alone—it’s about the patient as a whole. Similarly, a financial professional’s work isn’t about products alone. It’s about you—the investor—your life, your behavior, and your goals.

The Real Work: Managing Behavior, Not Products

This is where the true value of a financial professional lies. It’s not just in selecting the right investments. It’s in managing investor behavior.

Why does this matter? Because behavior is where most mistakes happen.

- Investors panic when markets fall.

- They get greedy when markets rise.

- They chase trends, trying to “beat the market.”

- They make decisions driven by emotion, not logic.

A financial professional’s role is to be the steady hand guiding you through this noise. They bring objectivity when emotions run high. They help you stay focused on the long term, when your instincts tell you to act on the short term.

They are not there to sell you a product. They are there to keep you on track.

This work is not glamorous. It’s not flashy. But it’s critical. Because as any seasoned investor knows, the biggest threats to wealth are not market downturns—they are poor decisions driven by fear or greed.

What Happens When You Ignore Expertise?

Imagine a patient ignoring a doctor’s advice and self-medicating. The wrong medicine can lead to severe consequences.

In investing, it’s no different. Investors who override their financial professionals’ guidance often end up:

- Buying high and selling low.

- Chasing trends that fizzle out.

- Missing opportunities to compound wealth over time.

- Taking too much risk or taking too little risk

- Not Saving and Investing Enough

The consequences? Years of progress can be wiped out. Goals can be delayed. Long-term success can be derailed.

And here’s the hard truth: When you lose money through poor decisions, you’re not just losing money. You’re losing time. And time is the one thing you can’t get back.

Trust the Professional You Hired

So, why does this happen? Why do investors undermine the professionals they’ve hired to help them?

Because trust takes effort.

Investors must remind themselves why they hired their financial professional in the first place. They sought someone with knowledge, experience, and the ability to guide them. They sought someone who could help them navigate the complexities of their financial lives.

But when emotions rise, trust can waver. And that’s when the mistakes happen.

The next time you feel tempted to “prescribe” your financial decisions, pause and reflect:

- Are you acting based on emotion?

- Are you responding to headlines, noise, or social media?

- Are you making a decision in haste, without a long-term perspective?

Or are you trusting the professional who has studied your life, your goals, and your financial health?

A Financial Professional Is Like a Doctor for Your Financial Life

Doctors don’t just prescribe medicines. They study their patients. They monitor symptoms. They look for underlying causes. And they create plans for long-term health.

A great financial professional does the same.

- They understand your financial life, not just your investments.

- They align your portfolio with your goals.

- They look at the big picture—retirement, lifestyle, legacy, risks.

- They help you make better decisions by managing your behavior.

The relationship you build with a financial professional is like the one you have with a trusted doctor. It’s about care. It’s about expertise. And it’s about partnership.

Are You Trusting the Process?

Here’s a thought to leave you with. When you hire a doctor, you don’t question every decision they make. You trust that they have your best interests at heart.

So why is it different with a financial professional?

If you’ve hired someone you trust—someone with expertise and experience—let them do their job. Give them the space to guide you. Work with them, not against them.

Because in the long run, trusting the process will serve you better than trying to control it.

The Important Question for Investors

Are you the patient who insists on self-prescribing? Or are you the patient who trusts their doctor to guide them to better health?

In investing, the choice is yours. But remember this: The real work isn’t about chasing returns or products or beating someone. It’s about your financial life—your behavior, your decisions, and your long-term success.

Trust the professional. Trust the process. And trust that you’ll be better for it.

and then tap on

and then tap on

0 Comments