All of us would be better investors if we just made fewer decisions

Nobel Prize Winner and Author, Daniel Kahneman said these Golden Words. They are so insightful that I repeat them here “All of us would be better investors if we just made fewer decisions”. The key point then is to figure out those fewer decisions.

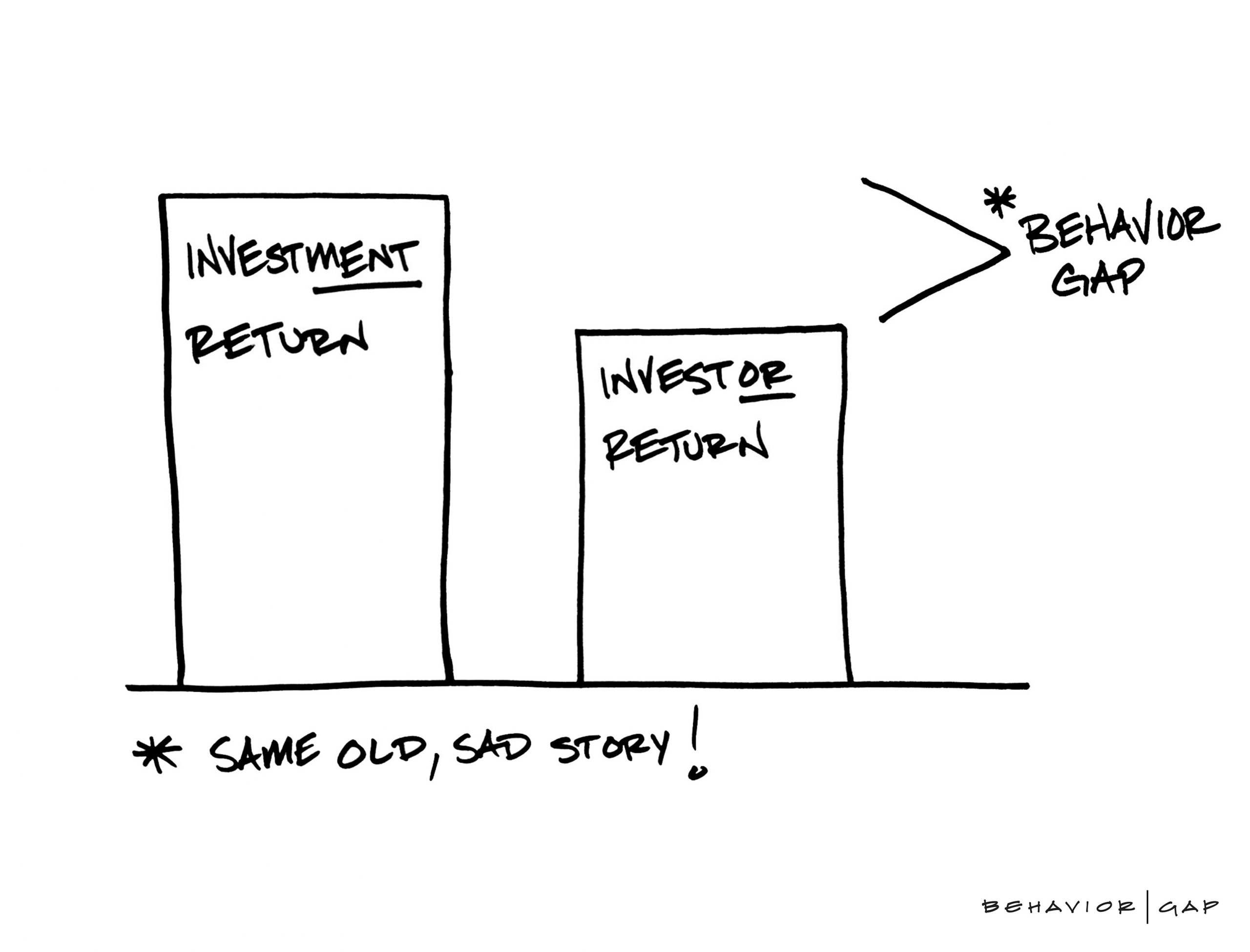

Before I get into these important decisions, here is why I believe Kahneman said these golden words. He believed (based on research and studies on this subject) that Humans are not wired to be Successful Investors. There is a ton of research on this front. This observation has been wonderfully captured in the below given sketch about the “Behaviour Gap” by New York Times Columnist and Author Carl Richards.

It is one of my favourites and pardon me if you have seen this before.

The point here is that there is a clear difference between Investment Return and Investor Return. This difference is significant and varies from investor to investor. Understanding all of the above, a long time ago, Benjamin Graham, the mentor of legendary Warren Buffett (By the way, Mr. Buffett turns 90 on August 30th, 2020) said “ The Investors Chief Problem and even his worst Enemy is likely to be himself.

I could not agree more and thus sharing a few key decisions that every investor must take for his/her long-term investing success.

The first is that you need the guidance of a Real Financial Planner. This is not a Do It Yourself Fun activity like buying your own groceries or air tickets. This is the equivalent of conducting a Surgery on your own Financial Life. Remember even Surgeons do not operate on themselves. Investing is all about helping you live the life you have imagined and thus Investing is about your Financial Life. I am not talking about people giving you access to different products (however exotic they may be) or even someone who specializes in financial astrology. I am also not talking about people telling you rosy & fearful stories about the markets and economy. I am talking about someone who helps you navigate this uncertain landscape – a Real Financial Planner who is your Financial Sherpa in your life journey to Mount Everest. Just like you do not climb Mt. Everest on your own, you would surely benefit from the counsel of a wise Financial Sherpa. My August 18th post focused on this person. This is such an important decision that I took some more time on this decision even at the risk of sounding repetitive. You got to absolutely understand this one.

Once you have taken this decision, the second decision is the choice of a Real Financial Planner. There are so many folks posing as professionals and the industry has made it so confusing for you to even identify the real one. I think my August 18th post will help you understand the work that this person does. However, I will write a separate detailed post on identifying such a professional.

The third decision for you is to follow the process of your Real Financial Planner and let her/him guide you. Ask meaningful questions with the intent to learn or improve the process further. This process will be goal oriented and driven by the world class process of Financial Planning. The investments will be made in accordance to your needs, goals, and financial situation.

Once this is done, the fourth step is great behaviour. This is such an important step, but it is not a one-time activity. You got to demonstrate great behaviour over your lifetime of investing. The best way to do that is to tune out the noise and the financial pornography networks. Focus on the process of financial planning and have meaningful conversations with your Financial Sherpa as and when needed. The Real Financial Planner will take you through Annual Financial Planning Sessions to make sure that your plan is current, reflecting reality and factoring in any course correction required. Most of the time, there might be no activity and it might feel boring, but the strategy is best left alone.

We all know of people who are still out of the market and calling in for corrections sighting various problems. Yes, the market might correct just like it could at any point of time. Like we have discussed in the past, market corrections are as natural as the monsoon season in India. Do not expect that markets will not go down because you do not like it. Follow the above 4 steps and I am confident that you can sail through any turbulence and be able to create the financial life that you have imagined for yourself.

I finally end with an amazing quote by Nick Murray “Permanent Loss in a broadly diversified portfolio of quality equities held for the long term is a MYTH. That in fact when permanent loss occurs, it is always a human achievement, of which the equity market itself remains incapable”.

and then tap on

and then tap on

0 Comments